Developers are realizing big returns with the construction of mid-rise hotels along the industrial margins of the Long Island City central business district, an area already thick with skyscraper glass. Now they’re marching further north into the neighborhood’s most industrial sectors.

This August’s Department of Buildings filings yielded six new hotel plans totaling 409,000 square feet and 1,135 units city-wide. Two of those plans are set for the increasingly less industrial Garment District, and three are planned for Long Island City, where development is on a seemingly summitless climb.

A Pratt Center for Community Development study released in March illustrated that Long Island City hotels have a higher net operating income, average revenue, and average market value per square foot than residential, commercial or industrial properties. Developers are making these gains building hotels as-of-right in industrial zones, or in paired districts that allow them to build alongside (or even inside of) existing manufacturing space.

Some predicted earlier this spring that the de Blasio administration would soon restrict or require some form of political approval for continued hotel development in manufacturing zones. That still hasn’t happened, and northern Long Island City, with at least 17 hotels built north of the Queensboro bridge (chain hotels such as Sleep Inn and Howard Johnsons abound), is already something of a pre-postindustrial resort village, with name-brand lodgings scattered among active and operating auto repair shops, metal and glass manufacturers, and industrial tool suppliers. It turns out there’s plenty of room for more hotels, though, as plans are popping up further north on streets still dominated by industry.

Hotels are pushing further into northern Long Island City

In July, Janat Hospitality Group applied to construct a 175-key hotel at 12-02 37th Avenue in the neighborhood’s northern edge. A month later, two more hotels are already planned around the corner. Greenwich Street Equities decided this August it would begin building a more than 150-unit hotel replacing an auto repair shop at 38-04 11th Street. Sunny Builders Corp. filed a 96-unit hotel at 37-35 21st Street, to rise next to another auto repair shop. A third hotel, filed in southern Long Island City at 21-16 44th Drive by Youtube-sensation-cum-hotel-developer George Dfouni, will be 29 units.

Meanwhile, in Manhattan, the usual suspect took to keeping up with the Howard Johnsons of the world. Sam Chang of the ubiquitous McSam Hotel Group filed for two hotel buildings at 338 and 342 West 39th Street, on a block in the Garment District where many lots are still designated for industrial and manufacturing land use. In fact, the building where the 175-unit and 400-unit hotels will rise was once host to some some real life manufacturers, until Chang evicted them earlier this year. The lots face an already existing Hampton Inn, a Candlewood Suites and a Holiday Inn Express.

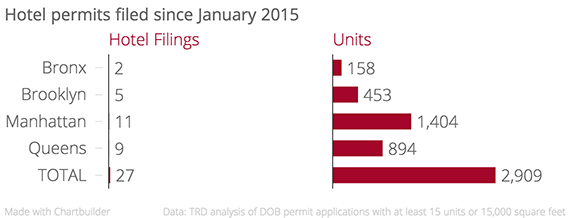

In total, August’s hotel filings bring the count of units included in qualifying permit applications since January to nearly 3,000 across the city.

But beyond the hotels, August was the busiest month for residential development in New York City since March. Brooklyn led the way with over 1.4 million square feet of planned apartment construction, according to a TRD analysis of residential permit applications with at least 15 units or 15,000 square feet. Four projects and 354 units were planned for Bushwick alone, the biggest at 338 Evergreen Avenue, where Moshe Braver is planning a 180-unit, 304,000-square-foot building.

By unit count, the Bronx continued what is now a sustained filing spurt with the most units planned during August—1,166—and five buildings counting more than 100 units. The largest of those, Cheskel Schwimmer’s 352,000-square-foot, 435-unit application for 198 East 135th Street, will rise on the banks of the Harlem River in the South Bronx.

The largest residential filing of the month goes to Sheldon Solow, who finally has plans for a 42-story, 550-unit apartment tower at 685 First Avenue, a parking lot across from the no longer empty development site at 626 First Avenue that Curbed once affectionately referred to as the First Avenue Mud Pit (Solow sold it to JDS Development in 2013).

And finally, some TRD readers suggested that we were not trying hard enough to highlight new development in Staten Island. Brace yourselves, YIMBYs of St. George: plans were filed this past month for Triangle Equities’ Lighthouse Point development at 35a Bay Street. Plans call for a 16-story, 116-unit mixed use building, complete with a 46,000-square-foot parking garage. The master plan calls for a 140,000-square-foot, 180-key hotel tower still yet to be filed, according to architect of record Cooper Cary’s website.