When Donald Trump began to seriously reckon with taking on the Hillary Clinton fundraising machine in June, he took some of his closest real estate buddies to lunch.

Richard LeFrak, Steven Roth, Howard Lorber, Michael Fascitelli and Steve Witkoff were reportedly among the guests, according to Bloomberg. The matter at hand: how to raise enough funds for what would promised to be an uphill battle against Clinton.

He later named LeFrak, Roth and Lorber to his economic advisory committee, and his son-in-law Jared Kushner, the CEO of development and investment firm Kushner Companies, became a key advisor.

When Trump triumphed Tuesday night, many of these same friends were on hand to celebrate with him at the New York Hilton. And on Thursday, when Trump met Obama at the White House, he brought along Kushner, who is likely to stay a key adviser while also running his own real estate firm.

“I’m not surprised, I’m astonished,” LeFrak told ABC about Trump’s victory. “But he gets the ball down the field, he’s going to put it in the end zone and score a touchdown — that’s the way he his.”

Never before has an American president surrounded himself with so many key advisers who all hold powerful positions in a single industry – in this case, real estate. And the president-elect has shown little inclination to keep real estate interests at bay.

“Trump is the only politician at this level that I know who has been totally unwilling to draw a line between his political persona and his business,” said Daron Acemoglu, an economist at MIT and co-author of the book “Why Nations Fail.” The danger that Trump’s real estate entourage could use their relationships with him to advance their businesses is real.

“This concerns me a great deal,” Ray Fisman, a behavioral economist at Boston University, wrote in an email. “I will hope that their every step will be scrutinized.”

Blurred Lines

Crony capitalism, the practice of business elites abusing access to political power for their own financial gain, isn’t new to Washington. The spread of big-ticket campaign donations and lobbying have made lawmakers increasingly beholden to business interests. In The Economist’s most recent crony capitalism index, which measures the share of a country’s wealth held by crony sectors, the United States ranks far behind serious offenders like Russia, Singapore and Mexico. But it ranks ahead of Japan, Germany and even Argentina.

The Ethics in Government Act of 1978 requires members of Congress to steer clear of policy issues that touch on their own financial interests.Those rules, however, don’t apply to the president, meaning Trump is technically free to pursue policies that benefit those close to him.

But despite the lack of safeguards, cronyism hasn’t been a hallmark of the American presidency. “There is a lot of corruption in the U.S. but arguably less than in many other economies,” said Acemoglu. “And it’s been relatively limited at the very top level.” No U.S. president has been investigated for financial corruption, he added.

One reason may be that presidents are obsessed with public perception — job approval ratings are a key factor in their ability to negotiate legislation and build their legacy. In a 2012 paper, Fisman and his colleagues studied the performance of Halliburton under the Bush-Cheney administration. (President George W. Bush formerly worked as an oil executive and his vice president Dick Cheney had served as CEO of oil services firm Halliburton.) They found Halliburton didn’t significantly outperform its peers and likely didn’t receive preferential treatment. In the case of Cheney, Fisman et al. argued that intense media scrutiny likely helped prevent Cheney from favoring his former employer.

“Whether or not you think Cheney was a good person or a good vice president, I doubt he was corrupt by most definitions,” Fisman told TRD. “I wish I could be so sanguine about the current situation.”

The problem with Trump, however, is that though he is said to be sensitive to how he is perceived in the mainstream media — many publications, including this one, have received his hand-written criticisms — that doesn’t seem to change his behavior. And given that he prevailed in the face of overwhelming media opposition, he may continue to act as he sees fit.

News reports have long scrutinized the potential conflicts of interest facing Trump, whose holdings range from his New York real estate portfolio to golf clubs and casinos. And while the candidate paid lip service to those concerns – saying his company “won’t matter” if he won, his actions during the campaign have been far from reassuring.

Trump has sent campaign letters on company letterhead. He has talked up his buildings during presidential debates. He has channelled campaign funds into his own companies. He has appointed family members and business buddies to political advisory positions. And in one memorable March incident, he used a campaign event at his Florida home to fill the stage with products bearing his name, and talked at length about how terrific they were.

In October, he interrupted his campaigning to open the Trump Organization’s latest hotel in Washington, D.C. The event was listed on his campaign’s website and partly staffed with campaign officials. Journalists were confused about whether he would talk business or politics.

The obvious irony in all this is that Trump ran a campaign on the promise to “drain the swamp” of Washington corruption. If he has mixed business and politics during the campaign, will he do the same as president? And will those close to him benefit?

Andy Barnett, a professor emeritus at Auburn University who has studied cronyism in Middle Eastern countries, isn’t so sure. Cronyism is based on two factors, he said: access and leverage. It’s clear that real estate bigwigs will have unprecedented access to the next U.S. president. But they may not have the leverage to pressure a President Trump to make things happen, given his wealth and the fact that he hasn’t been so reliant on large campaign donations.

