During a year of market turmoil in 2018, brokers hopped, skipped and jumped between New York’s major residential brokerages. We tracked the moves of brokers between five of the city’s major brokerages — Douglas Elliman, Corcoran, Compass, Brown Harris Stevens and Stribling — to see who went where, and why.

To quantify broker movement between firms, The Real Deal compared licensing data from the Department of State’s Division of Licensing Services from the fourth quarter of 2017 to the same time period in 2018, across all five boroughs. (These numbers show how many agents are licensed at each individual firm, but not whether those agents are actively doing deals.)

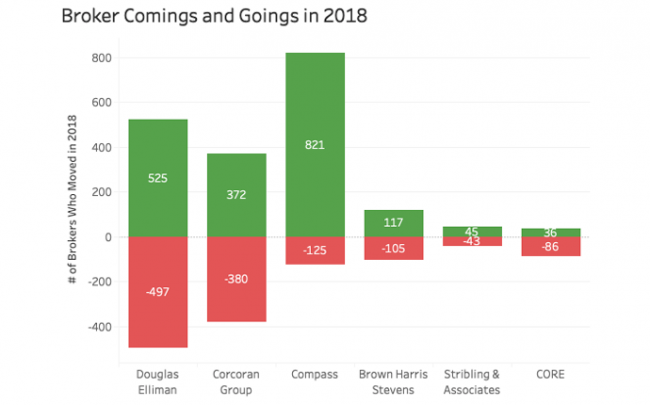

Comings and goings

Many brokerage heads attributed increased broker movement to a soft market in 2018.

“Whenever the market changes, or it feels like it’s changing, then there’s a lot more movement,” said Steven James, CEO of Douglas Elliman in New York.

Sales across Manhattan, Brooklyn and Queens fell throughout 2018, despite boosts from legacy contracts closing in Manhattan. Meanwhile, prices have continued to rise alongside increased inventory entering the market.

At Douglas Elliman and Corcoran, the city’s two biggest brokerages, large numbers of agents came and went, even though both firms ended 2018 with relatively stable net numbers.

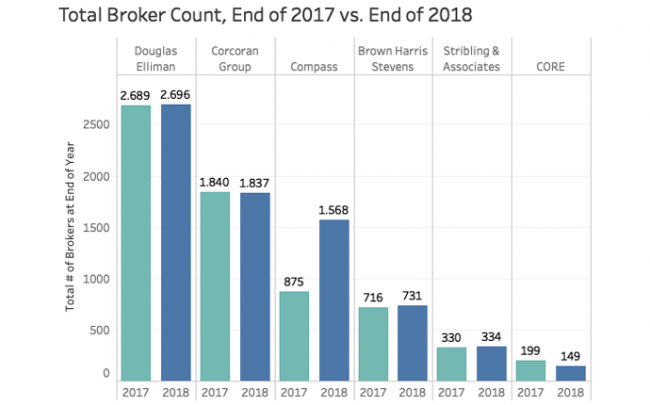

Elliman finished 2018 with 2,696 agents, a net increase of 1 percent on the year before. In that time period 497 agents left the firm, but 525 agents joined. Corcoran’s numbers showed a similar pattern. In 2018, 380 agents left and 372 joined the firm, leaving them down less than half a percentage point year over year.

Agents also hopped between the two top firms in fairly equal numbers: 21 agents moved to Corcoran from Douglas Elliman, while 23 agents moved the other way, jumping from Douglas Elliman to Corcoran.

James said that some of the change in headcount was a result of agents leaving who couldn’t hack the business. TRD’s data analysis show 277 agents previously licensed through Douglas Elliman at the end of 2017 did not renew their real estate licenses the following year, suggesting they left the business entirely. James acknowledged that a changing market “puts pressure on those agents who didn’t get into the groove of selling.”

To stay at Elliman, he said: “You must sell or list, or both.” If not, the firm will take away an agent’s desk. That’s usually the “big awakening” for an agent, James said, who added that it was possible, but very hard, for an agent to get back a desk once it had been lost.

