The dynamic duo of suburban hotels and offices have dipped into distress in some markets around the nation’s capital.

Four hotels in the Washington, D.C. metro area are tied to loan portfolios that are in default, according to the Washington Business Journal. Two hotels each are linked to a defaulted commercial mortgage-backed securities loan.

There’s a $204 million balance on a CMBS loan tied to 22 properties nationwide. The affected properties are almost all hotels secured through leaseholds, including a 120-key Residence Inn by Marriott in Greenbelt, Maryland, and a 203-key Courtyard by Marriott in Alexandria, Virginia, near the Mark Center office campus.

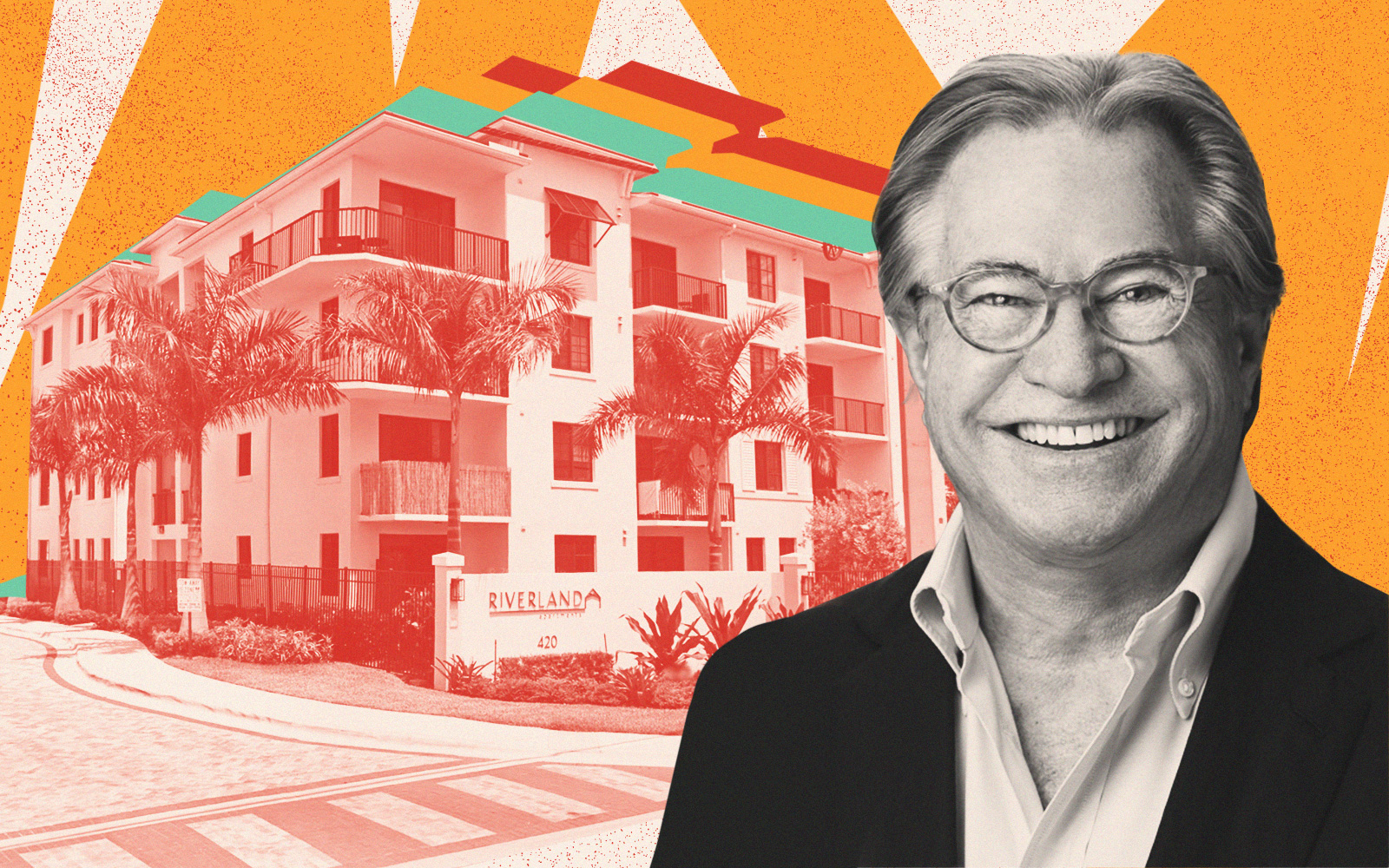

The Shidler Group’s Jay Shidler, who didn’t comment to the outlet, is the loan sponsor. National Select Service Funding originated the loan in 2017.

That debt has been in default since 2020 and the owner is set to hand back the keys of the hotels to the lender, according to notes shared with bondholders. A sale of the portfolio was in the works in 2022, but fell apart. A transfer could be finalized early this year.

There’s a separate $415 million balance on a CMBS loan tied to 30 hotels, including a 134-key Courtyard by Marriott in Herndon, Virginia — near Dulles International Airport — and a 147-key Courtyard by Marriott in Rockville, Maryland. DigitalBridge Group — formerly known as Colony Capital — is the borrower.

Morgan Stanley issued the loan in 2018. The borrower defaulted on that loan in 2020, recovered, then defaulted again and had the loan transferred to special servicing; KeyBank is the special servicer. DigitalBridge was working on bringing the loan current, according to bondholder notes from August.

The performance of suburban hotels and offices are “connected at the hip,” CoStar Group hospitality sector analyst Jan Freitag told the Business Journal, as the proliferation of hybrid and remote work drags down weekday business travel.

As of the end of last year, the CMBS delinquency rate in the D.C. market for lodging assets is 4.2 percent, according to Trepp, well below the market’s overall delinquency rate of 9.1 percent and the office sector’s 18.3 percent delinquency rate. However, it’s the second-highest delinquency rate among asset types in the region.

— Holden Walter-Warner

Read more