With the housing market still stuck in the mud — and Congress taking a closer look at corporate investor ownership of homes — two major companies in the single-family rental space are talking about merging.

Mynd is in advanced discussions to merge with rival Roofstock, Bloomberg reported. An announcement could come as soon as this week.

Mynd declined to comment, while Roofstock didn’t respond to the publication’s request for comment.

Both firms guide investors in buying, selling and managing single-family rentals across the country. It’s a sector that exploded during the pandemic as families sought more space, but couldn’t overcome barriers to become homeowners themselves.

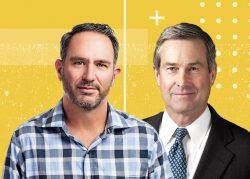

The leaders of both companies also have shared history, which could make a merger more seamless. Mynd CEO Doug Brien and Roofstock CEO Gary Beasley both worked at Waypoint Homes, an early entry into the single-family rental field that was ultimately rolled into Invitation Homes.

Both companies also lean into technology. Roofstock was founded in 2015 as an online platform for single-family rentals. The company provides key metrics such as yield, annual return and home price appreciation, taking a 3 percent cut of the transaction price from sellers and a 0.5 percent fee from buyers. In March 2022, it raised $240 million at a $1.9 billion valuation.

Mynd, meanwhile, operates a platform aimed at democratizing real estate access and helping investors buy, sell or manage single-family rentals. Its stature in the field increased tenfold in 2021 when Invesco agreed to spend as much as $5 billion to purchase 20,000 single-family rental homes in the country over a three-year period.

Single-family rentals boomed. By 2021, buyers with five or more properties accounted for a sizable portion of single-family home purchases, reaching a peak of 28 percent in the first quarter of 2022.

But the good times haven’t lasted. Investors pulled back when rents softened in some regions and interest rates rose.

Scrutiny regarding institutional investors in the housing market isn’t going away, either: In December, Democrats introduced the “End Hedge Fund Control of American Homes Act.”

Read more