While residential-focused real estate investment trusts like AvalonBay Communities and Equity Residential saw double-digit returns mirrored by positive stock price performance last year, their office counterparts such as SL Green Realty, Vornado Realty Trust and Boston Properties had difficulty coming up with the goods.

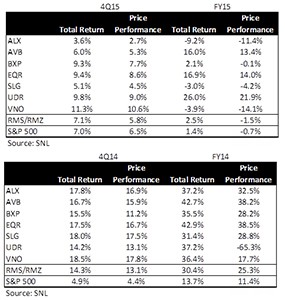

In 2015, SL Green and Vornado delivered total shareholder returns of -3.0 percent and -3.9 percent, respectively, according to data provided to The Real Deal by investment banking firm Sandler O’Neill + Partners. Both companies’ share prices also dipped over the course of the year, to the tune of -4.2 percent for SL Green and -14.1 percent for Vornado.

In 2014, for comparison, total returns were 31.4 percent for SL Green and 36.4 for Vornado, while those companies saw their share prices jump nearly 29 percent and 18 percent, respectively.

Boston Properties, meanwhile, saw total shareholder returns of 2.1 percent in 2015, with price performance of -0.1 percent for the year just failing to break even. In 2014, the Boston-based REIT delivered total returns of 35.5 percent, while its shares rose more than 28 percent on the year.

By contrast, AvalonBay and Equity Residential delivered total shareholder returns of 16 percent and 16.9 percent, respectively, the data show. Both REITs benefitted from “the reacceleration of apartment fundamentals last year” nationwide, according to Sandler O’Neill analyst Alexander Goldfarb. AvalonBay stocks rose 13.4 percent across 2015, while Equity Residential’s jumped 14 percent.

The fourth quarter of 2015 was largely successful for all the above REITs, however, with positive shareholder returns and price performance across the board. Vornado had the best fourth quarter by those metrics – breaking into the double digits with total shareholder returns of 11.3 percent and stock price performance up 10.6 percent.

Goldfarb noted that most REITs “rallied” in wake of the Federal Reserve’s December interest rate hike, which “shows there was a lot of nervousness in the market” about the effect that rising rates would have on publicly-traded REITs. But those fears were mitigated by news that “the pace of Fed [rate] increases is going to be slow,” he added.

So why did New York’s major office and retail REITs have difficulty delivering for shareholders in 2015? Goldfarb noted that despite “a lot of growth” in the tech, advertising and media sectors – the TAMI tenants who have driven much of the city’s office market in recent years – “there hasn’t been a lot of froth” in the city’s commercial real estate market as of late.

“You’ve certainly had an expansion of neighborhoods; Midtown South went from being a second-tier submarket to becoming the [major] submarket,” Goldfarb told The Real Deal. “[But] you haven’t been seeing people talk about rent spikes, or needing to take space now because you won’t get it [in the future].”

By contrast, the residential sector has seen apartment values “driven by new condos or areas that suddenly came on the map,” he said. “You saw Brooklyn residential surpass Manhattan residential as far as where people want to live.”

There was also heightened scrutiny regarding REITs trading at a discount to the underlying value of their assets – up to and exceeding 20 percent of net asset value for office REITs, in particular.

SL Green’s planned 1.6 million-square-foot One Vanderbilt office tower near Grand Central Terminal “went from being a positive for them to a negative, in investors’ minds,” Goldfarb said, with concerns over what Midtown office leasing conditions may look like upon the tower’s completion.

Vornado, meanwhile, felt the effects of spinning off its Urban Edge Properties shopping center division early last year, which hurt its share price in the early part of the year. But the company also seemed to lose some momentum as far as value-growth initiatives bringing an “excitement factor” for investors, Goldfarb noted, having reverted to being “A Normal Office Company With Street retail.”

In general, the REIT sector didn’t have the best 2015. The MSCI U.S. REIT Index, which tracks REIT performance nationwide, dropped -1.5 percent over the year and delivered total shareholder returns of only 2.5 percent.