After a disastrous start to the year spurred by January’s stock market nosedive, New York City’s major real estate investment trusts rebounded strongly in the first quarter to deliver modest investor returns. Office-focused REITs, however, continued to struggle.

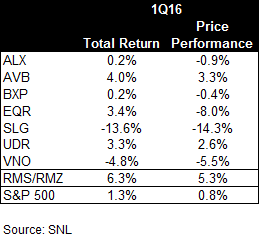

Similar to last quarter, residential-focused REITs AvalonBay Communities, Equity Residential and UDR delivered positive first-quarter returns to the tune of 4 percent, 3.4 percent and 3.3 percent, respectively, according to data provided to The Real Deal by investment banking firm Sandler O’Neill + Partners.

Those REITs outperformed their commercial-focused counterparts such as SL Green Realty, Vornado Realty Trust and Boston Properties, which have struggled to deliver positive returns. While Boston Properties investors saw a total return of 0.2 percent in the first quarter, SL Green and Vornado investors saw negative returns of -13.6 percent and -4.8 percent, respectively.

Retail and mall REIT General Growth Properties outperformed even its residential counterparts, delivering a total return of 9.3 percent in the first three months of this year.

“In the first quarter you had a market that went into a panic at the start of the year, and that extended into mid-February,” said Alexander Goldfarb, a managing director at Sandler O’Neill. “Then the market started to breathe again, and I think people assessed the situation and you saw [REITs] rally.”

Much of that rebound came in the past month, Goldfarb said, when REITs by and large outperformed the S&P 500. The S&P brought positive total returns of 1.3 percent over the entire first quarter, while the MSCI US REIT Index – a national index of the major REITs – delivered returns of 6.3 percent in the period.

Apart from the macro factors that hurt the stock markets, Goldfarb noted that commercial real estate landlords are dealing with “some concern in the market about the drop in rents,” particularly for prime Manhattan office properties in core markets like Midtown.

While that drop has, in effect, wiped out much of the rent growth seen in the market last year, Goldfarb said that by and large, the city’s major publicly-traded office landlords “are fine.”

“When you speak to brokers, they’ll tell you midway through last year New York City boosted [office] rents $5 to $10 [per square foot], and this year they’ve pulled back.” he said. “What we’ve heard is that it’s a tenant’s market, but at the same time, landlords aren’t panicking.”

He also noted the effect of emerging office submarkets in Manhattan such as the Far West Side market, which is anchored by Related’s Hudson Yards megaproject, and a Downtown market that continues to grow.

“Leasing has happened in Midtown, but you have new buildings going up on the Far West Side and Downtown at rents that are $20 a foot cheaper,” Goldfarb said. “This office recovery has seen a lot more submarkets participate.”

SL Green, in particular, gave investors reasons to be glum with a bearish fourth-quarter earnings call in January, when CEO Marc Holliday spoke of a negative impact on leasing velocity thanks to factors like slowing job growth in New York.

While the tone struck by the city’s biggest office landlord “shocked the street,” Goldfarb said SL Green shares have rebounded in recent weeks and the company has talked up “strong” leasing figures in the first quarter. Still, its stock dropped 14.3 percent in the period, overall.

Vornado stock also dropped 5.5 percent overall in the first quarter, while Boston Properties – which recently saw cofounder Mort Zuckerman announce he’d be stepping down as chair – was the most stable of the major office REITs, with shares falling only 0.4 percent over the first quarter.

AvalonBay and UDR saw positive price performance in the first quarter, with shares up 3.3 percent and 2.6 percent, respectively, in the period. The same could not be said about Sam Zell’s Equity Residential — its stock dropped 8 percent over the course of last quarter but still delivered positive returns, thanks to a large special dividend connected to its massive $5.4 billion sale of a 23,000-unit residential portfolio to Starwood Capital Group.

GGP, meanwhile, rebounded from a difficult 2015 with stock price performance up 9.3 percent in the first quarter. The Sandeep Mathrani-led REIT – which holds several assets in The Prime Upper Fifth Avenue retail corridor, in addition to its national retail and mall holdings – benefited from “listening to market concerns on street retail,” according to Goldfarb, and saw its shares bounce back to near post-bankruptcy highs.

GGP’s total return of 9.3 percent – the same figure as its stock price performance – could have been even greater had the company’s stockholder dividend been recorded in the first quarter and not, instead, paid out in April. Mathrani’s total compensation for 2015 was $39.2 million, GGP recently reported.

The S&P 500 was up 0.8 percent in the first three months of 2016, while the MSCI US REIT Index jumped 5.3 percent in the period.