Click

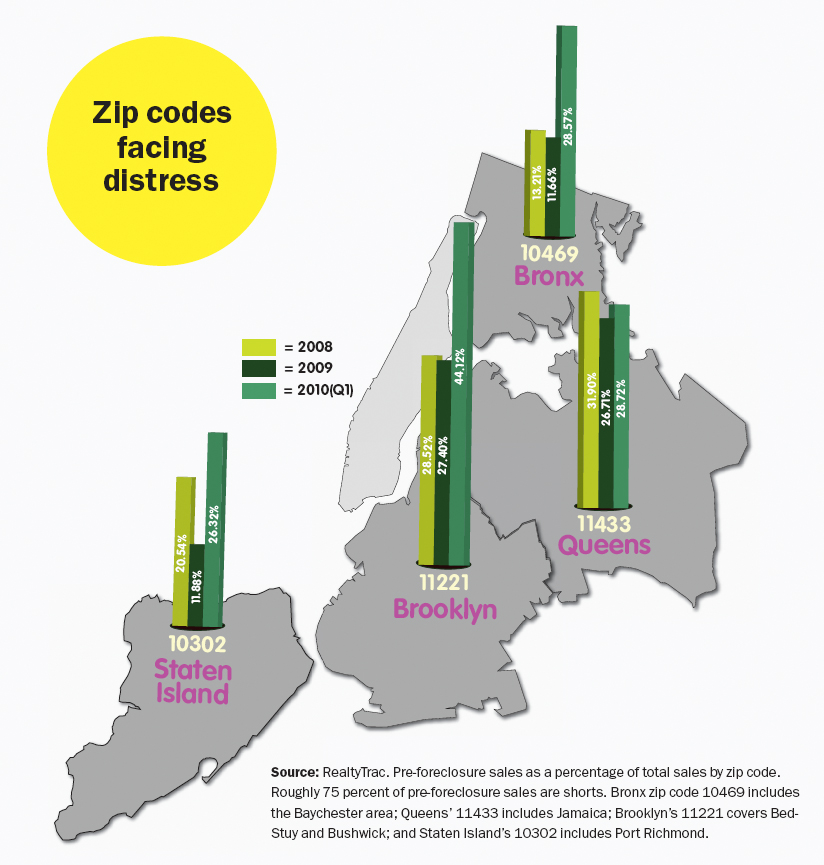

the image for a larger version. Source: RealtyTrac. Pre-foreclosure

sales as a percentage of total sales by zip code. Roughly 75 percent of

pre-foreclosure sales are shorts. Bronx zip code 10469 includes the

Baychester area; Queens’ 11433 includes Jamaica; Brooklyn’s 11221

covers Bed-Stuy and Bushwick; and Staten Island’s 10302 includes Port

Richmond. The short-sale trend sweeping the rest of the country has

stormed into New York City, with some areas in Queens, the Bronx and

Brooklyn far outpacing the national average.

Research conducted by online foreclosure marketplace RealtyTrac for The Real Deal

shows that pre-foreclosure sales — of which roughly 75 percent are

shorts — are spiking dramatically in a few zip codes here. In several

areas of Queens, Brooklyn, Staten Island, and the Bronx,

pre-foreclosure sales were 20 to 40 percent of all sales in the first

quarter of this year, far outpacing the national average of 12 percent.

Short sales, which occur when a home is sold for less than what is

owed on the mortgage, are also on the rise in New York City overall.

“There’s been a lot of discussion that short sales are coming, but

the reality is they are here,” said Jonathan Miller, CEO of Manhattan

real estate appraisal firm Miller Samuel.

Manhattan, however, remains largely unscathed, with just 15 pre-foreclosure sales in the first quarter of 2010.

The neighborhoods with the highest percentages of short sales so

far this year include Morrisania and Baychester in the Bronx; East New

York, Bushwick and Bedford-Stuyvesant in Brooklyn; Jamaica, Far

Rockaway and South Ozone Park in Queens; and Elm Park and Port Richmond

in Staten Island.

While RealtyTrac records pre-foreclosure sales that are already

underway, more are hitting the market. StreetEasy lists 77 short sales

on the market in the neighborhoods that have been the busiest in

Queens, Brooklyn and Staten Island. The current total of listings for

Queens is 1,368, according to calculations from Philip Tesoriero,

broker/owner of Exceptional Homes Real Estate on Long Island, based on

data from the Long Island Multiple Listing Service.

Perhaps not surprisingly, the hotbeds of short-sale activity

correlate closely to foreclosure activity. The 10469 zip code in the

Bronx, for example, has one of the highest percentages of short sales

in the county. It also has the highest percentage of foreclosures in

the county, according to RealtyTrac, which is based in California.

The zip code’s raw number of short sales for the first quarter is

small, about 10, but the growth rate and comparisons with last year

reveal a troubling acceleration. Short sales in 10469 — which covers

Baychester — in the first quarter were about half the total for all of

last year.

Broker Jacqueline Edwards of Perfect Quarters is seeing the uptick

in short sales in 10469. She believes the area has suffered from

widespread mortgage fraud, and many homeowners are struggling with

option-ARM loans far above what they can afford.

“There’s more short sales for sure,” said Edwards. “The majority

are people I spoke to last year who were in denial and trying to do

loan modifications.”

In Brooklyn, two zip codes that cover Bushwick, Bedford-Stuyvesant

and East New York led in short sales for the first quarter, and also

had among the highest percentages of foreclosures in the borough.

Short sales are rising in part because many cash-strapped sellers

are not obtaining modifications through the government’s Home

Affordable Modification Program, or HAMP — or the mods aren’t

effective. The federal government has also encouraged short sales this

year with incentive payments to loan servicers and banks. Banks,

meanwhile, are taking the losses and approving short sales to avoid the

cost and hassle of foreclosures.

What’s more, New York State has an exceptionally long foreclosure

cycle, which gives more time for seller and bank to hammer out a

short-sale deal. In New York, the average foreclosure process can last

more than 450 days, according to Rick Sharga, senior vice president of

RealtyTrac.

He contrasts that to Texas, which he said has the shortest cycle in

the nation at just 21 days, leaving little time to arrange a short sale

as an alternative to a foreclosure.

The spike in short sales in certain New York City neighborhoods

will put continued downward pressure on housing prices there. Some real

estate experts expect the trend to dampen the wider metro area’s

recovery, too, as they become more common throughout the city as a

whole. In addition to selling at a discount, short sales often take

several months longer to close than traditional sales, dragging out

their time on the market.

“There tend to be more severe discounts associated with them, and

as the volume goes up, it serves to temper the possibility that housing

prices will head upward over the next few years,” said Miller.

While acknowledging the hits to pricing and inventory levels,

RealtyTrac’s Sharga also noted that short sales help the market work

through troubled inventory. They allow homeowners to exit properties

they cannot afford.

“Along these lines, it’s probably a good sign to see an

acceleration of short sales, as it gives the marketplace a chance to

get through this correction,” said Sharga.