TRD Profile:In July, Chaim Miller and his sidekick Sam Sprei attended a bankruptcy hearing in Lower Manhattan. At Issue Was 45 John Street, a condominium development site that investor Harry Sohn claimed Miller was to sell him for $66 million.

Sohn, who controls Orin Management, accused Miller and Sprei of failing to disclose that the property’s mortgages were in default, and said the two — whom he described as “nothing short of scoundrels” — were backing out because Miller’s own partners on the deal were suing him.

“I think it was Churchill that was describing Russia as an enigma wrapped up in a riddle,” Sohn’s attorney Kevin Nash said at the hearing. “And I think Mr. Miller and Mr. Sprei would make Churchill’s Russia. They have a penchant for moving in and out of properties with other people’s monies.”

Behind the story:

The suit was the latest chapter in Miller’s extraordinarily contentious real estate career, one punctuated by missed payments, stalled deals, foreclosure proceedings and fractured partnerships. In the past three years, the prolific real estate investor has made a series of splashy buys, including the Beekman Tower, pushing his total New York portfolio to over 1 million square feet. But the majority of his deals are marred by battles with his partners, investors, buyers and sellers, according to an analysis of court records by The Real Deal. Many of them now appear to be stalled, and his lenders hover over him, waiting to pounce.

A magnet for litigation

Miller, who goes by both Chaim and Harry, owns at least 17 confirmed properties spanning Manhattan, Brooklyn and Queens, according to data from city records and Reonomy. But since 2014, he and Sprei have been hit with at least 18 lawsuits from at least 29 individuals and entities.

[vision_pullquote style=”1″ align=””] “I think it was Churchill that was describing Russia as an enigma wrapped up in a riddle. And I think Mr. Miller and Mr. Sprei would make Churchill’s Russia. They have a penchant for moving in and out of properties with other people’s monies” – Kevin Nash, attorney for Harry Sohn [/vision_pullquote]

“There’s so much litigation involving [Miller and Sprei] in all sorts of different places, that I can scarcely keep count,” Judge Sean Lane of the U.S. Bankruptcy Court for the Southern District of New York said at the July hearing.

Miller, who is believed to be in his 50s, and Sprei, 25, declined to comment for this story. But court records show that their investors and creditors are trying to trace the trail of $31 million that Miller used to buy out his partner, Manhattan-based Chinese developer Bo Jin Zhu, in four Brooklyn properties. The 45 John plaintiffs claim that instead of paying off his lenders, Miller used Orin’s $9.7 million deposit for 45 John Street to help him buy out Zhu’s stake in 203-205 North 8th Street, 32-34 5th Avenue, 29 Ryerson Street And 97 Grand Avenue.

Nearly a dozen Chinese investors and creditors have since joined in on a lawsuit against Miller, alleging he owes them millions. They’ve moved to temporarily block him from selling 45 John until their money is returned and Miller’s partner on the property, Chun Peter Dong, consents to the deal.

[vision_pullquote style=”1″ align=””] There’s so much litigation involving [Miller and Sprei] in all sorts of different places, that I can scarcely keep count.” Judge Sean Lane [/vision_pullquote]

Miller is now at risk of losing several assets. In February, Miller’s main financial lender, Madison Realty Capital, acquired the deed to 29 Ryerson, a roughly 200,000-square-foot building in Brooklyn’s Wallabout neighborhood, in lieu of foreclosure in connection with a defaulted loan. And since June, Madison has filed foreclosure proceedings on five of his properties, including a residential building at 203-205 North 7th Street in Williamsburg and an Upper East Side office building at 261 East 78th Street.

Always be Closing

It’s clear that Miller has an enormous appetite for New York property. His ability to digest king-sized deals, however, has sometimes been tested.

