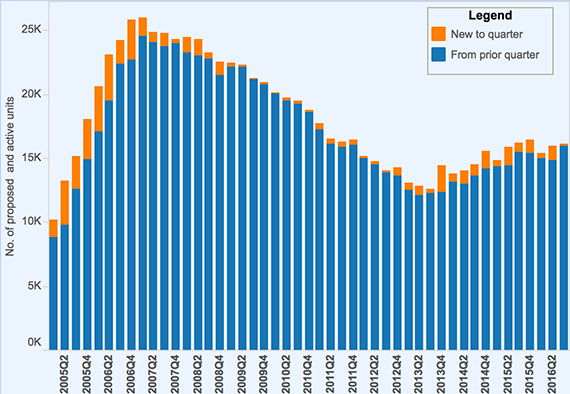

Manhattan’s condo pipeline, showing the number of active and proposed units (Credit: The Real Deal)

And that existing pool may begin to diminish even further as a tighter financing market weeds out those projects deemed to be too risky in the current market.

Manhattan’s condo pipeline may finally have peaked (Illustration by Lexi Pilgrim for The Real Deal)

“Here’s the harsh reality of where we are. Based on the capital markets, some very, very large percentage of the [pipeline] projects are not going to be financeable,” said Tim Crowley, director of new development for the residential brokerage CORE. “If you don’t have a construction loan today and you’ve acquired dirt, there’s a very good chance you’re not going to find [financing].”

It’s increasingly challenging for even the most established of developers to obtain financing in a condo market with a glut of new product, particularly large, expensive luxury units that have come to define this cycle.

Some 14,500 units are expected to hit the Manhattan market between 2015 and 2017, which at the current absorption rate works out to anywhere from four-to-six years of excess supply, TRD reported in March.

The pipeline of Manhattan condo units — submitted to the New York Attorney General, under construction and on the market — has grown steadily for the past three years since bottoming out at 12,602 units in the third quarter of 2013. (Using data from the AG’s website, the New York City Department of Buildings and ACRIS, TRD defined the pipeline as units in projects submitted to the AG’s office, or that were actively under development, or that were completed but less than 75 percent sold out.)

And as the condo pipeline has flattened, the number of new residential permits issued is on the decline.

Through the first half of the year, the DOB issued construction permits authorizing just 634 residential units in Manhattan, according to a TRD analysis of DOB data. (The DOB data doesn’t distinguish between condos and rentals, but rather offers an overall indicator of residential construction in the borough.)

That’s a huge drop-off from the nearly 10,000 units permitted through the same period in 2015, which hit a 20-year high partly due to developers rushing to beat the expiration of 421a, according to the New York Building Congress.

So what does that mean for the condo pipeline?

The data suggests that it’s very possible the condo pipeline peaked in the fourth quarter of 2015 at 16,458 units. At the end of June this year, the pipeline stood at 15,931 units. If the trend in paltry building permits filters through to the condo pipeline, it could be reduced even further.

But if late 2015 did prove to be the height of the potential condo supply, it’s still a far cry from last cycle. The 16,000-plus units at the end of that year are about a third fewer than the 25,986 units in the pipeline at the beginning of 2007.

Jonathan Miller, president of the appraisal firm Miller Samuel, said the reason is simple: developers this cycle were going bigger.

“While the number of units are up since the financial crisis, it’s nowhere near the last boom,” he said. “My rationale is that the units that they’re building are significantly larger than the last cycle, on average. So you have fewer units and larger square footage.”

TRD’s pipeline analysis supports Miller’s assessment. At the end of last year, there was an average of 71.5 units per condo plan in Manhattan. That compares to the average of roughly 88 units per plan back in 2007.

Condo developers this cycle have moved toward four-bedroom apartments averaging around 3,000 square feet. But if lenders push developers toward smaller, more moderately priced apartments, the total supply of condos could increase.

CORE’s Crowley said that’s exactly what he thinks developers will do.

“The cheaper an apartment is, the more people can afford it. If I take a $10 million four-bedroom and I make it $7 million, the $10 million buyer might still be out there but I capture the $7, $8, $9 and $10 million buyer,” he said.

And where is the most demand?

“Today, yesterday and the day before, it’s always the two-bedroom,” Crowley said.

If the 230 condo plans active at the end of 2015 were being constructed with the same average number of units seen at the peak of the last cycle, they would produce 20,240 units (The last time the market saw that many units was early 2006.)

Andrew Gerringer, managing director at the Marketing Directors, said the growth of the condo pipeline in that cycle was the result of banks’ willingness to finance new projects, and lenders are unlikely to shell out money the way they did last time around.

“You’ll never see the financing for these developments available that you had in 2005, 2006 and 2007 leading up to the crash,” he said. “Just prior to 2008 when the market fell apart, all you needed was a heartbeat and you’d get financing. So you had all kinds of people in the market with projects.”

Miller said that developers this cycle have focused on a very niche segment of the market, namely, the luxury market. But the real demand is for the entry level and middle of the market.

“There’s a perception that there are so many towers everywhere. But the devil is in the details,” he said. “It’s just very visible on the skyline.”

Adam Pincus contributed reporting