In a city of multibillion-dollar Manhattan skyscrapers, single-family home construction in the outer boroughs often goes unnoticed. But even the small-fry homebuilding market has its titans, and The Real Deal set out to find them.

From January 2008 through March 2017, developers filed over 2,200 permit applications for single-family homes in Brooklyn and Queens, according to TRD’s analysis of the city’s Department of Buildings records. During the same 10-year stretch, over 27,000 applications were filed for co-op and condominium units between the two boroughs.

The single-family homebuilding applications were spread between a number of developers. In Queens, the top six permit filers comprise more than a third of all applications, and the remaining 905 applications were shared by 776 different owners, none of whom submitted more than eight applications to the DOB. A similar pattern emerged in Brooklyn, where 476 applications list 372 different owners, TRD‘s analysis shows.

“I just think that those communities have largely built out, so the opportunities are really infill,” said Kirk Goodrich, managing director and partner at Monadnock Development, referring to plots of land only suitable for one or two buildings, sometimes between existing homes.

The number of applications does not necessarily reflect the total number of homes built during that time — applications may have been denied, the homes may yet to be built, or multiple applications may refer to the same intended structure. It’s also not always clear whether individuals listed as owners on applications are, in fact, the property’s true owner. But the numbers offer an important glimpse into the homebuilding market in the two boroughs.

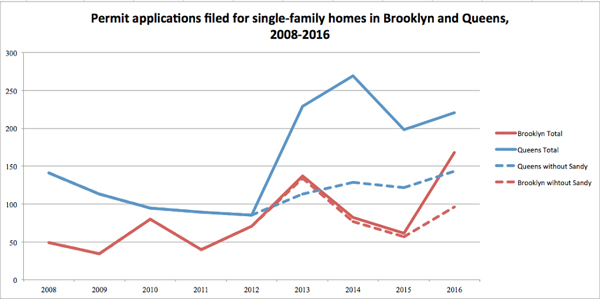

In the last decade, single-family home construction in Brooklyn and Queens has been significantly impacted by Superstorm Sandy, as 24 percent of all permits stem from the destruction caused by the October 2012 storm. Many applications listed the federal “Build It Back” program, which has been marred by mismanagement by city officials.

Even without the storm, permit filings have remained relatively steady over the years.

Brooklyn

Topping the list of Brooklyn application filers is the city’s Department of Housing Preservation and Development, which filed 202 applications since 2008. Many of the filings refer to homes included in the ongoing Nehemiah Spring Creek development in East New York. Over 300 homes have been built there over the last decade.

HPD’s name on permit applications does not necessarily mean the agency is developing the site or plans to own it in the future, according to Goodrich, whose firm has built a number of homes in Nehemiah through the construction arm of its business. But “up until the financing closing, they [HPD] remain in ownership of the site,” Goodrich said.

Building affordable single-family homes doesn’t make much financial sense without a “humongous subsidy” from the government, according to Fulcrum Real Estate Advisors’ Timothy O’Sullivan.

In Nehemiah Spring Creek, many single-family homes in one development phase sold for under $200,000. But each home required about $100,000 in land and cash subsidies from the city, and upwards of an additional $40,000 in subsidies from the state, according to data provided by Monadnock.

This kind of funding has allowed Nehemiah homes to remain affordable, along with “incredible amounts of city-owned vacant land,” said Father Edward Mason of East Brooklyn Congregations, a coalition of faith-based organizations behind the Nehemiah developments.

“The challenge now is identifying affordable land” in an area where much of the city-owned real estate has already been developed, Mason added.

| Brooklyn Top 6 | |

|---|---|

| Name listed as owner on application | # Applications filed, 2008-2016 |

| Housing Preservation and Development (John E. Gearrity, Timothy Joseph) | 202 |

| SANBA Partners (Alessandro Zampedri) | 22 |

| Hamlin Ventures & Time Equities (Abby Hamlin) | 18 |

| Bouler Pfluger Architects (James Bouler) | 13 |

| Wallace Lau | 11 |

| Kamali Organization (Jackie Kamali) | 10 |

| Source: TRD analysis of Department of Buildings records | |

In contrast to the affordable projects sprouting in deep Brooklyn, private homebuilders over the last decade have targeted a moneyed crowd in brownstone Brooklyn, where new construction townhouses can sell for well over $1 million.

In 2004, Abby Hamlin, founder and president of Hamlin Ventures, spotted the opportunity to buy a block of Boerum Hill real estate. Hamlin and partner Time Equities developed 14 townhouses on the block. They sold out in 2006, Hamlin said, averaging over $2 million a sale. In a later development, Hamlin and Time shot even higher, and received on average $3.5 million on nine townhouses, she said. (Only permit applications relating to the latter development are included in TRD’s ranking.)

“I think that single-family home development has great potential in Brooklyn and in parts of Queens,” said Hamlin, whose 18 permit applications ranked third in our list for Brooklyn. “Part of the fabric of what Brooklyn has always been about is homes.”

Like Hamlin’s development, SANBA Partners’ 22 townhouses in Red Hook, which put the company second on our list for permit applications in Brooklyn, have sold for over $2 million a piece, according to StreetEasy.

Queens

As in Brooklyn, homebuilders who targeted buyers with more modest incomes topped the list in Queens. Arthur Lighthall, Breezy Point Cooperative’s general manager, takes the top spot in Queens with 466 permit applications filed in the last decade. More than 80 percent of these applications came since the start of 2013, after the damage caused by Superstorm Sandy and a resulting fire that destroyed over 100 homes in the development.

With 47 applications, O’Sullivan’s Fulcrum placed second in the borough. Nearly all of O’Sullivan’s filings reflect the company’s planned Whitestone development, which began construction last year. Fulcrum bought the site, a former country club, at a foreclosure auction for $14 million in 2015, TRD reported, and hopes to sell the homes for up to $2.2 million a pop.

O’Sullivan described the project’s scale of over 40 homes as “basically unheard of,” underscoring the difference between developing single-family homes and apartment buildings.

“You’re never going to have thousands of units” coming to market in the single-family housing game, added Hamlin.

| Queens Top 6 | |

|---|---|

| Name listed as owner on application | # Applications filed, 2008-2016 |

| Breezy Point Cooperative (Arthur C. Lighthall) | 466 |

| Fulcrum Real Estate Advisors (Timothy O'Sullivan) | 47 |

| Urban View (Robert Michaeli) | 14 |

| Hamid Kavian | 12 |

| Bedford Construction Group (James Vilardi) | 10 |

| Khanom J. Nabati | 10 |

| Source: TRD analysis of Department of Buildings records | |

Homebuilders in the outer boroughs can run into the same market forces as bigger real estate developers in Manhattan. One of O’Sullivan’s main concerns, he said, centers on capital controls in China that restrict prospective buyers from transferring money out of the country, an issue TRD took an in-depth look at in May.

Still, O’Sullivan said Chinese investors comprised “just one part of our market” and said the single-family homebuilding market was “still really strong right now.”

Hamlin sees other challenges to the business. “The whole issue is really the zoning,” she said. “It’s not the market by any means.” Unlike Manhattan, where developers often apply for variances to build higher density developments, single- and two-family homebuilders look for lower density zoning.

“You’re not going to see single-family home development when you can build a 10-story building,” Hamlin said, noting that she continues to look for land similar to her Boerum Hill townhouse development.

“If I could find another block like that, I’d do it again in a nanosecond,” she said.

Yoryi De La Rosa contributed research.

(To view a ranking of the most expensive single family home sales in Brooklyn in 2016, click here)