Elliman’s numbers were also boosted by acquisitions. In May 2018, the firm bought the Park Slope and Long Island City branches of Space Marketing Shop. The data shows that 21 agents came with the deal.

James also noted that, like many other firms, Elliman has been the subject of aggressive recruiting. “We were poached,” he said, “Everybody’s been poached.”

Where did all the brokers go?

Of those that stayed in the business, many jumped to venture capital-backed Compass, known for its aggressive recruiting tactics.

Corcoran lost 97 agents to Compass in the year between the end of 2017 and the end of 2018, while Douglas Elliman lost 74.

By contrast, Compass’ broker numbers increased by a whopping 80 percent. The firm ended the year with 1,568 licensed agents in the city, up from 875 at the end of 2017.

“We don’t measure growth based on agent count. It’s not always indicative of growth, because any one can just hire agents to a company,” said Rory Golod, general manager of Compass in New York, “but we have been really fortunate that we’ve had a number of people who’ve joined the company.”

Golod also said the Compass itself measures agent retention by counting only principal brokers or team leaders, rather than using TRD’s method of counting any person licensed to sell real estate with the firm. He said this is because Compass’ team leaders can hire and fire team members and assistants independently of the firm.

‘That’s not going to be an agent who we lost,” he said, “That was a decision made by that team.” Golod says Compass’ internal numbers suggest less than 2 percent of brokers leave the company.

Compass recently denied rumors that they were offering agents incentives to join, such as a $75,000 signing bonus and 100 percent splits.

“Agents that come over to the company are offered a small incentive to aid their transition,” Golod told TRD last month, but did not specify any amount.

Although Compass gobbled up agents from other firms, they also weren’t immune from broker churn. The firm itself lost 125 agents over the year period.

Some agents left Compass to return to New York’s more established firms. Eleven agents moved to Elliman from Compass, including Lindsay Barton Barrett, one of Compass’ early hires. A further eight Compass agents moved to Corcoran, and one went to BHS.

One of the firms most hurt by Compass’ intense recruiting was CORE Real Estate, which lost 35 agents to Compass. Some of these included Heather McDonough, Henry Hershkowitz, Doug Headings, David Innocenzi, and the team of Todd Lewin and Michael Rubin. A further nine CORE agents moved to Corcoran, while one CORE agent moved to Elliman and Brown Harris Stevens respectively.

In total, CORE lost 50 agents between the end of 2017 and the end of 2018, a decrease of 25 percent reduction in agent headcount.

When asked about the losses, CORE’s CEO Shaun Osher, sent a statement.

“CORE’s resale business model remains the same as it has always been – to only operate 100 high performing businesses,” he wrote, referring to CORE’s view that each agent is a separate business. “For the past five years, regardless of the fluctuations, we have maintained that number.”

Staying stable in a changing market

Meanwhile, churn continued on a smaller scale at the city’s other major firms. At Brown Harris Stevens, 105 agents left the firm while 117 joined, leaving the firm with 12 more agents overall.

“Changing and growing is essential,” CEO Bess Freedman said of BHS’s strategy, “But I don’t want do it fast, I just don’t believe in that philosophy.” She thinks that agents are attracted to BHS by their roster of top agents like Lisa Lippman and John Burger.

“You want to play tennis with people who play better than you,” Freedman said.

The company made several key hires in 2018, like Bonnie Goldner, who was formerly the number one agent at Keller Williams NYC, and Jodie Garay, who defected from Corcoran.

Meanwhile, Stribling hired BHS’s Kristin Hurd to head corporate strategy and business development at the brokerage. Stribling made 45 hires while 43 brokers left, leaving them up by two agents.

Stribling’s president, Elizabeth Ann Stribling-Kivlan, said that even though it’s upsetting when agents leave, she tells herself: “This is business and you can’t take it personally.” She said an agent’s decision to leave is always about more than a grass-is-greener attitude.

“It’s not just about what you’re being offered by other place, it has to be something about the internal structure,” she said, arguing that an agent leaving is also an opportunity for improvement and to hire new blood.

“If you spend all your time reacting to people getting recruited, you’re not going to grow your company.”