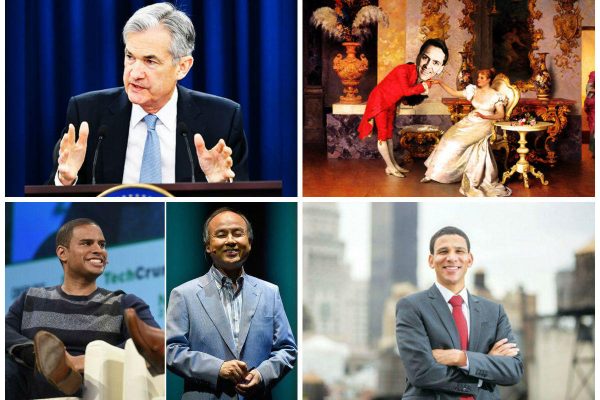

Fed keeps interest rates where they are, with a rate raise expected next month

While the Federal Reserve held off in raising interest rates this month, many expect that it will raise them in September, the Wall Street Journal reported. The Fed has raised interest rates twice so far this year — most recently in June — and is expected to raise them again at least twice. In a statement, it said that “[e]conomic activity has been rising at a strong rate.” Officials arrived at the decision to keep rates where they are for the time being in a unanimous vote on Wednesday. [TRD]

Brookfield Asset Management snapping up Forest City Realty Trust for $6.8B after renewed talks

Brookfield Asset Management plans to shell out $6.8 billion for Forest City Realty Trust in a deal valued at $11.4 billion, including debt, Bloomberg reported. A few months ago, Forest City said it wasn’t planning to pursue a sale, but the REIT apparently reversed course after it restarted talks with Brookfield earlier in the summer. News of the purchase comes a week after shopping mall behemoth General Growth Properties shareholders approved a $15B buyout offer from Brookfield Property Partners. [TRD]

Compass ends short-lived tech licensing agreement with MA brokerage

A little over a week after Compass announced it would license its technology to other real estate firms — starting with Massachusetts-based Leading Edge Real Estate Group — the brokerage decided to withdraw from that plan. Compass agents were worried about the brokerage’s “Powered By Compass” initiative, and as a result, the brokerage ended its agreement with Leading Edge, Inman reported. In a statement, Compass noted that it has “received interest [in Powered by Compass] from over 30 brokerages where there’s no geographic overlap with our current offices.” Leading Edge CEO Linda O’Koniewski said her firm “[plans] on taking the high road” following Compass’ pivot. [TRD]

Cadre won’t get an investment from Softbank’s Vision Fund due to conflict of interest

Real estate investment startup Cadre won’t get an investment from Softbank’s Vision Fund after all, Bloomberg reported. Softbank had been considering investing at least $100 million in Cadre, which was co-founded by Ryan Williams and Jared and Josh Kushner, but the investment could have been a conflict of interest, as Softbank’s Vision Fund receives billions of dollars from Saudi Arabia and the United Arab Emirates and Jared Kushner advises President Donald Trump on U.S. Middle East policy. Though Cadre has said Jared isn’t actively involved in the company, the elder Kushner brother hasn’t sold his Cadre stake. [TRD]

Federal Housing Finance Agency director accused of sexually harassing employee

A special adviser at the Federal Housing Finance Agency has accused director Mel Watt of sexually harassing her, Politico reported. In an Equal Employment Opportunity complaint, the staffer claims Watt harassed her during pay discussions. Watt reportedly made an inappropriate comment about the tattoo on the staffer’s ankle and propositioned her during a meeting he requested take place outside of the office. “I mentioned to you that there is an attraction here that I think needs to be explored,” Watt said in a taped conversation, according to Politico. Watt himself told the outlet his actions weren’t “contrary to law.” [TRD]

MAJOR MARKET HIGHLIGHTS

Brookfield Property Partners shedding stake in Manhattan office and multifamily portfolio

Brookfield Property Partners is shedding stake in its Manhattan office and multifamily portfolio. The real estate company already sold a 28 percent stake and is planning to sell up to 7 percent more in a set of deals worth $1.8 billion. “The capital raised from the sale will be used by Brookfield Property Partners for various higher-yielding investment opportunities, including share buybacks, and to reduce corporate leverage,” a Brookfield spokesperson said. The sales are happening around the same time as Brookfield Asset Management’s Forest City Realty acquisition, as well as Brookfield Property Partners $15 billion General Growth Properties buyout, but aren’t directly related to the two. [TRD]

Report warns of ‘fiscal death spiral’ that could hurt Chicago’s commercial real estate market

The commercial real estate industry in Chicago could be in danger, according to a new Green Street Advisors report which named the city as having the worst fiscal health score in the country. The real estate research firm says both Chicago and Illinois are in a “fiscal death spiral” that could ultimately increase the cost of investing in property in the city since financial obligations like underfunded public pensions could make the cost of property investing much higher in the future. The city’s finances could end up pushing out people looking to settle down in the area. “Newly minted college graduates in the Midwest strive to establish careers in Chicago,” the report said, according to Crain’s. “Career opportunities and lifestyle draw them in, but the effects of poor fiscal health may ultimately push them out.” [TRD]

Beverly-Hills based brokerage The Agency plans to open an office in Miami

Los Angeles-based brokerage The Agency is expanding to Miami. The Agency, which currently has more than 350 agents, plans to open an office in Miami before the end of the year, sources told TRD. This won’t be the first foray into expansion for the brokerage, which has offices in Park City, Scottsdale, Turks and Caicos, Los Cabos and Punta de Mita in addition to its L.A. locations. “As long as everything keeps going in the right direction, that is the plan,” The Agency’s CEO Mauricio Umansky said of the Miami office plans. The brokerage is still trying to determine what the new space will be like and who will run it, he added. [TRD]

Marco Rubio proposal aims to crack down on real estate-centric money laundering

Florida Sen. Marco Rubio wants to keep real estate buyers from hiding behind shell companies. Under Rubio’s proposal, shell companies making real estate purchases of more than $300,000 in cash in the U.S. would have to disclose their owners. The amendment aims to eliminate real estate-centric money laundering. “Shell companies involved in shady activities are a big problem, especially throughout South Florida,” Rubio said in a statement, according to the Miami Herald. “With this provision, a study would be conducted to look at requiring all shell companies that make cash transactions, regardless of their area, to disclose their identities.” [TRD]

Georgetown estate once rented by Ted Kennedy hits the market for $22M

A Georgetown estate that Sen. Ted Kennedy and his first wife rented in the 1960s has hit the market for $22 million, the Wall Street Journal reported. The nine-bedroom, 10-bathroom home is currently owned by Cathy Brentzel, a former attorney who bought it for $11.8 million a decade ago. It’s well-known in the area as “a gathering spot for the political elite,” according to the outlet. Supreme Court Justice Sonia Sotomayor presided over a wedding that took place on the estate. It’s undergone a number of renovations since Kennedy rented it. [TRD]