From the January issue: In August, Joe Moinian watched yet another potential anchor tenant for his planned Hudson Yards tower slip through his fingers, when the pharmaceutical giant Pfizer agreed to move into a rival project next door.

It’s a drill the developer has become all too familiar with.

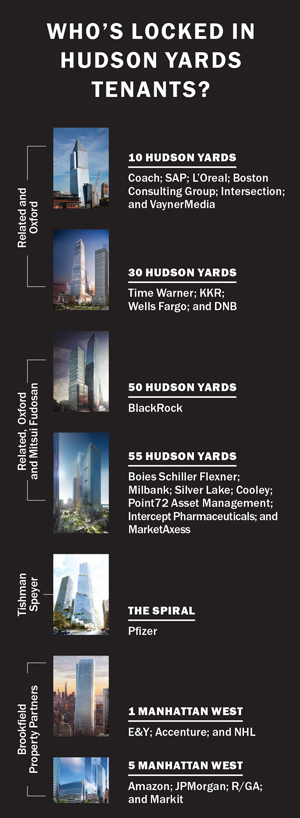

In the past several years, tenants have enthusiastically flocked to Manhattan’s Far West Side. Companies such as Coach, Time Warner, the National Hockey League and mega-asset manager BlackRock have all inked leases in the area.

Despite the breakneck pace of leasing activity in the neighborhood, however, the Moinian Group has still not reeled in an anchor for its planned 3 Hudson Boulevard.

But the developer recently signaled that he’s shaking up his strategy at the project, which sits at the corner of 11th Avenue and 34th Street.

In the past few months, the 63-year-old developer fired and replaced his Avison Young leasing team, scaled back the size of tower, scrapped plans for a residential component of the project and hired a team to secure $3 billion in debt and equity. Oh, and he broke ground on the site’s foundation.

“You can only go so long without a tenant,” said real estate attorney Joshua Stein, who is not involved in the project but has been keeping tabs on it. “That is a little scary.”

Moinian has a lot on the line — 3 Hudson Boulevard is a legacy-defining project for him in a high-profile and emerging location. And as rivals like Related Companies, Brookfield Property Partners and Tishman Speyer lock in tenants, the industry is watching Moinian to see if he can move the project from rendering to reality.

“If developers can sign on new anchor tenants, then they’ll get their deals done,” said Alexander Goldfarb, a REIT analyst at Sandler O’Neill.

“If developers can sign on new anchor tenants, then they’ll get their deals done,” said Alexander Goldfarb, a REIT analyst at Sandler O’Neill.

“You need tenants to feel like this is a project that the developer can deliver,” he said.

Showing up early

Moinian was one of the first to the Hudson Yards party.

The developer, who declined to comment for this article, bought the site from Verizon for $54.8 million — a steal by today’s standards — in late 2005. His purchase came just months after the Bloomberg administration rezoned 48 blocks on the Far West Side.

His foresight couldn’t have been more on point.

High-profile developers — from Related to Extell Development to Tishman Speyer to Brookfield — all followed right behind Moinian en masse. In 2008, of course, the Metropolitan Transportation Authority tapped Related to develop 28 acres over its rail yards — a city-within-a-city project that’s now transforming the once-industrial section of Manhattan.

But although Moinian showed up early, he didn’t start leasing at the site until January 2013. (Some of that delay was likely due to the financial crisis, which brought development citywide to a halt.)

That’s when he tapped Avison Young’s Arthur Mirante — an industry veteran and former CEO of Cushman & Wakefield — to lease what was then planned as a 65-story, 1,000-foot, 1.8 million-square-foot tower. But the Toronto-based Avison was a relative newcomer to New York and it had never handled such a large project.

The fact that Moinian did not bring on one of the city’s premier firms like Cushman, CBRE, Newmark Knight Frank or JLL was an early sign of struggle at 3 Hudson Boulevard, sources said.

But perhaps the biggest thorn in Moinian’s side is the perception that he’s not a serious office developer.

