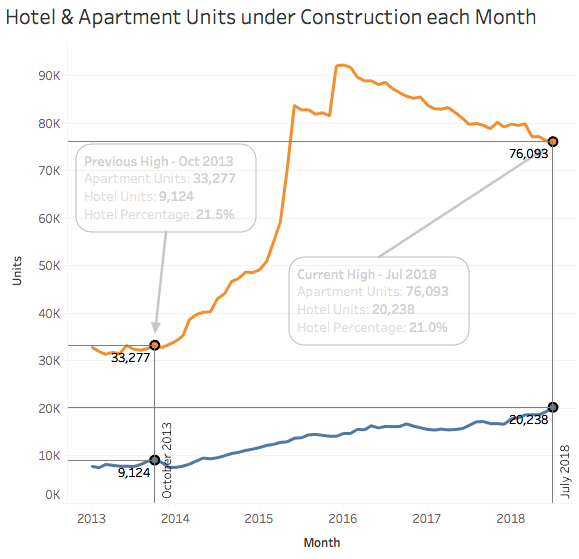

One out of five dwelling units currently under construction in New York City is in a hotel. That’s the highest proportion since 2013, according to an analysis by The Real Deal.

This milestone reflects a combination of several factors. As the volume of active apartment construction has slowly trended downwards over the past two years, hotel construction has continued to show strong growth despite earlier signs of a slowdown and predictions of an impending demise.

Over the past two years, the number of apartment units in the construction pipeline has fallen from a peak of 92,000 units in early 2016 to 76,000 units this July, as the number of units newly permitted for construction has lagged behind the number of units reaching completion.

For example, this July, construction began on 45 apartment projects totaling 1,200 dwelling units over 1.1 million square feet, whereas construction wrapped up for 43 projects totaling 1,400 units and 1.5 million square feet – resulting in a net reduction of 200 units and 400,000 square feet in active construction, although the total number of projects did go up by two. Most months over the past two years have looked similar to July 2018.

In contrast, hotel construction has shown a strong upward trend for years, with the total number of hotel units in the construction pipeline more than doubling – from around 8,000 in 2013 to more than 20,000 today. The period from late 2015 to early 2017 did show some signs of a potential slowdown, but the pace seems to have picked up once again.

July was representative of recent trends for hotels as well. Just one hotel was completed last month – Sam Chang’s 89-unit, 30,000-square-foot project at 337 West 36th Street – while six new projects kicked off, including three in Midtown, and one each in the South Bronx, Long Island City and Jamaica, resulting in a net increase of 900 units and 300,000 square feet in the hotel pipeline.

To determine which projects are currently under construction, TRD’s analysis considered all DOB new building job filings which had already received an initial building permit, and had not yet been issued a temporary certificate of occupancy (TCO).

Of course, not all projects that have received building permits will actually be completed. To account for abandoned projects, the analysis removed jobs from the active population one year after the expiry of their most recent permit.

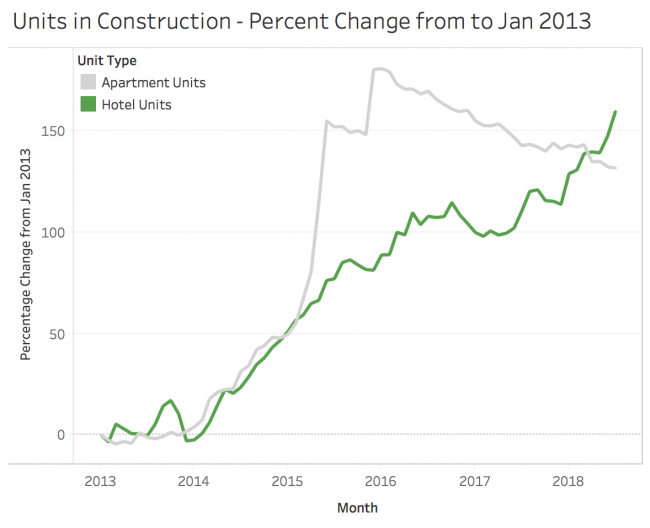

Despite the recent decline, apartment construction is still at historically high levels itself. Like hotel construction, active apartment construction in New York City today involves more than double as many projects, dwelling units and square footage than it did back in January 2013.

In fact, apartment construction peaked early. As noted in previous analyses, an enormous number of building permits were issued for apartment projects in 2015, just before both 421a deadlines that year. The subsequent two-year slide in construction activity is arguably just a regression to the mean after this major anomaly.

Compared to the awkward spike and slide in apartment construction, hotel construction has grown more steadily, as can be seen when apartment and hotel construction are compared on the same scale in the graph below. In that sense, hotel construction only caught up to the growth rate of apartment construction a few months ago.