Why buy one apartment when you can own two?

That’s the tactic some developers are employing to lure buyers to a crop of combination units that have hit the market in recent weeks. Though apartment mashups are not new, they’re being positioned as a value play for potential buyers amid softening at the upper levels of Manhattan’s residential market.

“The market is dominated by apartments that are $10 million-plus and I don’t think people want to spend that kind of money,” said Sherry Tobak, head of sales at Carnegie Park, Related Companies’ 277-unit condo conversion on the Upper East Side. The developer recently listed three sprawling combination apartments for under $5 million at the building. One is a three-bedroom, measuring 1,576 square feet, asking $2.925 million. Another is a five-bedroom spanning 2,500 square feet, which is asking $4.985 million.

Carnegie Park

“We’re able to offer value that doesn’t exist in other buildings to cater to the demand for larger homes, with price tags under $3 million for three bedrooms and under $5 million for five bedrooms, which is just not seen in this area,” said Tobak, who said the building’s blended average price per foot is $1,600. That’s below the $2,210 per foot average price that new condos commanded during the fourth quarter, according to real estate appraisal firm Miller Samuel.

Overall, Manhattan’s residential market has seen softening at the top in recent months. The number of contracts signed on residential properties $10 million and up dropped 16 percent in 2015, according to Olshan Realty.

Miller Samuel president Jonathan Miller said that by his rough estimate, apartment combinations accounted for 4.6 percent of sales during the fourth quarter, up from 2.9 percent a year earlier. “It’s consistent with the market narrative, which is ‘I need more space, but I need something affordable,’” he said, noting that developers like Related are smart to offer buyers a “value play” by cobbling together larger homes.

Since sales launched in January 2015, Related has created 34 combination homes at Carnegie Park, including three penthouses. The developer has sold 27 of those units, and will soon list the penthouses, with prices ranging from $4.795 million to $7.15 million.

“If I could build 10 more [combo units],” she said, “I would.”

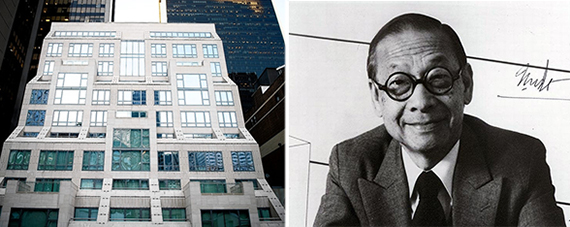

At the Centurion, a 47-unit condominium at 33 West 56th Street, developers Antonio Development and Stillman Development International are re-listing two 16th-floor penthouses as a full-floor unit with a price tag of $9.6 million. When combined, Penthouses D and E — previously asking $4.95 million and $4.9 million, respectively – will measure 3,338 square feet.

The Centurion and I.M. Pei

Building marketer Thomas Guss, founder of New York Residence, said a full-floor unit one floor up sold for $14 million this past November. “After the floor above sold, it made much more sense to sell them as a combination,” he said. “When you have a comparable [that sold] for $14 million and you can buy the same space for $9.6 million, there’s still money on the table.”

Guss said he’d received multiple offers for the individual apartments over the years. But combining the apartments at the I.M. Pei-designed building always proved to be problematic since the units were connected by a hallway leading to A Common Terrace. “People didn’t want two-thirds of the floor,” he said. In December 2015, Guss said he convinced the building’s board to make the hallway space and terrace available for purchase, too. (If sold, proceeds will fund a new rooftop terrace for other residents to use.)

The trend isn’t limited to new development. At the historic Eldorado at 300 Central Park West, agent Royce Pinkwater of Pinkwater Select is marketing a two-bedroom unit for $5.2 million. A key selling point? The owner has full architectural plans to combine the unit with Bruce Willis’ former pad located one floor up, a three-bedroom pad with an asking price of $12.9 million. The combination unit at the co-op would measure about 5,000 square feet.

Joseph Moinian

At the Atelier, the Moinian Group’s 478-unit condominium at 635 West 42nd Street, several units have been cobbled together as demand has picked up for larger spreads, according to board manager Daniel Neiditch of River2River Realty. “We had demand from families who were priced out of Chelsea,” he said.

The combinations range from a three-bedroom apartment listed for $2.6 million to a mammoth $50 million unit that’s spread over five floors. The $50 million home was configured from six units and Neiditch said it’s set up to be a “townhouse in the sky.”

Also on the market is a duplex asking $22.5 million, which was cobbled together from four units.

The building also has an $85 million apartment on the market at the property. To further entice buyers, the unit comes with a $1 million yacht, two Rolls Royce Phantoms and $2 million in credits to renovate the unit.

Several owners at the Atelier recently filed a $100 million lawsuit against Moininan, alleging that the firm is preventing them from accessing the building’s amenities, a claim the developer said is meritless.