Values in New York City’s luxury market have grown more in the past year than values in competing global markets, according to a recent wealth report from global property consultancy Knight Frank.

The Prime International residential Index, which measures the performance of prime real estate in the world’s top luxury cities and second home markets, shows that the prices of New York luxury homes increased by 18.8 percent during 2014, topping the list of locations.

Of the 10 markets where luxury values appreciated the most, four are located in the U.S. Just after New York is Aspen, ranked second with 16 percent growth, San Francisco is sixth with 14.3 percent growth and Los Angeles is 10th with 13 percent growth. American cities rounding out the top 20 are Miami (#17 on the list, with 9.8 percent growth) and Washington, D.C. (#19, at 8.7 percent growth).

The report notes that the threat of Mayor Bill de Blasio’s pied-à-terre tax doesn’t appear to have discouraged ultra-high-net-worth individuals from buying second homes in New York. London, however, is a different story: The city has seen growth curtailed in prices of properties valued over £2 million ($2.95 million) due to a new “stamp duty,” or purchase tax, limiting the value increase there to just 5.1 percent — which tied London with Bangkok and Madrid in 32nd place on Knight Frank’s list.

Overall, U.S. luxury real estate had a stellar year, increasing in value almost 13 percent nationwide, while worldwide values rose 2 percent and top European cities saw just 2.5 percent growth.

Other top performers were Bali in Indonesia and Istanbul in Turkey. In both markets, luxury prices increased 15 percent.

Other top performers were Bali in Indonesia and Istanbul in Turkey. In both markets, luxury prices increased 15 percent.

Jakarta, last year’s top-ranked city, slipped to 12th place this year with growth of 11.2 percent, which the report says is typical of the luxury market slowdown in many Asian cities last year.

Dubai, which was once a frontrunner with 17 percent growth in 2013, slowed to 0.3 percent growth, partially due to the Central bank of the United Arab Emirates’ mortgage cap, while government policies in China that have been aimed at controlling values also slowed growth in the biggest luxury markets there, such as Shanghai (0 percent), Beijing (-0.5 percent) and Guangzhou (0.6 percent).

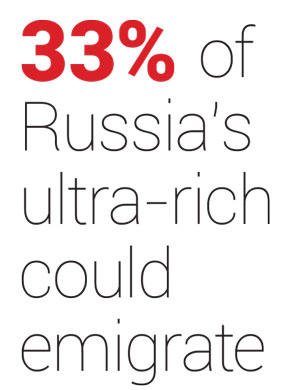

Knight Frank also predicts that by 2025, New York City will be home to the world’s largest number of super-rich, surpassing London, the current leader. At a panel discussion on the 64th floor of One World Trade Center last month, Knight Frank’s head of research, Liam Bailey, said a driver of this shift is the increased emigration of multimillionaires from certain countries such as Russia and China. A staggering 33 percent of Russia’s ultra wealthy, for example, are considering moving to another country, he said.

At the event, leaders in the luxury business discussed some of the ramifications of this trend. While the influx of foreign wealth has been an obvious boon to New York’s real estate industry, it has also created difficulties, such as worries over a luxury condo bubble. “One area of weakness are the $100 million penthouses,” said Howard Lorber, chair of Douglas Elliman, which formed a partnership with Knight Frank in October.

At the event, leaders in the luxury business discussed some of the ramifications of this trend. While the influx of foreign wealth has been an obvious boon to New York’s real estate industry, it has also created difficulties, such as worries over a luxury condo bubble. “One area of weakness are the $100 million penthouses,” said Howard Lorber, chair of Douglas Elliman, which formed a partnership with Knight Frank in October.

Lorber argues that there isn’t enough demand for the number of units in this price class that have hit the market. He also cautions that some wealthy buyers may not have the patience to wait for a new skyscraper’s completion. “Most buyers want instant gratification, and the long lead time sort of hurts new development,” he said.