A few blocks north of Times Square, the Brill Building at 1619 Broadway was once the center of America’s popular music industry. But more recently, it was at the center of an odd sequence of events that saw a group of investors bid for the entire building, then settle for a minority stake in the building, and eventually lose their entire investment to foreclosure. Two years later, at least one investor still isn’t over it.

Simon Garber

“Taxi King” Simon Garber, a former associate of Michael Cohen who owns more than 200 taxi medallions in New York City, filed a lawsuit earlier this month against his attorney Boris Volfman and his firm in a last-ditch attempt to recoup his $1.75 million investment in the Brill Building. Garber claims he lost his investment due to malpractice on Volfman’s part.

“Had Defendants acted with even a scintilla of professional competence so as to effectuate their clients’ instructions, Plaintiffs would have been able to pursue the Promoters for the full amount of the Amended Guaranty (i.e., $1.75 million) and recover their investment,” the lawsuit states.

The “Promoters” are Ilan Bracha and Haim Binstock of B+B Capital, who in 2015 began raising funds for a near $300 million acquisition of the Brill Building. The bid has previously been described as involving a “byzantine” ownership structure, and Garber’s involvement was not previously reported. In fact, it may have gone unnoticed if not for two lawsuits filed in the wake of the failed venture.

Volfman declined to comment on the matter, and has yet to file a response to Garber’s latest complaint. Garber and Bracha did not respond to multiple requests for comment.

B+B’s Byzantine Brill Bid

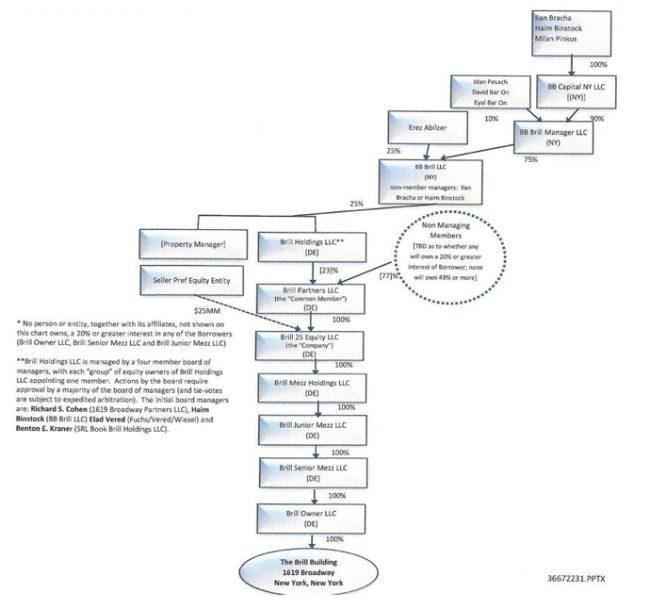

(The structure of the Brill deal prior to Garber’s investment, as described in the first lawsuit. The other three direct investors in Brill Holdings LLC – Conway, Schottenstein and Fox – are omitted from this chart. Click to enlarge)

The Taxi King’s original plan was not to sue his own attorney.

Garber filed his first lawsuit over the Brill boondoggle in February 2017, one month before the foreclosure auction took place, and placed the blame squarely on his co-investors – Bracha, Binstock, three other individuals, and the LLCs involved in the deal.

“Plaintiffs never would have agreed to convert their loan to equity had they known the loan was in default,” Garber’s complaint stated, seeking damages on charges of breach of contract, fraud and unjust enrichment.

As previously reported, B+B Capital’s partners in the deal included landlords Conway Capital and Schottenstein Realty, and the Israel-based fashion chain Fox-Wizel. Each of these partners controlled one-fourth of the entity that would go on to acquire an interest in the building: Brill Holdings LLC.

But Brill Holdings’ complex structure also made room for several other secondary investors, and Garber was among them. Instead of Brill Holdings LLC, Garber’s $1.75 million contribution went to an entity known as BB Brill Manager LLC, which in turn owned a majority interest in an entity known as BB Brill LLC, which represented B+B’s 25 percent share of Brill Holdings. (See chart above.)