“Can they translate that access into favorable decisions and crony capitalism? Well maybe not so much,” Barnett said. “He doesn’t owe them anything.”

What the real estate industry wants

Whether or not Trump is beholden to the real estate interests close to him, his early policy proposals have certainly been going in their favor. Suri Kasirer, a New York lobbyist who counts many developers among her clients, said two federal issues top the industry’s wish list: lower top income-tax rates and increased infrastructure spending. Trump has championed both. He has vowed to deregulate the financial sector (easy access to credit is another top priority for real estate developers). And while he promised to go after outsourcing manufacturers and close tax loopholes used by firms like Apple and Amazon, he stayed mum about a tax break favored by the real estate industry: the so-called 1031 exchange that allows investors to defer capital gains tax payments on real estate deals.

Interest rates are another crucial issue for developers, said Edward Wallace, co-chair of the New York office of law firm Greenberg Traurig. “Real estate thrives on high leverage, and leverage thrives on low and predictable interest rates,” he said. The president appoints the Federal Reserve chair, who is the most important force in shaping monetary policy.

Beyond these broader policies, the possibilities for crony capitalism are wide. Government agencies pay good rent, and as it happens, Roth, through the newly-formed JBGSmith, is one of Washington, D.C.’s largest office landlords.

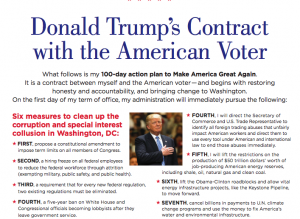

In his “Contract with the American Voter,” a plan for his first 100 days in office, Trump promised to use “public-private partnerships, and private investments through tax incentives, to spur $1 trillion in infrastructure investment over ten years.” Public-private infrastructure partnerships could mean plenty of business for real estate firms with past business ties to Trump. Procurement rules make it tough to hand government contracts to cronies, but a firm with close ties to the administration may still like its odds.

Kasirer said she has been fielding calls from developers looking to gain access to the future Trump administration.

For those in the industry who lack close ties to Trump, there are numerous potential middlemen that could help gain access, sources say. One is Trump’s attorney Jay Neveloff, who heads the real estate department at Kramer Levin. Asked for comment, Neveloff said he is certain Trump will not be susceptible to special interests.

“Knowing Donald, he is going to bend over backwards to be fair,” he said.

Other obvious contact points are Kushner and Trump’s three older children: Ivanka, Don Jr. and Eric. And then there’s Rudy Giuliani, who is popular in real estate circles, and is among the front-runners to be the next secretary of state. “The real estate industry in general would not regard Giuliani as unfriendly,” said George Arzt, a Democratic political consultant. “They think of him as a conservative.”

In “Why Nations Fail,” Acemoglu and fellow political scientist James Robinson argue that successful countries tend to be inclusive economies that allow everyone a say in the political process and a fair shot at wealth. Failing countries, meanwhile, tend to be countries where a narrow elite exploits their power for their own financial benefit.

While discussion about U.S. corruption has focused on the financial sector, the industry that has the greatest influence on politicians in most developing countries is real estate, according to Acemoglu. “That sector has become the nexus of all sorts of corruption and a big driver of a slide in quality of governance and transparency,” he said.

From left: Recep Tayyip Erdogan and Silvio Berlusconi

Consider Turkey. The country’s president, Recep Tayyip Erdogan, is a conservative strongman with a penchant for nationalist rhetoric and a well-documented disregard for democratic norms. Over the past decade, his government has championed major real estate development projects in an effort to modernize the country. Almost from the start, his opponents alleged Erdogan and his supporters benefitted from the building spree.

In 2013, an unpopular construction project in Istanbul and corruption allegations triggered widespread street protests against the government. Later that year, prosecutors launched a corruption probe into Erdogan’s inner circle and arrested the construction tycoon Ali Agaoglu. Erdogan responded by dismantling the independent judiciary and concentrating more power in his own hands.

And then there’s Silvio Berlusconi. In 1994, Italians first put the eccentric media and real estate mogul into power on the hope that his business experience would revive the country’s sluggish economy — similar reasons voters gave for supporting Trump. A big part of Berlusconi’s appeal lay in the fact that he was rich, and therefore supposedly less beholden to special interests.

Over the following two decades, Berlusconi did little to boost Italian growth. But he did manage to enrich himself and those close to him even further.

“Trump’s success suggests that the U.S. is looking increasingly like Italy,” Luigi Zingales, an economist at the University of Chicago, wrote in a May op-ed. “And not in the good ways.”