The New York State Department of Banking shut down developer Shaya Boymelgreen’s struggling LibertPointe Bank, and the Federal Deposit Insurance Corporation sold its assets to Wayne, N.J.-based Valley National Bank, marking the first New York state bank seizure this year.

The shut down — which will cost the FDIC $24.8 million — comes nine months after federal and state regulators issued a cease and desist order against the lender for using unsound banking practices, including operating with an excessive amount of commercial real estate loans.

“It is a top priority of the New York State Banking Department to protect the deposits of consumers of New York State banks and ensure the safety and soundness of the banking system in the state,” said Richard Nieman, state superintendent of banks, in a statement.

Valley National Bank officials said the bank assumed about $200 million in deposits and received about $180 million in loans, which are subject to a loss-share agreement with the FDIC. The bank also received $20 million in cash and other assets.

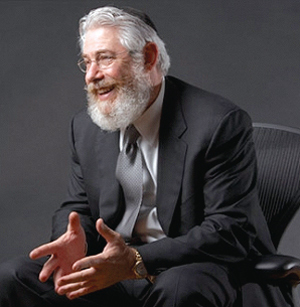

“We welcome LibertyPointe bank customers to Valley National Bank and are pleased to provide a safe and secure home to these customers,” said Gerald Lipkin, president of Valley National, in a statement.

After shutting down LibertyPointe, state banking officials named the FDIC receiver over the bank.

As of December 2009, LibertyPointe, which operated one branch in Manhattan and two in Brooklyn, had assets of $216.5 million and deposits of $209.5 million, according to the state banking department. Valley National Bank will pay a premium of 0.15 percent to the FDIC to assume all of the deposits of LibertyPointe. Valley National agreed to buy virtually all the assets of LibertyPointe.

In a February interview, LibertyPointe president Mertyn Corn told The Real Deal that he was not aware that the FDIC was about to seize the bank’s assets and said the bank was continuing to try and raise capital.

FDIC officials were not immediately available for comment.