Clockwise from top left: Lu Zhiqian, a rendering of Riverside Center (credit: Christian de Portzamparc) (inset from top: Gary Barnett and James Linsley), a rendering of 520 Fifth Avenue (credit: Handel Architects) and a rendering of 525-529 East 73rd Street (credit: Memorial Sloan Kettering Cancer Center)

Dreams of Manhattan condominiums dominated 2015’s top 10 development site deals. While Gary Barnett’s Extell Development – which is known for this sort of thing – appears on the list as both a buyer and a seller, the crop of developers overall is best characterized by its diversity. Three Chinese firms appear, including locally-based Kuafu Properties. Global firms like GID Development Group and the Carlyle Group showed up next to local fixtures like Ziel Feldman’s HFZ Capital and Joseph Sitt’s Thor Equities. And while the outer boroughs failed to place, Manhattan – at least the expensive parts – was fully covered, from the far West Side, through Midtown, to the Upper East Side, and all the way Downtown.

76 Eleventh Avenue near the High Line

1. 518 West 18th Street, $870 million

Buyer: HFZ Capital Group

Seller: Edison Properties

Ziel Feldman’s firm closed on this 76,000-square-foot High Line-adjacent site, also known as 76 Eleventh Avenue, back in May in one of the most expensive transactions in the city’s history, valuing the lot at over $1,100 per square foot. Back in June, the developer told The Real Deal the buy was “worth every penny.” Feldman is planning a two-building, 850,000-square-foot luxury condominium project at the site.

2. 40 Riverside Boulevard, $410.8 million

Buyer: GID Development Group

Seller: Extell Development, Carlyle Group

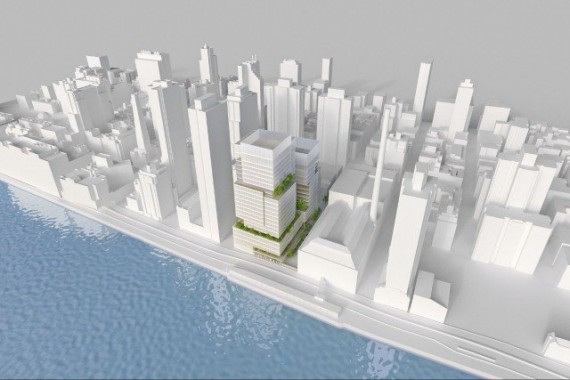

This massive – and massively expensive – 45,000-square-foot site was just one of five that comprised Extell Development and the Carlyle Group’s Riverside Center project on the Far West Side. James Linsley’s GID Development Group is planning a 37-story, 877,000-square-foot mixed-use tower at the site. It’s slated to include 595 residential units along with 18,500 square feet of commercial space, which will house a bar, an amphitheater and a music lounge.

A rendering of Riverside Center (credit: Christian de Portzamparc) (inset from top: Gary Barnett and James Linsley)

3. 80 South StreetAnd 163 Front Street, $390 million

Buyer: China Oceanwide Holdings

Seller: Howard Hughes Corp.

Billionaire Lu Zhiqiang’s firm bought the two South Street Seaport sites – only about 15,000 square feet between them – with plans to build an 820,000-square-foot tower, with 440,000 square feet dedicated to residential space and 380,000 square feet of commercial. Howard Hughes Corporation, which is leading the Seaport’s redevelopment, bought the sites in two deals last year, totaling about $124 million.

Lu Zhiqiang

4. 1865 Broadway, $300 million

Buyer: AvalonBay Communities

Seller: The American Bible Society

AvalonBay Communities bought the American Bible Society’s longtime headquarters with plans to develop a 32-story, 343,000-square-foot residential and retail project on the site. The firm plans a mix of rental and condominium units, with 131 of the former and 26 of the latter planned. Retail at the building will occupy about 70,000 square feet.

5. 200-204 Amsterdam Avenue, $275 million

Buyer: SJP Properties, Mitsui Fudosan America

Seller: American Continental Properties

SJP Properties and Mitsui Fudosan America paid nearly $700 per square foot for this Upper West Side site, between West 69th and West 70th streets, with plans to build the neighborhood’s tallest building. That project, a 55-story, nearly 400,000-square-foot condominium tower, will replace the church building that currently occupies the site. The new tower’s residents will have a protected view of Central Park.

From left: Joseph Sitt and a rendering of 520 Fifth Avenue (credit: Handel Architects)

6. 520 Fifth Avenue, $270 million

Buyer: Ceruzzi Properties, SMI USA

Seller: Thor Equities

Fairfield, Conn.-based investor Ceruzzi Properties and Shanghai-based SMI USA bought this 11,000-square-foot Midtown site aiming to follow through on Thor Equities’ plans for it: a 71-story, roughly 354,000-square-foot residential, hotel and retail tower. The price paid adds up to about $763 per buildable square foot. Two prewar buildings at the site have already been demolished.

7. 20 Riverside Drive and two adjacent parcels, $265 million

Buyer: GID Development Group

Seller: Extell Development, Carlyle Group

Earlier this month, GID Development Group followed up its previous Riverside Center purchase (see above) with another buy, this time for three parcels between West End and 12th avenues. The developer’s plans for the site aren’t yet known, but the three properties together have a combined 1.1 million buildable square feet, according to public records.

From left: A proposed rendering of 143-161 East 60th Street on the Upper East Side (credit: Cushman & Wakefield) and Shang Dai

8. 143-161 East 60th Street, $254 million

Buyer: Kuafu Properties

Seller: World Wide Group

New York-based Chinese developer Kuafu Properties bought six contiguous Upper East Side parcels, closing in October. Together, the lots total about 20,000 square feet and offer about 283,000 buildable square feet above grade, for a per-square-foot price of about $1,060. Kuafu’s exact plans for the site are unknown, but sources told TRD the firm is contemplating a luxury condominium building with about 60,000 square feet of retail at the base.

9. 1710 Broadway, $247 million

Buyer: Extell Development

Seller: C&K Properties

Extell bought a 39 percent stake in C&K Properties’ Midtown, closing earlier this month. The deal includes air rights across a total of six lots, with the possibility of some air rights being transferred to another Extell project, at 842-846 Seventh Avenue. The site offers a total of 370,000 square feet of buildable space. The two firms will team up to build a planned 60-story condominium and hotel project there.

A rendering of 525-529 East 73rd Street on the Upper East Side (credit: Memorial Sloan Kettering Cancer Center)

10. 525-529 East 73rd Street, $226 million

Buyer: Memorial Sloan-Kettering Cancer Center, Hunter College

Seller: New York City Economic Development Corporation

The partners – listed as Memorial Hospital for Cancer and Allied Diseases – are planning two buildings at the Upper East East Side site: a 500,000-square-foot cancer treatment facility next to a 300,000-square-foot nursing school. The price paid to the city agency, while high, amounted to just $283 per square foot.