Got all that? Corporate complexities aside, Brill Holdings ultimately paid a total of $40 million for a 41 percent stake in the Brill Building – with the option to buy out the rest for about $56 million within 18 months. The full buyout would represent a considerable discount from the agreed-upon value of the building, pegged at $295 million, and this was largely due to the mountain of outstanding debt on the property.

The Brill Building at 1619 Broadway (Credit: Google Maps)

Allied Partners and Brickman, the majority owners, had bought the entire 175,000-square-foot building for $185.5 million in 2013. Court filings show that the Brill Building was encumbered by three loans when B+B and partners acquired their minority stake: one $175 million mortgage loan and two mezzanine loans worth $35.85 million each. All three loans were originally provided by an affiliate of Brookfield Asset Management in June 2015, though city property records show that the mortgage loan was reassigned to Bank of the Ozarks (now Bank OZK) a few months later.

(Because specifics of the deal were not publicly available at the time, previous reports stated that the value of the 41 percent share was $295 million, which now appears inaccurate.)

If the owners had successfully followed through with their plans for the property, these outstanding loans may not have been a fatal issue. At the time of the closing, the owners already had a lease out with Jimmy Buffett’s Margaritaville to open its first New York location, while other deals with CVS and WeWork were in the works, which would have brought the building to 85 percent occupancy.

But none of those plans materialized in time. “Defaults subsequently occurred in connection with several loans related at the Property due to, among other things, a weak retail leasing market,” Bracha said in an affidavit.

With the building more than half vacant, Brookfield foreclosed on its defaulted mezzanine debt and took control of the property for $213 million at an auction in March 2017. After Brookfield acquired the 175,000-square-foot property, it signed WeWork to a 75,000-square-foot lease deal.

Brookfield did not respond to requests for comment and Allied declined to comment.

Penthouse Partners

According to the lawsuit, Garber was first approached by B+B in November 2015 with the opportunity to invest in Brill. A month later, Garber wired $1.75 million to B+B’s counsel to be held in escrow.

Garber and Bracha — who is also a broker and co-founder of Keller Williams’ New York franchise — soon entered into another, rather unusual type of real estate deal as well.

When Garber put his Tribeca penthouse on the market for $25 million in January 2016, his listing brokerage was none other than Keller Williams NYC. An archived listing page from the time shows that Bracha was the lead listing agent for the property, located on the 32nd floor of 101 Warren Street.

Later business disputes would make this arrangement untenable. According to StreetEasy, the Keller Williams listing was removed in August 2016, about a month after Garber — through his attorney Volfman — approved the release of his funds from escrow in order to close the Brill investment deal.

The nature of this release of funds was at the core of Garber’s dispute with B+B. According to Garber, because the new deal was “materially worse” than the original plan to buy 100 percent of the property, he was entitled to get his money back thanks to a guaranty that B+B has agreed to.

But B+B needed Garber’s funds to close the transaction, and Garber says he only agreed to release his $1.75 million on the condition that it was treated as a loan, with the option to convert to preferred equity later on.

B+B denies this, pointing to the fact that there was never any written agreement to that effect, among other things.

“This lawsuit is nothing but a misguided attempt by the Garber Parties, who were fully aware of the risks in investing in New York City real estate, especially where a large debt load is involved, to avoid sharing in the fate of the rest of their partners,” Bracha said in an affidavit.

“Each of the investors in BB Capital and BB Brill Manager, including myself and Mr. Binstock, lost their entire investment in the venture.” (BB Capital NY LLC, which represented Bracha and Binstock’s investment in the venture, contributed $3.25 million, according to court documents.)

The court sided with B+B’s interpretation, and dismissed the lawsuit last May. Garber appealed the decision soon after, but withdrew in December.

Garber now says that he would not have lost the first lawsuit if Volfman had just done his job. In the new lawsuit, he says that Volfman “carelessly and incorrectly” drafted an email that misrepresented his position, stating that “Simon has a three month [sic] to make a decision to stay as a member or be a lender.”

