Gary Barnett’s Extell Development is in talks to bring on a capital partner at Central Park Tower, the developer’s 1,500-foot condominium project on Billionaires’ Row, sources told The Real Deal.

Extell filed an offering plan for the 182-unit development in July, but it withdrew the plan a month later, according to filings with the state Attorney General’s office recently reviewed by TRD. Sources close to the project speculated that Extell – and its unknown partner – would refile the offering plan under a new sponsor name.

The project is expected to have a $4.4 billion total sellout, including $4 billion worth of condo sales and $400 million from the sale of the commercial space at the tower’s base to Nordstrom, according to regulatory filings on the Tel Aviv Stock Exchange, where Extell sold $300 million worth of bonds. The average asking price for the condos works out to just over $6,500 per square foot.

Extell owns 87 percent of Central Park Tower, according to TASE filings. At One57, in comparison, it owns just a 12 percent stake, with Abu Dhabi-based investors such as Aabar Investments and Tasameem Real Estate Companies holding the rest.

One source told TRD that Extell is in talks with a Chinese partner who could pump $500 million into the project. The source said the tower’s design is not changing. The project’s estimated cost is still unclear.

According to the withdrawn offering plan, Central Park Tower, formerly known as the Nordstrom Tower, will have units ranging in size from a 564-square-foot studio to a triplex penthouse spanning more than 17,800 square feet. The plans also include 18 full-floor condos measuring 7,073 square feet, as well as two duplex units spanning 12,582 square feet and 11,481 square feet. Prices were not disclosed.

Extell projected $2 billion in profits from the 1.3 million-square-foot development, which is expected to be completed by 2019, according to TASE filings.

Although the design is not expected to change, industry veterans said such a move would be understandable given the slowdown at the top of the real estate market.

“If the units are really big and really expensive [at Central Park Tower], you’d probably want to go back and see what you can do,” said the Marketing Directors’ Andy Gerringer.

The number of sales of high-end Manhattan pads slipped last year compared with 2014. There were 177 sales above $10 million in 2015, a 14 percent drop from the year prior, according to recent reports.

“The big picture on Billionaires’ Row is there’s probably too much being developed, almost certainly,” said Michael Falsetta, executive vice president at commercial real estate appraisal firm Miller Cicero. “The truth is, none of us were ever able to accurately measure the depth of demand.”

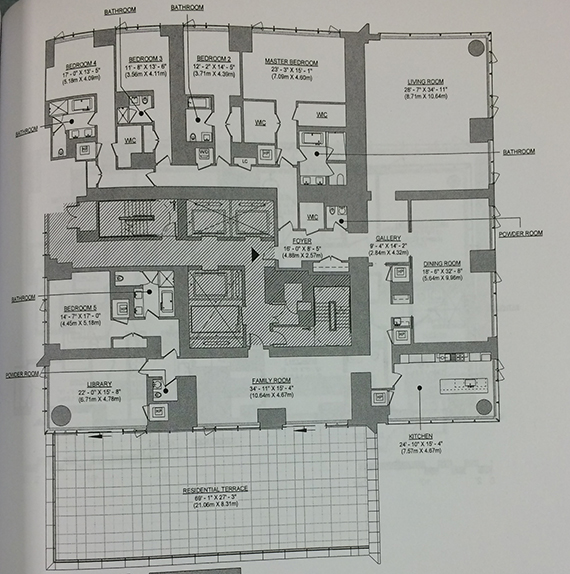

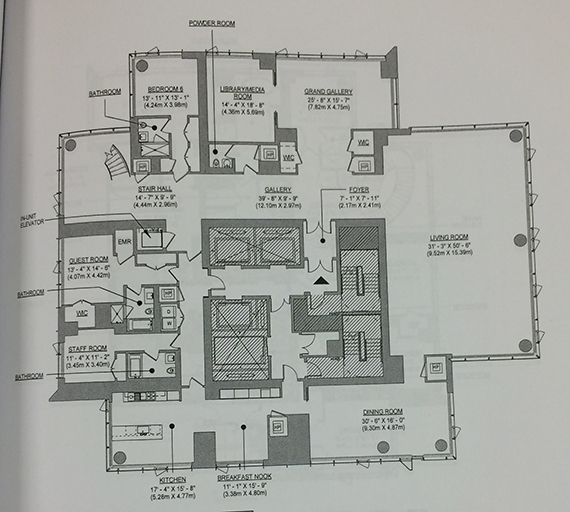

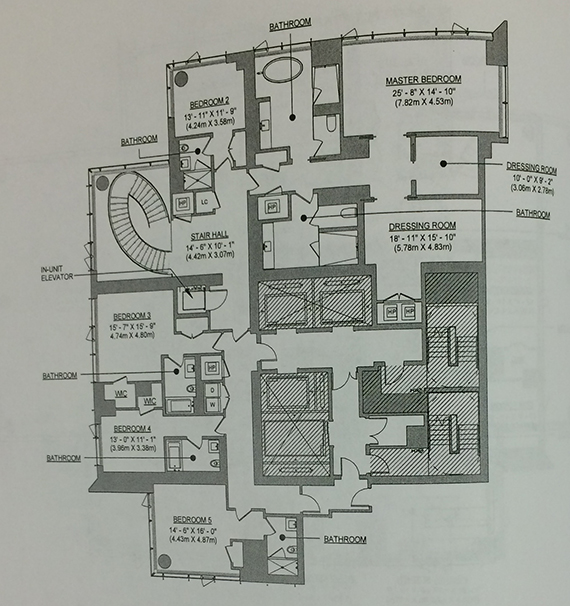

Residence 53 at Central Park Tower

Lower floor of a duplex

Upper floor of a duplex