The motivations behind the pending sale of a Nashville scrapyard reveal the pressing financial realities facing one of Wall Street’s most famous investors.

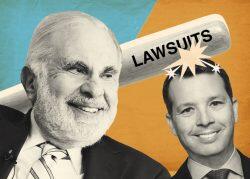

Billionaire Carl Icahn has entered an agreement to sell a 45-acre scrapyard in the city’s East Bank, a transaction aimed at addressing recent financial setbacks within his company, Icahn Enterprises, the Nashville Business Journal reported. CBRE’s Bryan Fort and Frank Thomasson are managing the sale.

The property, which Icahn acquired through his ownership of PSC Metals LLC, has been a focal point in the city’s vision for revitalizing the East Bank area. The land, located at 710 South First Street, sits strategically among high-profile developments, including Oracle Corp.’s planned tech campus and the new Tennessee Titans stadium.

Although the scrapyard was initially announced for auction in September, the sale appears to have moved forward through a traditional transaction. While the buyer and sale price remain undisclosed, Icahn reportedly sought a minimum of $200 million for the property.

The pending sale follows a difficult year for Icahn Enterprises, marked by operational struggles and portfolio losses that have weighed heavily on its financial position. The company’s stock has seen a steep decline, which has intensified the need for liquidity.

Proceeds from the sale are expected to exceed the land’s book value, providing a critical financial lifeline for the publicly traded company as it navigates these difficulties, according to Ted Papapostolou, Icahn Enterprises’ CFO.

Read more

For Nashville, the sale could represent the next step in transforming the site into a mixed-use district after decades of being unable to unlock its development potential. The site is currently leased to SA Recycling, which has begun rerouting some operations to a newly acquired property in West Nashville.

Ultimately, the decision to sell points to the company’s own financial distress, rather than a downturn in the local market.