Housing construction permits in New York City spiked to reach 2,218 new units approved to begin construction this September, the highest-volume month of 2016 so far, according to an analysis of Department of Buildings permit data by The Real Deal.

The year-to-date totals, however, are way down from last year, when developers citywide could still take advantage of expiring 421-a tax exemptions to build multifamily housing.

In September, more than half of the 2,218 units approved came from just three projects. Sheldon Solow’s 550-unit rental and condo project at 685 First Avenue was the largest among them. Artimus Construction’s 380-unit project in Jamaica, Queens and Blumenfeld Group’s Bjarke Ingels’-designed 146 East 126th Street project in Harlem, with 233 units, were the next two biggest projects to move forward with approved plans last month.

Citywide, there were 16 residential projects of 15 or more apartment units approved to begin construction across the five boroughs.

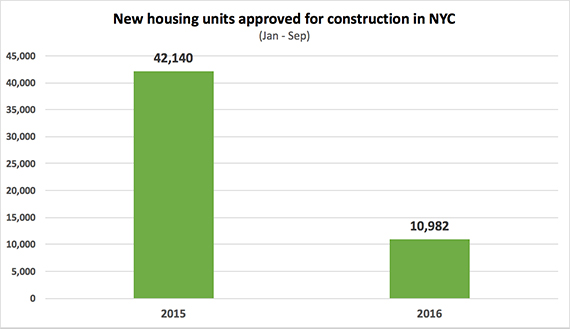

A wider angle shot, however, shows that the total number units approved in the first nine months of this year lags far behind the permits issued during same period in 2015, when two 421a expiration crises in Albany prompted developers to scramble to get stakes in the ground before critical tax subsidies expired.

New approvals this year dropped 74 percent by unit count from approximately 42,140 units in 2015 to 10,982 in 2016.

Source: TRD analysis of DOB permit data for initially issued new building permits. Includes single family homes, excludes hotels.

Although the number of units of housing in new construction permits has dropped in every borough except Staten Island this year, Brooklyn is experiencing the hardest fall.

Last year, housing permitted in Brooklyn made up 45 percent of the city’s total supply pipeline in the first nine months of that year, with 18,708 units approved to begin initial construction.

Just 3,112 units were approved over the same period this year, an 83.4 percent drop.

As TRD previously reported, most experts attribute the dwindling of new construction plans to the expiration of the 421a tax exemption program, which subsidized new multifamily development for more than 40 years before it officially ended in January.

The tax cut expired first in June 2015, inspiring a rush in permit approvals that brought more than 29,000 housing units to the construction pipeline in May and June alone.

After a last-minute, six-month extension of the program that June, another (more modest) rush to approve new buildings again occurred in December.

Those activity spikes account for a substantial part of the year-over-year difference, too, Real Estate Board of New York vice president Michael Slattery told the Commercial Observer in August. “New housing permits are down because of the absence of 421a and the push for projects leading up to December 2015 by developers who wanted to beat the deadline under the old program,” he said.