Even then, Garber notes that he still had a chance to save his investment by exercising the option to become a lender, but Volfman never advised him to do so: “Upon information and belief, Defendants never took these remedial steps because they were trying to conceal their previous mistakes in memorializing the Loan Agreement,” the lawsuit reads.

Meanwhile, the Taxi King’s lavish penthouse was put back on the market late last year. The property took a $3 million price cut in March and is now asking $19.5 million, per StreetEasy.

Medallion Meltdown

Ilan Bracha

In his rebuttal to Garber’s first lawsuit, Bracha drew an interesting parallel between Garber’s taxi business and his approach to the Brill deal.

“Mr. Garber, given the nickname ‘Taxi King’ in the press based on his ownership, through entities that he controls, of a very large number of taxi medallions in both New York City and Chicago, and his cab companies are no stranger to controversy,” his affidavit stated.

“Similar to the way in which Mr. Garber has apparently improperly attempted to benefit himself at the expense of others or in violation of the law by cheating his taxi operator partners and the public, he is now improperly attempting to benefit himself and his entities at the expense of Defendants.”

In 2014, Garber’s New York taxi company, Yellow Cab SLS Jet Management Corp., was made to pay $1.6 million in restitution and penalties for unlawfully overcharging his drivers with “late fees.” That same year in Chicago, a business associate of Garber’s was charged with laundering salvaged vehicles that were then provided to Garber’s companies to be used as taxis.

Much of Garber’s taxi fleet in New York was originally co-owned with former Trump fixer Michael Cohen, with the president’s former fixer reportedly operating personal-injury law out of Garber’s Long Island City office. The two eventually had a falling-out, and Cohen scaled back his involvement in the taxi business after he began working for the Trump Organization.

The rise of ride-sharing services like Uber has not been kind to the taxi industry in New York, and Garber’s business has been no exception. As many of his loans have gone into default, the Taxi King (often identified as “Symon” Garber in court filings) is now facing a broad array of lawsuits, and in some cases even the forceful repossession of his medallions.

In an ongoing lawsuit filed against Garber in 2017, Signature Bank alleges that it is owed nearly $57 million in debt on 28 separate promissory notes secured by Garber’s taxi medallions in Chicago.

Other creditors have shown less patience. According to court documents associated with another ongoing 2017 lawsuit, Melrose Credit Union hired an “asset recovery specialist” to repossess several of Garber’s New York medallions last March.

“On March 17-19, 2018, I was part of a three man team which was operating between the hours of 1:00 AM and 8:45 AM. During those time periods, my team and I successfully repossessed seventeen (17) of the Defendants’ taxicab medallions,” an affidavit states.

“After locating the subject vehicles, we were able to gain entry to them without causing any damage by simply using a slim jim (a thin strip of metal used to unlock automobile doors without the use of a key).”

Garber says that the credit union’s actions “breached the peace” and caused damage to his vehicles. Furthermore, the taxi magnate argues the Melrose’s own reckless lending practices are to blame for the collapse of the taxi industry, which was recently documented in a 10-month New York Times investigation.

The credit union “systematically made unsustainable loans through an asset-based lending push in an effort to capture as much of the taxicab medallion market as possible from competing banks,” Garber’s counter-claim states, “which ultimately led to a collapse of the New York City market and to borrowers’ inability to make monthly loan payments.”

“Despite the presence of Uber and other TNCs [“transportation network companies”], Melrose continued its unsound practices of easy lending with no warning to the taxicab industry of the market forces at play.”

Amid financial troubles, Melrose Credit Union was eventually liquidated by the National Credit Union Administration last August. The NCUA has continued to pursue Garber and other indebted taxi operators over millions of dollars in defaulted loans.

According to data from the Taxi & Limousine Commission, Garber’s Yellow Cab SLS Jet Management Corp has been steadily bleeding medallions over the past two years – while the company managed 267 medallions at the start of 2017, that number has since fallen to 211. The past month has been particularly tough for the company, with a loss of more than 30 medallions since early April.

Meanwhile, the taxi industry’s biggest rival, Uber, saw a record-breaking 11 percent dollar loss on its first day of trading last Monday. Lyft, which debuted in March, is also trading more than 30 percent down from its initial price.