Median rental prices in Brooklyn hit $2,964 in June — their highest level since 2008 when Douglas Elliman first started keeping track, according to the brokerage’s latest rental market report.

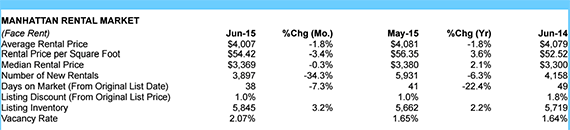

The median rent is up 5.9 percent year-over-year from $2,800. In Manhattan, the median rental price increased year-over-year for the sixteenth consecutive month, reaching $3,369, a 2.1 percent increase from last year.

There is now barely a $400 gap between median rents in the boroughs. The gap has wavered between $250 and $500 over the past several years, according to Jonathan Miller, president of real estate appraisal firm Miller Samuel and the author of the Elliman report.

The report tracks rentals in the north, northwest and east regions of Brooklyn. Prices in these more gentrified areas have been steadily increasing, fueled by development that caters to the high-end and record for-sale prices that force potential entry-level buyers to keep renting, according to Miller.

“It’s not as if there was a spike in rents, it’s just been grinding higher,” Miller said. “First-time buyers … can’t qualify out of the rental market, and you create all this price pressure because supply for rentals is relatively inelastic. It doesn’t respond immediately to changes in demand.”

(credit: Douglas Elliman/Miller Samuel)

In both Manhattan and Brooklyn, price gains were concentrated in smaller apartments. In Manhattan, the median studio rent increased 4.8 percent to $2,575, while the median price for two-bedrooms slipped to $4,267.

In Brooklyn, studio rents were up 4.8 percent to $2,284 and two-bedroom rents were only up 0.7 percent to $3,161, while three-bedroom rents were down 7.1 percent to $3,600.

Miller said that the cycle that creates increased pressure on smaller units can be traced back to record-high land prices, which force developers to build the most expensive product possible.

“That in a nutshell is the affordability crisis we’re seeing throughout the U.S.,” he said. “The new product being built “doesn’t connect with the demand.”

In northwest Queens, price indicators were down, with the median rent slipping 10.7 percent to $2,528. Miller said there is no straightforward explanation, but the data is “clearly showing a weaker rental market than Brooklyn and Manhattan.”