Last September, Waterbridge Capital’s Joel Schreiber, who was in a $100 million contract to buy a prime mixed-use portfolio on Williamsburg’s North 3rd Street, tried to flip it to an investor group led by Miller for $106 million, according to sources. But when Miller couldn’t come up with all the money, Schreiber went ahead and closed on it, sources said. Other sources told TRD in April that Miller holds a minority stake in the property.

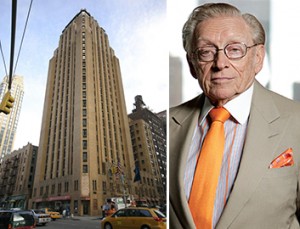

From left: the Beekman Tower at 3 Mitchell Place in Midtown East and Larry Silverstein

In April, Silverstein Properties claimed Miller defaulted on a contract to buy the Beekman Tower, a 170-unit rental building in Midtown East, for $137.5 million. Silverstein said Miller couldn’t come up with the cash in time. Miller countered by saying that Silverstein “wrongfully declared a default and wrongfully purported to terminate the contract of the sale.” But after the two parties agreed to push back the closing date, Miller closed on the property in July.

Miller was part of a consortium called Brooklyn Health Partners (BHP) which made a $250 million bid for the Long Island College Hospital site in Cobble Hill, and he was responsible for coming up with the $25 million down payment, according to court records. But after a contentious bidding process, a state Supreme Court ruled that BHP’s proposal contained “too many uncertainties.” (Fortis Property Group eventually bought the site for $240 million.)

The investor also made a play last year for 49 Dupont Street, a Greenpoint residential development site with more than 260,000 buildable square feet as-of-right. Williamsburg-based investor Joseph Brunner paid $23.3 million for the site, and reportedly flipped it to Zhu for about $48.5 million. Property records don’t show a link to Miller, but a source active in the market said that deal put Miller over the edge.

A tangled web

Miller is part of Brooklyn’s insular community of Hasidic real estate developers, a group that includes Brunner and Abraham Leser and came into the spotlight after the murder of Menachem Stark last year.

Miller got his start in the industry working for Leser, a veteran developer and founder of the Leser Group.

Leser’s attorney made an appearance during a court hearing for 45 John, in order to seek repayment of an $8.5 million loan he provided to Miller for 97 Grand. The attorney, Steven Weg, argued that before Orin is repaid, Leser, as a creditor, should receive a payout from the $41 million sale. He also claimed that Leser was not even aware that there were other investors in the property.

“Unfortunately, [Leser’s] an easy target, because perhaps he trusts Mr. Miller too much,” Weg said.

The group of Chinese investors in 45 John, however, see Leser’s demand for repayment as more of a calculated ploy.

“Mr. Miller worked for Mr. Leser as head of acquisitions for 20 years, and they’ve had plenty of transactions between them,” an attorney representing the investors said at the hearing. “So I’m not so comfortable in believing that if he gets that $8 million back, that the $8 million is going to somehow not work its way back to Mr. Miller.”

Miller denies he has an “indirect benefit” to repay Leser first, according to court documents. Leser did not respond to multiple requests for comment.

In a bankruptcy filing related to 45 John, Sohn said Miller and Sprei “have emulated the roles of Max Bialystock and his accountant in the Mel Brooks production, ‘The Producers.’ Bialystock sold the ownership of a Broadway show multiple times over to unwitting investors.”

In effect, Sohn and many others who sued Miller claim that he and Sprei left their Chinese investors out in the cold and never repaid their loans.

For the past few years, Miller has worked largely through Sprei, who goes by a number of names: Sam, Yechiel and Shimmy. The two have known each other for a decade and go to the same shul, according to a deposition Sprei gave in June.

Miller denies that Sprei is his partner, saying in a separate deposition that Sprei only got a fee for bringing him investors and financing, but holds no stakes in his properties. Though Sprei has brought him about a dozen deals, Miller claims to have profited from only one of them.

“[Sam] would never tell me from where he would get his sources and he would just tell me, you know, ‘here is a deal for that much and that much, I’ll give you that much financing, and that’s how we would go about the deal,’” Miller said in the June deposition.

