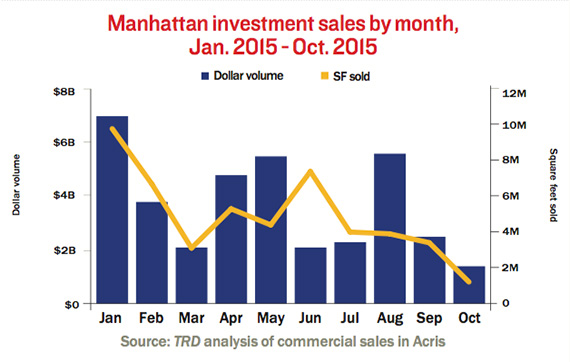

From the December issue: Manhattan investment sales began 2015 with several monster transactions, led by Ivanhoe Cambridge’s January purchase of 1095 Sixth Avenue for $2.2 billion from the Blackstone Group. And overall volume remained high from there.

From the December issue: Manhattan investment sales began 2015 with several monster transactions, led by Ivanhoe Cambridge’s January purchase of 1095 Sixth Avenue for $2.2 billion from the Blackstone Group. And overall volume remained high from there.

The year is expected to end with another huge property closing, the $5.3 billion acquisition of Stuyvesant Town and Peter Cooper Village by Blackstone. Through October, buyers have paid more than $37 billion for all commercial properties, according to The Real Deal’s analysis of Manhattan sales in city property database Acris.

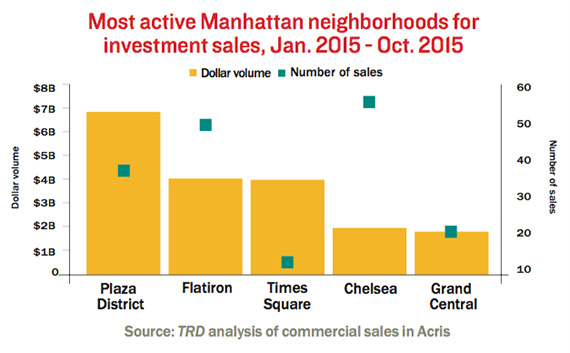

The most active area for investment sale transactions so far this year has been the Plaza District, boosted by the trades of the Waldorf Astoria Hotel for $1.95 billion and the Crown Building for $1.78 billion.

The most active area for investment sale transactions so far this year has been the Plaza District, boosted by the trades of the Waldorf Astoria Hotel for $1.95 billion and the Crown Building for $1.78 billion.

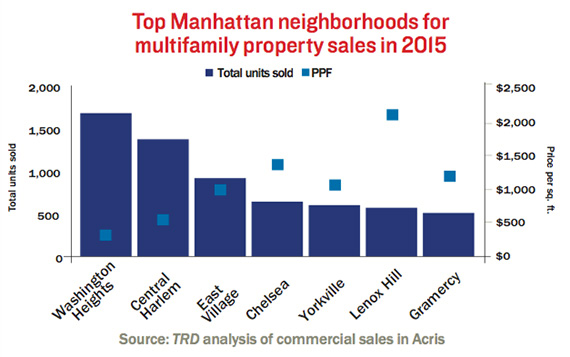

In rental apartments, investors bought up the most multifamily units in Washington Heights, with nearly 1,700 rentals changing hands. The buildings they snapped up had an average price per square foot of $305. Among the seven most active neighborhoods, Lenox Hill had the highest price per foot, driven by the sale of 151 East 60th Street, for just over $58 million or nearly $9,000 per existing square foot.

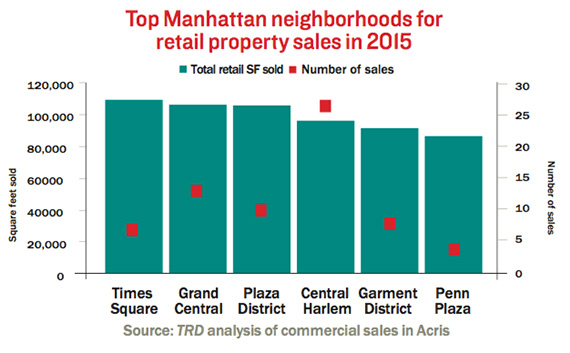

On the retail front, Times Square, Grand Central and the Plaza District saw the greatest amount of retail square feet sold. In nearly every case, the new owner plans to increase rates.