JLL plans $3B stock offering for one of its REITs

Jones Lang LaSalle hopes to raise up to $3 billion for one of its real estate investment trusts. The global commercial real estate company filed documents with the Securities and Exchange Commission indicating that its non-listed JLL Income Property Trust will be selling four classes of common stock. JLL will seek $11.82 to $12.14 per stock, the money from which will go towards paying off loans, growing the JLL portfolio and repurchasing shares. The stock offering follows Newmark Knight Frank’s initial public offering in December, and comes as Cushman & Wakefield prepares for its own IPO. [TRD]

Airbnb sets deadline for initial public offering amid employee frustration

Airbnb is gearing up for an initial public offering that’s expected to take place by late 2020, according to its CEO Brian Chesky. Chesky announced the news to employees who have been frustrated that the company hasn’t gone public yet, according to The Information. To address the delay, employees will be receiving cash bonuses “for the first time in years,” according to the outlet. An Airbnb IPO has been in the works for several years, but the launch date has kept getting pushed back. [TRD]

Startups and banks offer home-buying help to millennials with no savings

A bevy of banks and startups are offering home-buying help to cash-strapped millennials who aren’t able to save up enough money for a down payment on a home. Renters now have a range of options to help secure a mortgage, from a GoFundMe-esque site that allows them to collect donations from friends and family to a startup that will shell out money if the buyer agrees to Airbnb a room in whatever home they end up purchasing and fork over part of what they bring in. These options, however could end up making the shortage of new homes on the housing market worse, according to the Wall Street Journal. [TRD]

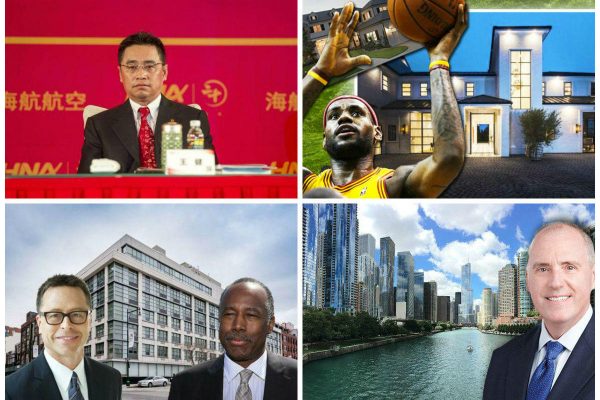

HNA Group founder and co-chairman dies after falling from cliff in France

HNA Group founder and co-chairman Wang Jian died Tuesday after falling from a cliff in the south of France, Bloomberg first reported. The 57-year-old’s sudden death appears to be an accident that happened as Jian was having his picture taken while he was on a business trip. The Chinese conglomerate has been selling its assets in an effort to mitigate “soaring borrowing costs,” according to the outlet. Jian owned a 15 percent stake in the company. [TRD]

MAJOR MARKET HIGHLIGHTS

HUD claims Toll Brothers violated Fair Housing Act at Queens condo

Pennsylvania-based developer Toll Brothers is in hot water with the U.S. Department of Housing and Urban Development over alleged discrimination at its eight-story Fifth Street Lofts condo building in Long Island City, Queens. HUD claims the developer discriminated against people with disabilities by failing to provide “safe and accessible routes” between units and to and from common areas for disabled residents. The condos also lacked accessible bathrooms, kitchens and doors, according to HUD. HUD has accused Toll Brothers, the building’s architect and the construction company involved in its construction of violating the Fair Housing Act. [TRD]

Wealthy buyers look to South Florida to avoid high taxes in other states

South Florida is attracting a host of wealthy buyers from other states following last year’s tax reform, according to brokers and developers in the area. Hedge funders, CEOs, entrepreneurs and other wealthy business people from states like New York, New Jersey and California are purchasing homes and condos in and around Miami in an effort to avoid high income and property taxes. “It’s one thing when the tax reform gets passed, and it’s another thing when you’re sitting with your accountant and you say, ‘Shit, I could just move to Miami,” Douglas Elliman’s Oren Alexander told The Real Deal. [TRD]

LeBron James bought two mansions in LA ahead of his move to the Lakers

LeBron James will be new to the Lakers when he takes his talents to Los Angeles, but he won’t be new to the Los Angeles real estate market. The NBA star shelled out $21 million for a mansion in Brentwood in November 2015 — a year after re-signing with the Cleveland Cavaliers. And in December 2017, he bought another Brentwood mansion for $23 million. James still has a 30,700-square-foot mansion in Akron, his hometown in Ohio, which is worth approximately $9.2 million. He offloaded his Miami mansion for $13.4 million in August 2015. [TRD]

Chicago is seeing a rash of condominium deconversions, realtors and attorneys say

The Chicago market is seeing a growing number of condominium deconversions as condo associations choose to cash out by selling their buildings for more than an individual condo would bring in. One “condo law firm” in Chicago has 16 members focused on work related to deconversion. “The business has quintupled,” one of the firm’s attorney’s said. Older properties with “deferred maintenance” are often prime candidates for deconversion. [TRD]