Tenants, who have had their backs against the wall in recent years, are expected to flex a little more muscle this month at the International Council of Shopping Centers’ Las Vegas conference RECon — the largest retail real estate convention in the world — taking place this year from May 20 to 23.

While some retailers are still signing high-profile deals, and activity in some of the country’s top markets, such as Manhattan, ticked up in recent months, there are still bankruptcies and mall closings aplenty in the headlines. And landlords have an enormous supply of space from which retailers can choose, giving them additional leverage.

“So what does that mean? You’ve got a lot of landlords competing for that one significant deal,” Todd Siegel, a Chicago-based broker with CBRE, said.

Retailers who’ve been battle-tested by the ravages of e-commerce in recent years are reaping the rewards that their survival affords them. Credit ratings agencies are not as fearful as they were just a year ago that every retailer is going to go under, and thus retailers are enjoying better ratings, said Jared Epstein, a principal with Manhattan-based landlord Aurora Capital Associates. “Tenants whose credit has improved are emboldened and feel they have the leverage, and for the most part they do,” he added.

As the industry heads to RECon, the general feeling is that brokers and landlords are expected to cater to tenants at the show. “There is a higher level of expectation now from retailers,” Jeffrey Roseman, a broker with Newmark Knight Frank, said. His firm is perpetually engaged in a sort of arms race with other brokerages, each seeking to provide the most valuable and relevant data for clients.

“Retailers are not just looking for a broker to show space. They are looking for a broker to help them grow, with a strategy regionally, nationally, internationally,” Roseman said.

The volume of meetings, for some, is also changing. CBRE’s Siegel said he was planning fewer sit-downs, but said each that he does do will drill deeper than the norm.

“It’s not like in years past, when you booked nonstop every 30 minutes. You have a half-dozen really critical flagship meetings over two days,” he said.

Who’s coming?

ICSC estimates that about 37,000 people will attend the show this year, which is on par with the past couple of years.

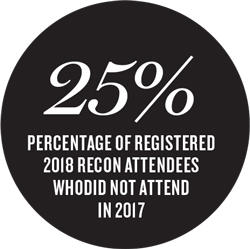

An analysis of the past three years of attendees by The Real Deal showed that about a quarter of the people at the show turn over every year, so there will be plenty of new faces. Approximately 25 percent of the nearly 29,000  people who registered for the show as of mid-May did not attend the show in 2017, the analysis found. Many are new brokers or new principals at long-attending firms, while others, such as development firm Tavros Capital, from Manhattan, are coming for the first time.

people who registered for the show as of mid-May did not attend the show in 2017, the analysis found. Many are new brokers or new principals at long-attending firms, while others, such as development firm Tavros Capital, from Manhattan, are coming for the first time.

TRD’s analysis also found that about half the people at the show attend consistently. ICSC did not return request for comment on their changing mix of attendees.

Although the number of participants at the show may wax and wane, the number of people who make the trip to Las Vegas but never step on the convention floor is growing, some attendees said. Plenty of networking and deals can be done outside the convention, and more businesses are taking that option.

Michael Demetriou, from Baum Realty Group in Chicago, has been going to the Vegas show for several years and believes that is definitely the case. “I think of it as a shadow economy,” Demetriou said.

Scheduling conflicts

This year, the convention is taking place during a major Jewish religious holiday, Shavuot, which will keep some major retail players away from the show and delay the appearance of others.

Insiders expect a more sedate scene poolside, as people who wanted to chat up major New York City-based investors who will be absent this year due to Shauvot — such as Jeff Sutton of Wharton Properties and Alex Adjmi of A&H Acquisitions — will have to make other plans.

“If you know the popular kids are not going to the party, then you are not going to go,” said Jonathan Adelsberg, a partner at New York-based law firm Herrick Feinstein. He has attended for the past several years, but is not attending this year, although not because of Shavuot.

“I think a good number of my clients are not going this year, and so my level of productivity would be much better if I stay in town,” he said.

Because of the Jewish holiday, some brokerages, including Meridian Capital Group, will have a sharply reduced groups, and Eastern Union Funding will not attend at all.

“We have attended the show for close to 20 years now,” Abraham Bergman of Eastern Union said. “We will miss it this year and will instead head out and meet our clients in their hometowns.”

Some observant real estate players are looking at a workaround, in which they would fly out Friday before sundown and not work until Monday evening, then attend parties and the show on Tuesday.

ICSC chartered a plane to fly from Chicago after sundown Monday to bring professionals from that city.

One New York owner/broker, who asked not to be identified, said he was frustrated that ICSC organizers hadn’t resolved the Shauvot scheduling conflict.

“The impact is tremendous,” the insider said. “You can’t really qualify what you are losing or not losing. It’s just not being out there.”

However, some attending don’t expect the conflict to have much impact on the conference.

“That will affect some of the New York turnout, but in the scheme of the show, it will be relatively insignificant,” said Rick Friedland, of Friedland Properties.

Due to the Jewish holiday — but also in part because of the sluggish market — many expect the New York-based social scene to be lower energy than in recent years. Several firms that hosted large parties in years past are not doing so this year, including RKF, Eastern Consolidated and Winick Realty Group. They are either having smaller dinners or holding off entirely.

But the pool parties, including the Wynn’s hopping cabanas on Saturday and Sunday, will carry on. Epstein of Aurora Capital will be hosting tenants and brokers at a cabana at the hotel, even as the firm’s principal, Bobby Cayre, won’t be there because of Shauvot.

“Just because the principal can’t be there does not mean the retailers won’t. That’s why we have to be there,” Epstein said.