The Shidler Group is facing yet another foreclosure.

But even in the complex world of non-judicial foreclosures, a lender’s action against the firm is a strange one.

The lender, a mysterious entity known as ACF L5-M, launched a foreclosure auction against interests in a hotel portfolio tied to Shidler. The properties consist of nearly 20 hotels across the U.S., including Hilton Homewood Suites in Phoenix, the Hilton Hampton Inn in Charlotte and the Hyatt House in Scottsdale.

But, unlike a normal U.C.C. foreclosure, the lender is pursuing an auction on interests in “purchase options” in the hotels. It appears that bidders in the auction, including this ACF character, can acquire rights to buy hotels in the Shidler portfolio individually, according to the sale notice.

An auction is set for Nov. 6. Brock Cannon of Newmark is marketing the sale.

U.C.C. foreclosures are workarounds to a traditional foreclosure. Think of it as the financial engineering of the foreclosure business. Lenders are not taking over properties, but interests in a company that controls a property. This type of foreclosure does not happen in the courthouse, but often on the courthouse steps.

The result is that lenders can avoid the sometimes years-long legal proceedings

The lender’s action against Shidler is another iteration of foreclosure engineering.

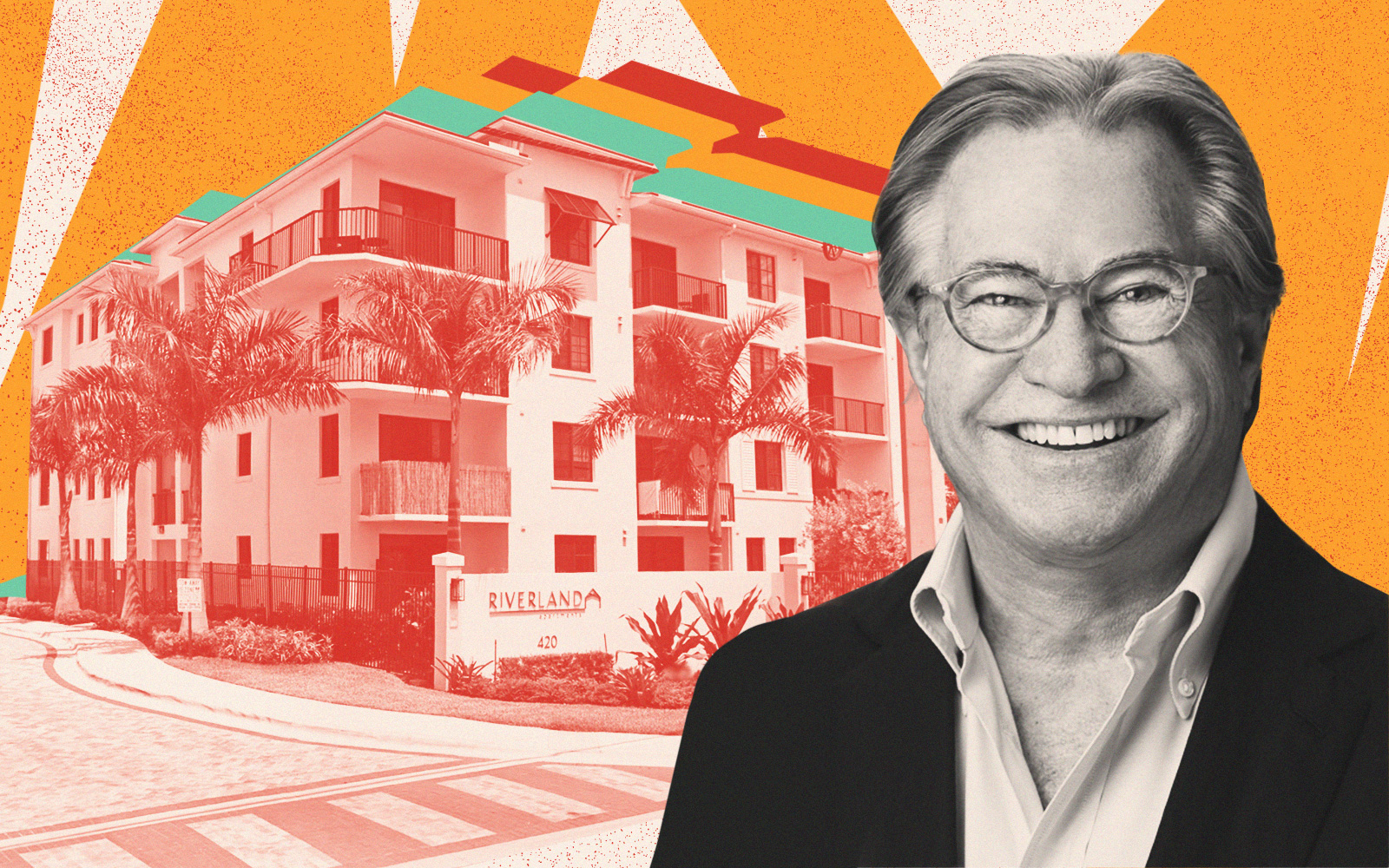

The firm, led by Jay Shidler, one of Hawaii’s wealthiest residents, specializes in ground leases. The company purchased the land beneath the hotels in 2015, according to its website.

It then looks as though four entities tied to Shidler Group pledged options it had to acquire the hotels at a future date to the lender as collateral, according to the foreclosure notice. At the auction, a new bidder can acquire those options.

It appears that Shidler Group has faced distress with this hotel portfolio since 2020, when a $204 million CMBS loan tied to 22 hotel properties went into special servicing. Earlier this year, Trepp reported that the properties would be handed back to the lender through a deed in lieu.

Read more

Eric Allendorf of Paul Hastings who represents the lender did not return a request to comment. Shidler Group also did not return a request to comment.

The firm has faced distress throughout the country. This summer, Wells Fargo filed to foreclose on an affiliate of Shidler Group for failing to make payments on a $42 million loan on the land beneath a Chicago office building.

This story has been updated to show that the hotel portfolio is tied to a $204 million CMBS loan that went into special servicing in 2020.