In 2008, at the height of the global financial crisis, the dean of Moscow’s elite diplomat academy MGIMO Igor Panarin predicted there was “a high probability” the U.S. would disintegrate by 2010. Turns out it’s 2015 and you can still travel from Manhattan to Wichita without a passport. Here’s another, more common prediction that also didn’t pan out: that securitization would disappear from the post-crash economy.

Commercial mortgage-backed securities (CMBS) – widely seen as a catalyst for the 2008 crash and subsequently a target of scorn and myriad regulations – are back in spades. New data from research firm Trepp shows just how much New York real estate investors once again rely on securitization for their funding.

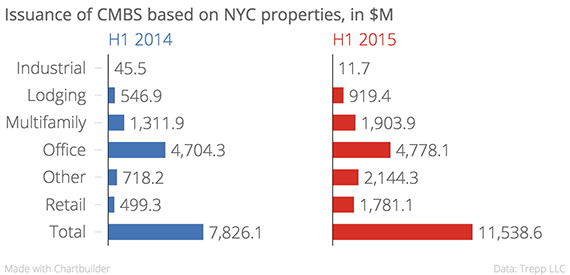

In the first half of 2015, new securitized loans based on New York City properties totaled $11.54 billion – up 47 percent year-over-year from $7.83 billion. That is the highest total in the first half of any year since the crisis and the second highest since at least 2003. Only at the height of the boom in 2007 were more CMBS based on New York properties issued (see chart above).

In a nutshell, securitization allows a bank or lender to issue a mortgage, then re-package it into bonds tied to the loan’s performance and sell them off to investors. The lender receives a fee for the securitization, and can use the money from the bond sales to issue more mortgages. By effectively multiplying the money multiplier, securitization increases the volume of loans available to real estate investors. In this sense, the boom in CMBS should be welcome news for the industry.

Sean Barrie, a research analyst at Trepp, said several factors explain the boom in loan issuance: the desire to lock in low rates before the expected rise in U.S. interest rates later this year, a large number of loans from the boom years maturing, and rising confidence in the real estate market.

The big question is whether lenders and investors have learned their lesson from the pre-2007 years, when lax underwriting and the opaque nature of the securitization market made for a junk loan bubble that calamitously burst. According to Barrie, however, lenders today are more cautious than during the past boom. “Underwriting standards are still right in the periphery of what we want,” he said.

The big question is whether lenders and investors have learned their lesson from the pre-2007 years, when lax underwriting and the opaque nature of the securitization market made for a junk loan bubble that calamitously burst. According to Barrie, however, lenders today are more cautious than during the past boom. “Underwriting standards are still right in the periphery of what we want,” he said.

Gabriel Silverstein, head of capital markets brokerage and advisory firm Angelic Real Estate, said it’s too soon to tell if lending practices are once again becoming reckless.

“I would definitely say that underwriting has gotten more aggressive in the last six months, whether or not it’s gotten more lax is hard to say,” he said, although he added that he has seen a few “crazy” CMBS deals close recently. Lenders today generally don’t securitize an entire loan — they keep a portion on their books, which tends to discourage risk-taking, he said.

Unsurprisingly, Manhattan office buildings accounted for the bulk of new CMBS loans issued in the first half of both 2014 and 2015, making up almost half of the total. CMBS loans based on retail properties saw the strongest growth among different real estate sectors (see chart).

Three CMBS loans worth more than $1 billion were issued in the first half of the year. Canadian pension-backed investment firm Ivanhoe Cambridge financed its $2.2 billion purchase of Blackstone’s 3 Bryant Park with a $1.13 billion loan that was then securitized. The owners of the MetLife Building at 200 Park Avenue, Tishman Speyer and Donald Bren, took out a $1.4 billion loan on their property, which is valued at close to $3 billion according to Bloomberg. And the Hudson’s Bay Company took out a $1.25 billion loan to Refinance The Saks Fifth Avenue building, valuing it at $3.7 billion.

What’s noteworthy is the marked increase in CMBS tied to properties in Brooklyn and Queens, two boroughs that have seen a boom in real estate investment. New securitized loans on Brooklyn properties ballooned from $341.9 million in the first half of 2014 to $1.13 billion in the first half of this year, Trepp data show, while the Queens total grew from $231.6 million to $1.23 billion. Manhattan still dominated CMBS origination but grew much less dramatically, from $6.71 billion to $8.93 billion.