Moinian has bought office buildings in the past, but they’ve largely been Class B properties. For example, he owns 500-512 Seventh Avenue with the Chetrit Group and Edward J. Minskoff Equities; 245 Fifth Avenue with Thor Equities; and 535 Fifth Avenue, 450-460 Park Avenue South and 60 and 72 Madison Avenue.

Unlike his competitors on the Far West Side, Moinian has not developed a large-scale, ground-up office project for a giant Class A tenant.

“Joe is an entrepreneurial guy. He’s not an institutional developer,” said one leasing source who spoke on the condition of anonymity. “Tenants want to go to someone they know will get the building built.”

And it hasn’t helped that there have been other setbacks at the project, including when the developer missed the deadline to apply for a city tax abatement in 2016 because he didn’t have an anchor tenant. Moinian will have to reapply.

Also, until this past fall, he had not fully ruled out constructing 3 Hudson Boulevard as a mixed-use project with residential units on top — a fact sources said could have turned off large office tenants looking for a corporate headquarters.

“If you’re the decision maker for the prospective tenant, and you’ve got all these people looking over your shoulder, you may go to an established office developer instead of Moinian,” another source said. “It’s like when everyone bought IBM computers because they knew they couldn’t get fired that way.”

Back to the drawing board

Moinian’s aggressive push to reboot the project has been on full display since August.

After firing Avison Young, the developer selected a leasing team at JLL led by Peter Riguardi, the president of the brokerage’s tri-state office, who sources said will likely hand the job off to his ace brokers Mitchell Konsker and Paul Glickman. Moinian also scrapped the residential component of the project and, in November, scaled back the height to 940 feet and 53 stories.

Sources say architect FXFOWLE’s new redesign also has wider floor plates to appeal to office tenants.

With all of those changes in place, Moinian held a press conference on a balmy November day to break ground on the firm’s “crown jewel.” While Gov. Andrew Cuomo attended — and praised Moinian for his “phenomenal accomplishment” and “phenomenal legacy” — tenant and bank representatives were noticeably absent.

But the developer — who immigrated to the U.S. from Iran when he was 17 and started a successful women’s apparel company before getting into real estate in 1982 — is now trying to drum up equity. This January, Moinian, who put $100 million of company money into the project, is planning to launch his search for a massive $3 billion in financing. The JLL team handling that search — Aaron Appel, Kellogg Gaines and Jonathan Schwartz — declined to comment.

While securing that kind of package is a tall task for a building being constructed on spec, if the team secures it, it would be one of the biggest debt-equity deals that New York City has seen this market cycle. The developer is said to be targeting roughly $1.8 billion in debt and $1.2 billion in equity, the latter of which could come from a tenant buying a commercial condo in the building, an equity partner, or a combination of both. “The $1.2 billion in equity will probably come from a hedge fund or a REIT like SL Green or a firm that is capable of loan-to-owning,” Stein said.

But Moinian’s stance on the tower’s finances have flip-flopped, creating uncertainty that sources say may not sit well with lenders or tenants.

Before TRD broke the news that Moinian was going into the market for $3 billion, for example, the developer had pegged the tower’s cost at closer to $2 billion.

In addition, at the groundbreaking, he said he was also seeking $500 million in EB-5 funding. But sources said that might prove to be unnecessary.

Greg Kraut, managing partner at K Property Group and formerly the founding principal of Avison Young, said uncertainty on development strategy never bodes well with potential partners. “At that size, the lender has to be your partner and believe in your underwriting and overall business plan,” he said. “At a certain number, it will get completed. It all depends on the valuation.”

Phoning a friend

Bringing on a large institutional equity partner with experience developing office buildings could be a game changer for Moinian, sources said.

Sources mentioned Boston Properties, Vornado Realty Trust and SL Green Realty as the kinds of companies that would help with a jump start.

SL Green, they said, seems like an especially likely candidate given that it’s partnered with Moinian in the past.

The Marc Holliday-led REIT rescued Moinian at 3 Columbus Circle — the only NYC office property he’s developed — back in 2010. The lender, Deutsche Bank, sued Moinian to foreclose, alleging that the developer had defaulted on $250 million in loans at the 26-story property.

