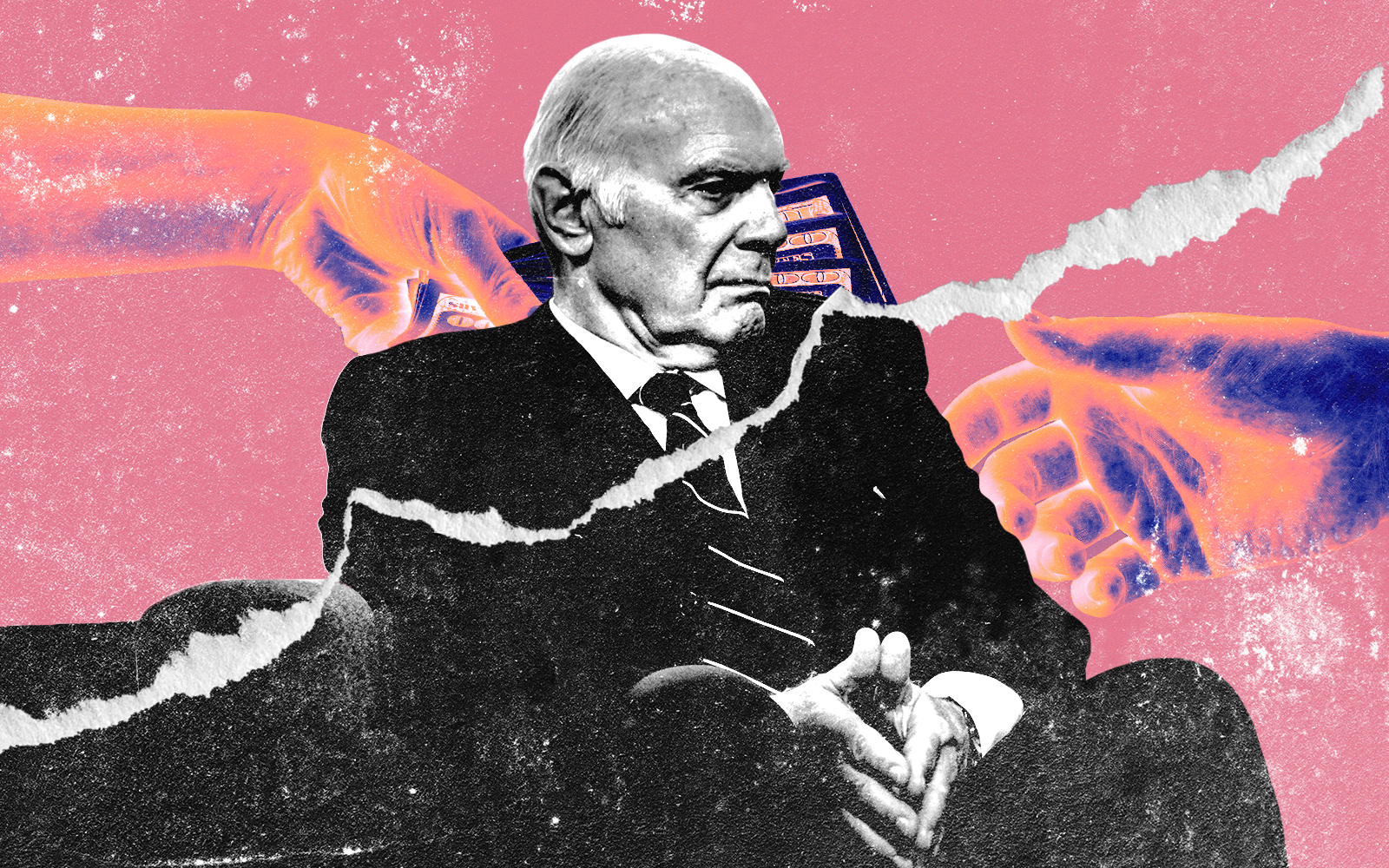

Steven Roth shows no signs of slowing down, but Vornado Realty Trust shareholders may be wishing he would go and enjoy retirement anyways, at least according to one analyst.

Roth’s retirement from the real estate investment trust’s throne could spur gains in the company’s stock price, JPMorgan real estate analyst Anthony Paolone wrote in a client note, according to Crain’s.

“We think succession planning and the future prospects around how the company will be run long-term – and by whom – could be a swing factor in the stock,” Paolone wrote. A spokesperson for Vornado declined to comment.

Roth is 83 years old, but remains publicly reticent to discuss a succession plan, even after a bypass surgery in 2018. That year, Roth did say on a conference call that he was “clearly on the back nine…may be on the back half of the back nine.”

Vornado’s board of directors initiated a “management success process” in 2019. A wideheld belief is that company president Michael Franco, who also became chief financial officer in 2020, is next in line at the firm.

Other concerns Vornado is facing, according to Paolone, include “structural headwinds” created by work-from-home policies and a “high level” of debt.

There are ways Vornado could become more bullish to investors, Paolone wrote. The analyst pointed to improved leasing, progress in redeveloping around Penn Station and potential sales as other ways to spark the company stock.

Vornado’s stock opened Wednesday morning at $41.07 after closing at $39.78 the previous day. The stock price is down more than 38 percent over the last five years, but is up more than 54 percent in the past year.

In 2023, the office landlord suspended its dividend for part of the year, deciding against giving regular distributions to shareholders. Vornado’s stock was also removed from the S&P 500 two years ago.

Read more