In August 1928, a hoist operator from Flatbush engaged in demolishing the old Hotel Beresford on 81st Street and Central Park West made a discovery that would earn Emery Roth’s forthcoming Beresford apartment building — this issue’s selection for our Board Approved series — its first taste of publicity.

“When the workmen began to tear down the [Hotel Beresford], which is to be replaced by an apartment house, [James] Blancett…heard a plaintive cry,” the New York Times reported in a article titled, “Workman brings food daily to feline family in building that is being wrecked.”

“The kittens were as wild as though they had been born far from civilization,” the Times reported, noting that Blancett brought the abandoned litter “milk and appetizing bits of liver” daily.

Following the report, more than 60 people volunteered to adopt the kittens, including “the Misses Murcheson” of the nearby Duck Inn Tea Room. A colonel from North Carolina sent Blancett $5 for their care.

While the story of the lost kittens might seem insignificant, it was symbolic of a rapidly changing neighborhood. The Upper West Side of feral kittens and quaint tea rooms was being demolished and replaced by luxury multifamily towers that rivaled those of Fifth Avenue.

In September 1928, two weeks after the last report on the kittens ran, the Hotel Beresford was completely demolished. Just one year later, Roth’s famed Art Deco showstopper was complete and setting rental records for Central Park West. The next report in the Times about the tower wasn’t concerned with local color; it reported that a beauty-products mogul had leased a penthouse spread.

In that regard, little has changed in the last century regarding the 23-floor Beresford. The building, which converted to a co-op in the 1980s, continues to attract bold-face names willing to pay dizzying prices for a Central Park view.

Comedian Jerry Seinfeld currently calls it home, while Diana Ross, Margaret Mead, Rock Hudson and Glenn Close once lived there. Powerful influencers in the financial sector have also paid staggering sums (an upper-floor unit was asking $62 million in 2014) to slip past the building’s fussy co-op board. Apartment listings in the building currently range from $4 million to $10.5 million

Here is a look inside at who calls the Beresford home.

Marc and Pamela Murphy

Price paid: $16.5M

Marc Murphy is a chef and TV personality who regularly appears as a judge on “Chopped.” Marc and Pamela co-own the Benchmarc family of restaurants, including Landmarc in Tribeca and the Time Warner Center, Ditch Plains in the West Village and Kingside at the Viceroy Hotel in Midtown.

Bill Ackman

Price paid: $39.5M

Bill Ackman is the founder and CEO of Pershing Square Capital Management, a hedge fund management company. He owns multiple units in the Beresford as well a $91.5 million apartment at One57.

Jerry Seinfeld

Price paid: Unknown

Jerry Seinfeld is the owner of a 19th-floor spread in the Beresford. But his move didn’t come without controversy: Seinfeld notoriously took years to renovate his apartment and move in, leading dozens of posh UWS co-op boards to adopt the so-called “Seinfeld Law,” which penalizes residents for extended renovations.

Rick Elice and Roger Rees

Price paid: Unknown

Rick Elice is a Tony Award-winning playwright who wrote the Broadway musical “Jersey Boys.” The late Roger Rees was a TV and film actor known for roles on “Law & Order,” “The West Wing” and “Robin Hood: Men in Tights.” He died in 2015.

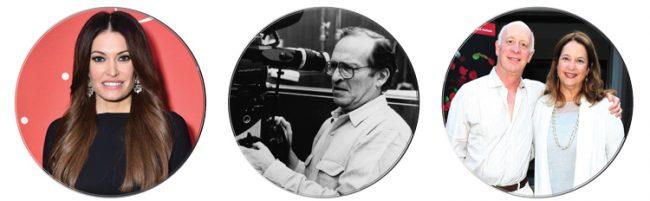

Kimberly Guilfoyle, Sidney Lumet, and Paul Goldberger and Susan Solomon

Bob Weinstein

Price paid: $20M

Bob Weinstein, the brother of Harvey,

is a film producer, the founder of Dimension Films and the co-founder and former co-chairman of Miramax Films. For nearly a decade, his six-bedroom duplex has been on and off the market, asking roughly $30 million.

Lewis Frankfort

Price paid: $15.3M

Lewis Frankfort is the chairman and former CEO of the fashion brand Coach. He joined Coach in 1979 as vice president of new business development, spearheading the growth of Coach’s stores and the company’s entrance into international markets.

Kimberly Guilfoyle

Price paid: $3.4M

Kimberly Guilfoyle, a TV news personality, hosts Fox News’s “The Five” and has appeared on the cover of LLNYC. She is a former attorney and former first lady of San Francisco. She was reportedly considered to replace Sean Spicer as President Trump’s press secretary.

Sidney Lumet

Price paid: Unknown

Sidney Lumet was a director, producer and screenwriter who made over 50 films, including “12 Angry Men” and “Murder on the Orient Express.” Lumet was married to Gloria Vanderbilt from 1956 to 1963. His trust has controlled his apartment since his death in 2011.

Paul Goldberger and Susan Solomon

Price paid: Unknown

Paul Goldberger is an architectural critic and a contributing editor at Vanity Fair. Until 2011, he was the New Yorker’s architecture critic. Susan Solomon is co-founder and CEO of the New York Stem Cell Foundation.

Vikram and Swati Pandit, Michele Anthony, and Paul Singer

Vikram and Swati Pandit

Price paid: $17.8M

Vikram Pandit is an Indian-born banker and former chief executive of Citigroup. He resigned unexpectedly in 2012. He is a member of the boards of Columbia University, Columbia Business School, the Indian School of Business and Trinity School.

Michele Anthony

Price paid: Unknown

Michele Anthony is the executive vice president of Universal Music Group. Previously, she was the president of Sony Music Group, where she signed bands such as Pearl Jam, Aerosmith, Rage Against the Machine and the Offspring.

Paul Singer

Price paid: $7.5M

Paul Singer is a billionaire hedge fund manager. He is a philanthropist who supports LGBT causes. He has advocated against raising taxes for the 1 percent and proposed fixes to the Dodd-Frank Act, according to Fortune.