But in an ugly back-and-forth, Moinian countersued Deutsche and Related, which co-owned the debt, claiming that the duo wouldn’t let him sign new tenants and that they had unjustly demanded a $54 million prepayment penalty.

SL Green’s $138 million equity investment saved Moinian. And the two went on to develop the 71-story rental tower Sky, which opened last year. The firms landed a $550 million refinancing in August — the largest-ever tax-exempt financing of a single building issued by the government-sponsored entity Freddie Mac.

But the rift with Related has now come full circle as Moinian goes head-to-head with the firm in Hudson Yards.

To be sure, Moinian is no lightweight. His firm currently has a 20 million-square-foot portfolio and, with partners, sold the former Sears Tower in Chicago for $1.3 billion to Blackstone Group in 2015.

Moinian — who is known as a hard-nosed negotiator — also has a long history with many prominent lenders on both his residential and office properties, including AIG Global Real Estate, Bank of America and Bank of China.

In addition, in February 2017, his firm launched its own lending division and in November, it secured a $104 million construction loan for its 165-unit rental project in Hell’s Kitchen. And the developer recently filed plans to build a religious center for the Persian community, of which he’s a prominent member, in Brooklyn’s Midwood.

Moinian also has a long list of major residential and hotel projects under its belt. In addition to Sky and the other above-mentioned projects, it’s completed the W New York Downtown hotel and the Atelier.

But an office tower is a different beast. Whether Moinian can pull off a Class A building on his own is up for debate.

“It’s all very circular,” said Dustin Stolly, co-head of Newmark’s debt and structured finance group, who is not involved in the project. “Pairing Joe with a big operator adds to the resume. Is it absolutely necessary? I don’t know.”

Anchor tenants in play

It’s been a strong year for the office leasing market — and a banner year for the Far West Side.

Tenants inked 2.2 million square feet on the Far West Side in the first three quarters, up from shy of 1 million during all of 2016, according to JLL.

And there are still potential anchor tenants in play.

Deutsche Bank, which last year expressed interest in Larry Silverstein’s 2 World Trade Center, is one, as is Morgan Stanley. But sources said the latter bank is closing in on Brookfield’s mammoth Manhattan West, where the REIT still needs an anchor for its 2 Manhattan West.

And the competition is fierce given all of the new inventory. Brookfield has several thousand square feet left at 1 Manhattan West. Related has about 2 million square feet at 50 Hudson Yards, where BlackRock signed on for 850,000 square feet in 2017. And Tishman Speyer will have 2 million-plus square feet left at the Spiral after Pfizer finalizes its deal for 800,000 square feet in early 2018.

But while Moinian is facing an uphill battle, his site does have some notable pluses.

Its front door will be just a few steps away from one of the entrances to the 7 train subway station. The building’s design allows for light and air to penetrate on all four sides. And it’s in the right neighborhood.

“It’s hard to find big blocks of space anywhere in Manhattan,” said Matt Kopsky, a REIT analyst at the financial service firm Edward Jones. “It’s not just the newness [of the building]. It’s about having a big enough block of space that’s attractive to tenants.”

Moinian now faces the “chicken or the egg” dilemma of searching for the tenant, partner and loan in the right order, Newmark’s Stolly said.

“It’s critical he identifies an equity partner with deep pockets who can be a backstop and showcase the project to prospective tenants,” Stolly said.

The order Moinian tackles each step could also determine whether he’s successful — or if he fails.

“He could get a partner to join him, but it won’t be close to a billion dollars unless he has some interest from tenants,” a source said.

At the same time, Moinian has pulled himself out of tricky situations before, and sources say he should not be underestimated.

“It’s a risk, but Joe’s an ambitious and extremely capable guy,” said Woody Heller, vice chairman and co-head of Savills Studley’s capital markets group.

The fact that the firm got into the site more than a decade ago at such a low basis gives it major breathing room.

And sources said Moinian is bound to land his first tenant sooner rather than later.

“It’s certainly more difficult to go forward fully on spec, but in time he’ll find a tenant,” Heller said.

“After all, Hudson Yards is the most successful submarket in the city,” he added. “So it’s really just a question of how much equity will be required.”