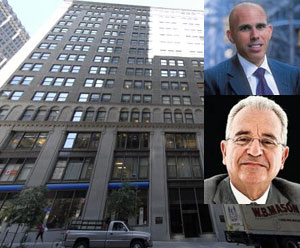

1 Park Avenue and, from top, Scott Rechler of RXR and Norman Sturner of Murray Hill Properties (building photo source: PropertyShark)

Vornado Realty Trust spent a total of $180 million to recapitalize and gain control of the 925,000-square-foot office building 1 Park Avenue from Norman Sturner’s Murray Hill Properties, which was in danger of losing the property to lenders.

The cash infusion included about $30 million in tenant improvement costs and other reserves, while at the same time Vornado secured $250 million in debt from a major investment bank, a person familiar with the deal, which closed last night, said. Murray Hill retained a small portion of the equity on the 20-story building located between 32nd and 33rd streets, the source said.

The original capital stack was comprised of a $375 million first mortgage, $100 million in mezzanine debt held by three companies and $120 million in equity.

Carlton Group arranged the financing, but declined to comment. Murray Hill and Vornado also declined to comment. The transaction was first reported by Bloomberg News last week before the deal closed.

In a play to take control of the property last year, Scott Rechler’s RXR Realty bought the most senior mezzanine position at a discount from its $25 million face value, but profited through Vornado’s purchase, another industry source said.

As part of the acquisition, Vornado paid off the mezzanine holders at a discount from the face value of the loan.

RXR declined to comment but the second source said the company “is pleased with the outcome, it being a significant multiple on our original investment.”

Additional reporting provided by C.J. Hughes.