LendingHome may be the biggest real estate tech startup most New Yorkers have never heard of.

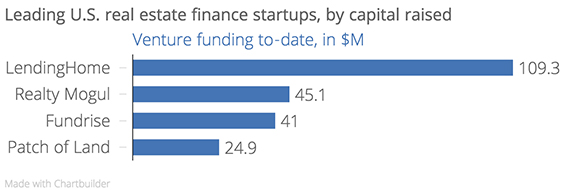

The mortgage-lending marketplace, founded in 2013, has raised $109.3 million in venture funding from firms like Renren – placing it among the real estate industry’s richest startups. That fact alone should make LendingHome the talk of the town. So why isn’t it?

One likely reason is that the San Francisco-based firm only just launched in New York, on July 16, and hasn’t financed any deals here to-date. But it’s also perhaps because of its focus: while other real estate startups are developing 3D technologies and cloud computing solutions for the Big Apple’s biggest landlords, LendingHome focuses on financing what is arguably the least flashy asset class in real estate: non-owner-occupied, single-family properties. “We started with these loans because they were particularly inefficient,” LendingHome’s co-founder and president James Herbert told The Real Deal in a recent interview. The lending market for these properties, he added, is dominated by small, local players and has made little use of technology. “We saw this as an opportunity to take a fragmented market and clean it up.”

Here’s how it works. LendingHome offers 30-year loans for those buying single-family homes to rent out as well as short-term bridge loans for those looking to buy and flip. Individuals can apply for a loan online by answering a handful of questions and uploading supporting documents, in a process the company claims takes just 20 minutes. If approved, it takes up to 14 days for a loan to close, according to the company’s website. Interest rates average around 7 percent for the 30-year loans and 11 percent for the twelve-month bridge loans, Herbert said, and LendingHome’s average loan size is $180,000.

Herbert, a Stanford grad and former executive at real estate investment firm Colony Capital, said the startup was born out of frustration with his own experience getting loans for his investment firm, Two Bridges Real Estate. LendingHome made its first loan in April 2014 and has originated more than $200 million in loans to-date. Sure, it’s a tiny sum in the world of real estate finance. But Herbert, who co-founded the firm with veteran tech entrepreneur Matt Humphrey, has grand plans: eventually, he said, he wants to dominate the market for mortgages on non-owner-occupied homes and also wants to start offering loans for owner-occupied homes.

Underwriting is done in more or less the traditional way by employees, and Herbert said the firm uses few of the high-flying metrics popular among consumer peer-to-peer lending platforms like Lending Club or Prosper.

For borrowers, LendingHome offers a service very similar to crowdfunding platforms like Patch of Land, Realty Mogul and Fundrise: real estate loans, processed online and in a low price range rarely served by banks. And both the startup and these platforms effectively act as a marketplace connecting borrowers and investors.

The main difference is that while crowdfunding platforms sell notes tied to the loans to small-time investors – the “crowd” – LendingHome passes all its loans on to institutions. For these investors – which include hedge funds, mortgage REITS and university endowments – the platform is essentially a new spin on mortgage-backed securities, allowing them to buy small loans in bulk.

At any rate, this distinction is beginning to disappear. “Institutional money is already usurping the crowd,” Sherwood Neiss, principal at industry consultant Crowdfund Capital Advisors, which advises government and financial institutions on crowdfunding, recently told TRD. “I think this is the general direction it will go in. Unless these are opportunities in small towns, I do believe that this will be mainly institutionally funded deals.”

Liberating small-time investors with the help of automated underwriting sounds great in theory. But finding hundreds of investors to fund a deal is tedious and severely limits the pool of available capital.

“When you look at the overall size of the market, the amount of capital needed to actually fund the origination volume that we do is pretty tremendous,” Herbert said. And since institutions have the most capital, it makes sense to tap into them.

LendingHome has its own plans to venture into crowdfunding by making its loans available to retail investors, but Herbert said the bulk of its funds would still come from institutions. This, essentially, is the model most crowdfunding platforms are also moving towards, albeit from the other extreme.

LendingHome retains none of the mortgages it originates, and thus none of the immediate risk. That kind of business raises concerns over risky lending — after all, the memories of the shenanigans of the previous boom are still raw. But Herbert insists his startup is exercising prudence, explaining that it typically lends only 70 percent of the total purchase price. “We only originate loans that have a high probability of getting repaid,” he said.