At a time when Chinese capital controls are putting the brakes on splashy Manhattan plays, a bank from the 278-square-mile nation of Singapore is still filling up its New York City dealbook.

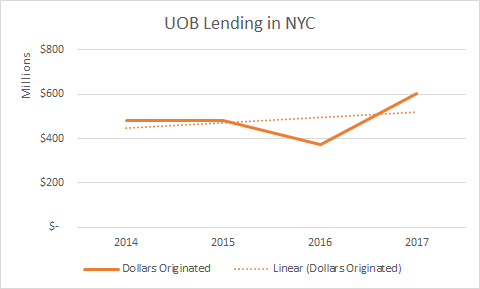

United Overseas Bank originated more than $600 million in loans on NYC commercial real estate so far this year, a steep increase from 2016, according to data provider CrediFi.

The bank has not shied away from construction lending while other debt providers are pulling back. And its total lending volume doesn’t include the $450 million package it’s set to provide for New Valley and Bizzi & Partners’ 125 Greenwich Street, a deal that should close in the near future.

Source: CrediFi (excludes some condominium financing)

Joseph Sarcinella, an attorney at Reed Smith who has worked with UOB on many of its financings in New York and in other states, called them “incredibly pragmatic” dealmakers.

“What they look for are strong sponsors,” he said. “They like the players that have the track record and the pockets. They need somebody that can stand behind—especially if it’s construction—cost overruns and certain other guarantees that are part and parcel of these transactions.”

Founded in 1935, UOB is a publicly traded company with a market cap of $25.6 billion, according to Forbes. It has offices in 19 countries and territories. A Singaporean subsidiary of Citibank owns the largest plurality of UOB shares, with 18.4 percent. The bank’s 88-year-old chairman emeritus and billionaire Wee Cho Yaw owns another 18 percent.

Wee is leaving UOB’s board next year, but his eldest son, Wee Ee Cheong, is the bank’s CEO. Cheong is also the CEO of his family’s real estate development business, Kheng Leong, which is focused on Asia but has investments in Los Angeles. Cheong’s stake in that company is worth some $140 million, according to data from global wealth research company Wealth-X.

The international bank has not been immune to troubles outside the U.S. recently, both regulatory and geopolitical in nature. In Malaysia, the bank was fined this year for money laundering violations linked to the scandal-plagued 1MBD investment fund. And in London last year, the bank’s outlook reportedly soured somewhat after the Brexit vote, when it announced a temporary stop on mortgage lending activity there. But the bank told investors that summer it would continue to expand its business and make new acquisitions, though more cautiously and selectively due to volatile market conditions.

“It’s very easy to grow, just as it’s easy to book loans. But can you collect?” the younger Wee told investors last year, according to a report in the Straits Times. “Having that discipline is the key.”

The bank’s senior economist, Alvin Liew, as well as a spokesperson for the bank, did not respond to requests seeking comment.

In New York real estate, UOB’s business has been smooth sailing of late. The bank has dished out major debt this year to the likes of Jeff Sutton at 1552 Broadway ($195 million), Savanna at 106 West 56th Street ($100 million) and Victor Group at 277-281 Fifth Avenue ($269 million).

Other deals to close in recent years include financing for Hines’ 53W53 in 2014, when it lent $220 million of a $860 million package. In 2016, the bank also originated $220 million for Alchemy Properties’ conversion of the Woolworth building and $116 million for Harry Macklowe’s 200 East 59th Street.

The $450 million loan package for 125 Greenwich Street has yet to close, but will once other sources of funding are drawn from first, Sarcinella said, as construction work continues at the supertall in the Financial District.