Mack Real Estate Group, W Holdings and ViaWest Group have entered a bidding war for 2,300 acres of state land for a high-tech hub surrounding the Taiwan Manufacturing Semiconductor facility in north Phoenix.

New York-based Mack, Tempe-based W and Phoenix-based ViaWest have joined a state land auction slated for May 29 with a minimum bid of $56.28 million, or $24,000 an acre, the Phoenix Business Journal reported.

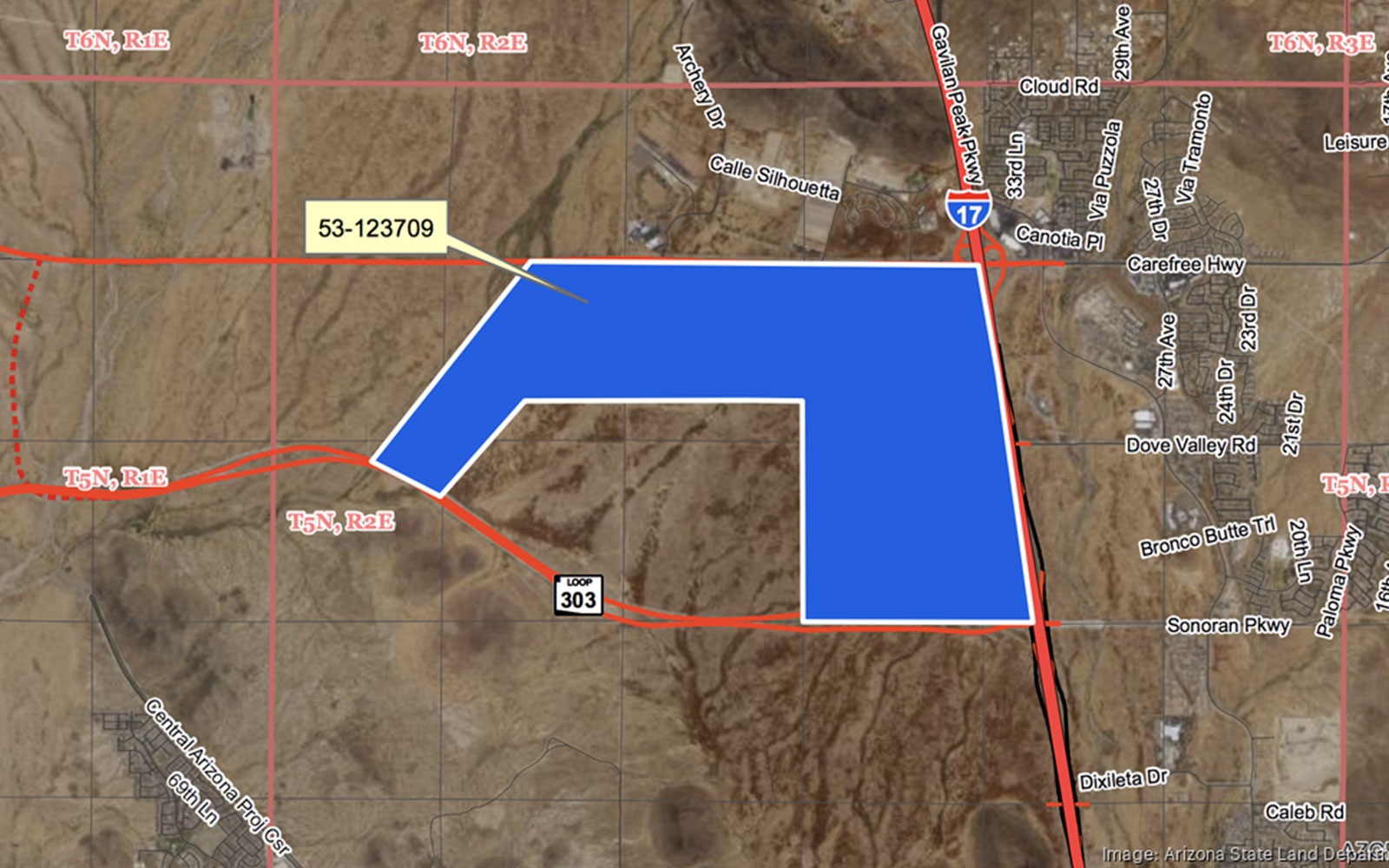

The endgame is to build a Sonoran Oasis Science and Technology Park to be anchored by the $65 billion Taiwan Manufacturing Semiconductor plant. The U-shaped site is north of Loop 303 and west of Interstate 17, in North Gateway, 26 miles north of Downtown Phoenix

The three real estate groups were approved to compete in the auction by the Arizona State Land Department, according to an evaluation by Gruen Gruen + Associates.

Only experienced firms that met specific capital qualifications could bid because of the cost of infrastructure, planning and development work required for the site, according to the Business Journal.

The estimated cost to build the total infrastructure is $1.7 billion, according to the state. Submissions for the auction closed in March.

The winner of the land auction must sign a contract with the state and invest hundreds of millions in infrastructure for the Sonoran Oasis Science and Technology Park. The infrastructure will boost the value of the property, an unidentified state land spokesperson told the Business Journal.

The City of Phoenix has zoned the 2,300-acre site for 10 million square feet of industrial space, 12.8 million square feet of offices, 4.4 million square feet of retail, 568 hotel rooms and nearly 9,000 apartments, according to state land documents.

Once infrastructure benchmarks are met, the winning bidder can sell parcels to other developers or develop the buildings itself. The project is expected to take two decades to build, with infrastructure work to begin next year.

The state is also expected to auction off another 1,500 acres it owns west of the semiconductor campus.

The auction bidders had to have 10 years of experience in developing infrastructure for commercial real estate, the ability to fund $150 million in infrastructure costs and experience in planning, developing and financing a $400 million commercial project.

Mack Real Estate, founded in 2013 by William, Richard and Stephen Mack, initiated the auction for the Phoenix site in 2022, according to the Business Journal.

The company has a large commercial track record, including the 3 million-square-foot Mack Innovation Park in Deer Valley, Ariz.; a 2,300-acre master-planned development in Orlando called ChampionsGate; and the 2.8 million-square-foot Time Warner Center in New York.

An affiliate tied to W Holdings and Ashton Wolfswinkel, son of real estate mogul Conley Wolfsinkel, and Carson Brown of CLB Partners, were also approved as an auction bidder.

The Wolfswinkel family has developed master-planned communities across Arizona, including the 8,000-acre Rancho Vistoso in Oro Valley. Wolfswinkel and Brown are now working on a 20,000-acre solar project in Harquahala, west of Buckeye. When completed, the $7 billion solar project could be the largest in North America.

The third bidder includes an undisclosed financial partner and ViaWest Group, founded in 2003, with nearly $3 billion in industrial investments around Phoenix, including the 2 million-square-foot The Base Industrial park, valued at $367 million.

The unidentified ViaWest partner is a “prominent individual” with a net worth of more than $2 billion who committed to spend $150 million in project costs, according to a state land report. The bidder would pay cash for the land and obtain a loan for development.

“It is a very complicated and challenging structure but a phenomenal piece of land,” Steven Schwarz, a founding partner at ViaWest, said in a statement to the Business Journal.

— Dana Bartholomew

Read more