However, other investors, including Dong, say Sprei holds interests in the properties, according to their complaints.

According to Sprei’s deposition, in 2013, he and Madison co-founder Josh Zegen discussed the possibility of Miller buying 45 John for $60 million.

Madison was already in contract to acquire the mortgage on 45 John from German bank Bayerische Landesbank. Sprei, who said he had made several financing deals with Zegen in the past, brought the proposal to Miller. Madison arranged for the deed to be transferred from the bank to Miller and his partners, and made them a $45 million acquisition loan.

[vision_pullquote style=”1″ align=”right”] “[Sam] would never tell me from where he would get his sources.”- Chaim Miller [/vision_pullquote]

Josh Zegen

While Miller downplays his connection to Madison, the lender and its affiliates have financed many of Miller’s purchases. Madison also provided Miller with three mortgages totaling $22 million to finance the buyout of Zhu’s interests, Madison confirmed.

“Sam had a relationship with Madison and he did all the negotiations where everything was done through him. I never really, really spoke to Madison,” Miller said in the deposition.

In a statement, however, Madison said: “Madison’s policy is to meet with all of its borrowers and in this case there was no exception. Josh Zegen has met with Claim Miller multiple times. In addition, Miller attended all of the loan closings and was always fully aware of the loan terms and the overall transaction.”

In limbo

Miller is now in contract to sell 97 Grand to an unidentified buyer for $41 million, according to his testimony at the July hearing. And though a deal to sell 32-34 5th to Hidrock Realty for $6.6 million was in limbo for a time, a bankruptcy judge recently lifted an injunction that allows that sale to proceed.

Zhu may have learned that Miller was selling off interests in the properties to numerous investors they shared, prompting him to sell off his stakes. Sprei testified that he and Miller were bullied into paying Zhu for the stake in the four Brooklyn properties before paying their creditors. According to Sprei, Zhu assigned his membership interests in the properties to an entity called Renatus Portfolio Company LLC. Sprei claimed that the frontman for Renatus was Brunner, who allegedly pressured the men into paying Zhu, even confronting Miller at his home and making threats.

“Unclear of [Sprei’s] rights and scared at the threat, Mr. Miller told Mr. Brunner that he would pay Mr. Zhu whatever amount he was seeking,” Sprei said.

“Brunner was sitting at the closing in a room downstairs together with Mr. Zhu, I guess getting excited they’re getting their money,” he added.

Brunner and Renatus, through their attorney, declined to comment.

As the case for 45 John lingered on into its seventh month, Dong was still looking to get paid. In September, he filed a third lawsuit against Miller in Kings County Supreme Court, alleging he was given a 10 percent membership interest in the entity that owns 97 Grand, as collateral for a loan Miller owed from 3112 Emmons Avenue in Brooklyn, according to the complaint.

[vision_pullquote style=”1″ align=””] “Brunner was sitting at the closing in a room downstairs together with Mr. Zhu, I guess getting excited they’re getting their money.”- Sam Sprei [/vision_pullquote]

Dong’s terms stipulated that Miller agreed not to sell or transfer any membership interests without his consent and approval, according to the complaint. But property records show Miller, Sprei and Brooklyn investor Moshe Oratz transferred nearly half of the interest in the property to developer Mordechai (Martin) Ehrenfeld in March. As of Oct. 12, Miller had not responded to the lawsuit.

These lawsuits now appear to be placing a strain on Miller’s relationship with Sprei and lead to doubts about Miller’s ability to raise capital for future deals. Sprei testified that because of the recent litigation, he has not brought Miller any recent deals.

Two law firms that represented Miller and Sprei in the bankruptcy case, Katsky Korins LLP and Ask LLP, have since withdrawn, citing a lack of communication and missed payments.

A source told TRD that despite his legal woes, Miller may be able to bounce back. “I’ve seen him execute in other deals,” the source said. “Some have gone very well for him.”