Extell Development quieted naysayers betting against Central Park Tower by closing $1.14 billion in financing for its planned supertall. But now the clock is ticking for Gary Barnett’s firm — thanks to a loan clause that requires the developer to sell $500 million worth of apartments by 2020.

Despite that three-year runway, luxury pads are taking longer to sell compared to years past: Properties asking $4 million or more spent an average of 433 days on the market in 2017, compared to 318 days in 2016, according to Olshan Realty, which tracks luxury units placed under contract.

“Big-ticket units definitely take more time,” said CORE’s Emily Beare. “There’s a really high expectation of what’s going to be delivered.” The buyer pool is also thin at the very top of the market, she added.

Prices at Central Park Tower, which is slated to rise 1,550 feet, range from $1.5 million for a 569-square-foot studio to $95 million penthouse spanning 7,984 square feet. At least 20 of the 179 units are asking $60 million or more — and three gargantuan units haven’t even been listed yet. But the bulk of the units are two- and three-bedrooms priced between $6.5 million and $26 million.The total projected sellout is $4 billion.

While closed sales data reviewed by The Real Deal isn’t as bleak as Olshan’s contract figures, pricier pads still take longer to sell.

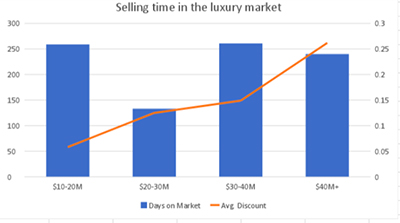

Properties priced between $20 million and $30 million spent an average of 133 days on the market — a number that jumped to 261 for properties that sold for $30 million to $40 million, according to appraisal firm Miller Samuel. Properties above $40 million spent an average of 240 days on the market.

Miller Samuel data also show that discounts got steeper for more expensive properties: The average discount was 5.8 percent for pads priced between $10 and $20 million; 12.5 percent for $20 to $30 million; 14.9 percent for $30 to $40 million; and 26.2 percent for properties priced at $40 million or more.

“There’s this false idea that nothing is selling; the issue is that most of the stuff in the $10 to $20 million segment is overpriced,” said Brown Harris Stevens’ Lisa Lippman. She said one of her clients was recently bidding on a condo whose owners upped the price from $18 million to $19.3 million. “My client was willing to bid in the high $18’s,” she said. But the higher price was simply “not going to happen.”

She said sellers (and developers) — got overly ambitious with prices in 2015 and 2016. “There gets to be a point where even the very wealthy push back,” said Lippman. “If you price at 2013, 2014 levels, units will sell. There’s just not this 20 percent of fat on top.”

That’s especially true in new development, where supply far exceeds demand.

The ratio of inventory to sales for properties above $30 million was six-to-one last year, according to data from StreetEasy. There were just 24 deals in that price category, but 145 for-sale properties on the market. (For the $10 to $20 million segment, the ratio was three-to-six; and for properties asking $20 to $30 million, it was five-to-eight.)

“There’s competition in the market, and that’s what’s made the high-end softer than before,” said Justin D’Adamo, a senior managing director at Compass.

Grant Long, a senior economist at StreetEasy, said the pipeline of projects still being built gives him reason to believe the luxury market will remain soft this year. “Each new building is trying to outdo the next,” he said.

According to Long, the $10 million market, in particular, has seen increased competition because the buyer pool is being pulled in so many directions. The $10 million buyer, he said, overlaps with ones who may be purchasing in the $5 million to $15 million range, or the $15 million+ range. “These are still really expensive apartments, but you get to a class of buyer that’s looking for a primary home in New York City.”

At Central Park Tower, the average price is $7,106 per foot — a relatively modest sum compared to neighbors like 220 Central Park South, where the average price was $7,357 per foot when sales launched in 2015. At 220 CPS, the cheapest condo available was a two-bedroom asking just under $12 million. By comparison, Central Park Tower’s least expensive pad is a studio for $1.5 million. Two-bedrooms start at $6.5 million.

“To do a two-bedroom facing the park under $10 million doesn’t exist, and they’ve done it,” said Compass’ Victoria Shtainer, who’s already taken two buyers to the sales center. She said the building is priced to sell today — not three years out. “Some developers price a $10 million apartment at $15 million because that’s where they think the market will be.”

BHS’ Lippman said the $10 million to $30 million market is highly dependent on the market and economy. “It’s usually not a ‘must purchase,’ it’s a ‘want to purchase,’” she said.

Several brokers said the economy and consumer confidence are strong — leading them to believe the market in 2018 will pick up. Shtainer cited a spate of recent sales at 432 Park Avenue, including a combination of three condos for $91.1 million. “Buyers are motivated,” said Shtainer. She also said the strong euro (and sagging dollar) is a draw for global buyers. “Foreign buyers are finding a bargain again,” she said. “They still feel the safest place to park their money is the U.S.”

Town Residential’s CEO Andrew Heiberger said domestic buyers — who have made fortunes in tech or on the stock market — are also in play for real estate. “There’s a lot of wealth being created right now,” he said. “They’re going to want to take their profits and diversify into real estate.”