It’s been a cold winter north of the border in Toronto, but crane activity was hot in January.

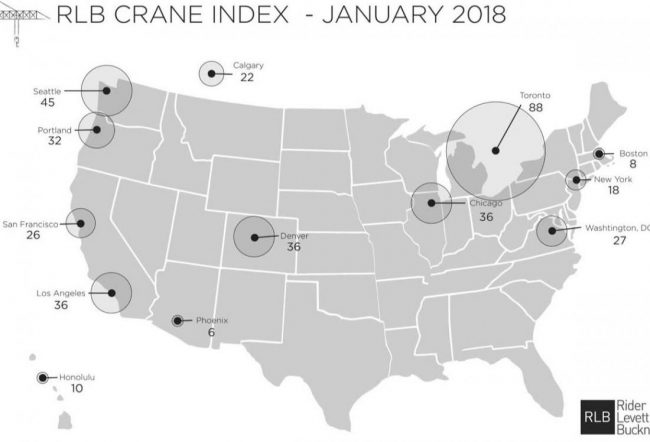

The 88 construction cranes in the Canadian metropolis led Rider Levett Bucknall’s biennial “Crane Index,” which found North American activity hitting a new peak in the first month of the year.

In Los Angeles, which had 36 cranes, activity was steady compared to the July 2017 survey. New York, meanwhile, had 18 cranes over the same period.

But L.A. did lead all North American cities in mixed-use development thanks Downtown’s abundant activity. Construction on the new football stadium in Inglewood — which will be home to the L.A. Rams and L.A. Chargers — and the Banc of California Stadium, future home of soccer’s L.A. Football Club also contributed to activity in the city.

L.A. tied with Denver and Chicago for the second-most active market in the U.S.

But the January count may be the last hurrah before crane activity begins to decline in L.A.

The city saw a drop in construction permits in 2016, ending a six-year growth streak. Still, demand is hot for residential units in particular, especially in Downtown. New condo units spend on average just 45 days on the market.

Rider Levett Bucknall associate principal Philip Mathur said the company believes L.A. has reached a construction peak. Despite that, he said there were ample number of projects in the pipeline to hold off a big decline.

“If you talk to general contractors, they’re busy enough,” Mathur said. He added there were “a ton” of projects in backlog that should carry through this year and possibly 2019, though it was a little early to make a firm prediction.

New York’s total crane count, at 18, remained the same compared to the July index. No surprise, RLB forecasts steady activity there, thanks in part to long-term projects like the ongoing redevelopment of the Hudson Yards in midtown Manhattan.

Rider Levett Buckner’s survey of crane activity around North America.

Overall, activity on the West Coast far outweighed that on the East Coast — there are 145 cranes active in the West, compared to 53 in the East.

Across North America, activity in five of 13 cities sampled by RLB increased fro its July study, six remained steady, and just two saw a decrease. Around 40 percent of all activity was in the residential sector, led by Toronto, while 25 percent was mixed-use, and 15 percent commercial.