Noble Investment Group closed its largest real estate fund to date and is poised for a massive investment in distressed hotels across the Sun Belt.

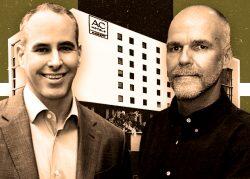

The Atlanta-based hotel investor, led by CEO Mit Shah, has raised $1 billion from 25 investors, public state pension plans, corporate pensions, endowments, foundations, insurance companies and wealth management funds, the Atlanta Business Journal reported.

Noble also received $150 million from Host Hotels & Resorts, which it formed a joint venture with in 2022. The closing of the fund coincides with what Shah called one of the “most opportunistic” economic times in the firm’s 31-year history.

Noble aims to capitalize on distress in the hospitality sector, focusing on select-service and extended-stay hotels, especially in Sun Belt markets.

More than $25 billion in hotel loans will mature this year, while short-term interest rates hover around 5 percent. Deferred renovations during the pandemic have created a demand for capital infusion in many properties.

“Our best investments came after the great financial crisis [of 2008], and it was because of the exact same thing,” Shah told the outlet.

The combination of upcoming maturities and overdue renovations have created “a generational investment opportunity for Noble to acquire income-producing hotels, recapitalize owners, and add value both operationally and physically,” said Ben Brunt, Noble’s managing principal and chief investment officer.

Stonebridge Hospitality Management’s recent acquisition of the W Hotel in downtown Atlanta at a steep discount underscores challenges in the hospitality sector. The pandemic caused occupancy rates to plummet across much of the nation, leading to distress and pushing down hotel property values. However, 2023 was a bounce back year for the lodging industry, with leisure travel returning closer to pre-pandemic levels.

The fundraising landscape has been notably challenging, with global private-equity firms raising approximately $509 billion by September 2023, marking a 46 percent year-over-year decline. Despite this backdrop, Noble’s fund surpassed its initial $800 million target. Roughly 20 percent of the fund is already committed, the outlet said.

Last year, Noble acquired a 14-hotel portfolio that included a pair of luxury hotels in Raleigh, North Carolina. It also started construction on a 153-room Tempo by Hilton hotel in Savannah. In Atlanta, the firm has invested about $1 billion, including notable developments like the Element and Courtyard hotel next to the Fox Theatre.

Noble’s portfolio now approaches 100 hotels nationwide, exceeding $6 billion in investments.

—Quinn Donoghue

Read more