Here’s something tenant advocates can be thankful for: Landlords have started to drop asking rents on some of the city’s priciest shopping strips such as Madison and Upper Fifth avenues, according to the Real Estate Board of New York.

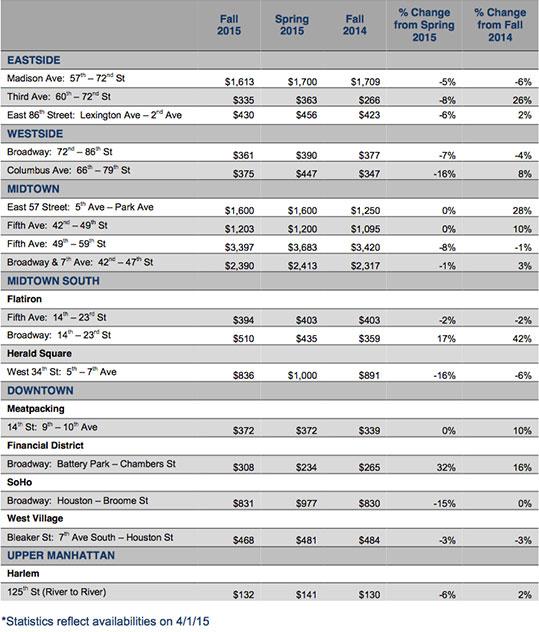

Ground-floor asking rents have fallen year-over-year on seven of the 17 Manhattan shopping corridors REBNY tracks on a semi-annual basis, according to the trade group’s fall retail report.

In the most severe cases, such as on Madison Avenue’s “Gold Coast” and the Herald Square area, average asking rents are down 6 percent.

Along the uber-luxury housing market, which observers say is experiencing a sales slowdown due to oversupply and unrealistic pricing, the retail sector has seen feverish gains this cycle, with observers watching it as a bellwether for the rest of the market. The cooling in retail rents could be another sign that the market may be nearing its peak.

Over the past several months, vacancies have been on the rise in areas like the Gold Coast and Broadway in Soho as tenants and their brokers have refused to meet the record rents landlords have been asking in these prime shopping areas.

REBNY pointed to this increase in supply as an explanation for the drop in asking rents – as well as moderate increases in the other areas compared to recent history – as it released the report Wednesday.

“[T]he softening we’re experiencing, particularly in the Madison Avenue corridor, is symbolic of current market trends and not emblematic of any weakening of interest in this corridor, or changing market fundamentals in the corridor,” Michael Slattery, REBNY’s senior vice president of research, wrote in a prepared statement. “The decrease is instead owed to the increased amount of supply available in the corridor and landlords becoming eager to keep their spaces occupied.”

On Madison Avenue between 57th and 72nd streets, asking rents dropped 6 percent from last fall to $1,613 per square foot. Retail On 34th Street between 5th and 7th avenues saw a similar decline to an average ask of $836 per square foot.

Even Upper Fifth Avenue, which is for the second year in a row the world’s most expensive shopping address, saw a slight decline of 1 percent down to $3,397 per square foot, according to REBNY.

A softening hasn’t stopped record retail deals from being inked. Luxury retailer Bulgari signed a 15-year lease at Wharton Properties and General Growth Properties’ 730 Fifth Avenue, setting a new city record at what sources pegged at $5,500 per square foot, The Real Deal reported earlier this month.

On the other side of the coin, Lower Manhattan’s resurgence and new residential development in areas like Midtown South and Billionaires’ Row have driven asks up in those areas, according to REBNY.

President John Banks said the upside to the softening retail market is that more deals are getting done as tenants are taking advantage of the lower rents.

“Manhattan is continuing to achieve robust asking rents and experience strong leasing activity, particularly in retail corridors experiencing significant residential development and a resurgence of neighborhood vitality,” he wrote in a prepared statement. “New York City is one of the world’s greatest shopping destinations and the softening of retail rents over the last several months has provided an opportunity for retailers to make moves.”