Call it a record number of records.

Ken Griffin (Credit: Wikipedia)

Since January, when hedge funder Ken Griffin closed on the most expensive apartment in the U.S. for $238 million, price records in Manhattan’s luxury market have been set and re-set: Just this week, Amazon’s Jeff Bezos set a Downtown record with his $80 million triplex purchase at 212 Fifth Avenue. Farther uptown, an unknown buyer set a new townhouse record by shelling out $77 million for financier Philip Falcone’s Upper East Side mansion.

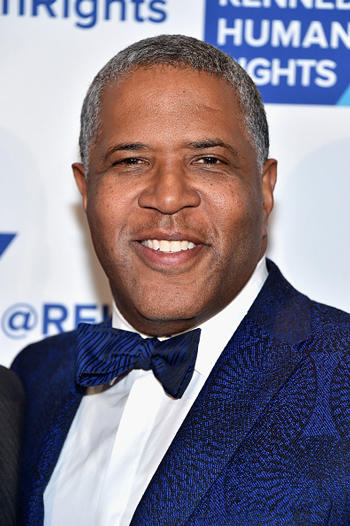

Robert Smith (Credit: Getty Images)

And those deals came on the heels of some other massive buys over the last year, including hedge funder Robert Smith’s $59 million purchase at the Getty, the priciest deal Downtown until the Bezos deal. (Before that, an unknown buyer shelled out $56 million at 70 Vestry.)

But industry sources said the string of deals says more about the economy than it does about the luxury market, which is still hurting. Luxury sales were down 3.2 percent during the first quarter, while days on market rose 23.5 percent, according to data from appraisal firm Miller Samuel.

“It’s clearly a paradox where you have a softening super-luxury market segment that occasionally churns out all-time records,” said Jonathan Miller, who heads the appraisal firm.

He noted the super-luxury market is an entirely new segment created in the wake of the financial crisis. “There was a perfect storm of a flood of capital looking for higher returns after the financial crisis and a lot of wealth creation coming out of Asia that didn’t exist a decade ago,” he said.

These days, ultra-rich buyers are largely domestic — and they’re capitalizing on the buyer’s market that’s taken hold over the past few quarters.

“There’s blood in the water,” said Ryan Serhant of Nest Seekers International. He said there are great deals to be had — and the wealthiest people have the means to get them. “Negotiability is better now than it was in 2009,” he added.

Compass’ Michael Graves said the current wave of wealthy buyers made their fortunes in technology and communications, and they’re gravitating toward Downtown. “They’re buying up properties that would never have been purchased — or frankly, built — 10 years ago,” he said. “If you look closely, we’re seeing a new concentration of wealth north Downtown, north of the Flatiron.”

The concentration of billionaires around the world (i.e., potential buyers) is also shifting. The number of billionaires in Asia dropped 13 percent to 677 in 2018, according to the research firm Wealth-X. (Globally, the number of billionaires dropped 5.4 percent to 2,604.) Meanwhile, the number of billionaires in the U.S. grew 3.7 percent to 705, thanks to a strong U.S. dollar, interest-rate hikes and tax reform. The Wealth-X report also found 15 cities were home to 30 percent of the world’s billionaires in 2018 — including New York, with 105.

70 Vestry Street

“There’s a huge amount of wealth to be invested and that facilitates those sales,” said Liam Bailey, global head of research at Knight Frank. He said in markets like New York, London and Hong Kong, buyers have the upper hand. “There is a willingness to buy and there’s a feeling that this is an opportunity to strike.”

Anecdotally, some brokers said the specter of a new mansion tax has buyers clamoring to close on purchases before July 1, when the new levy go into effect. Based on The Real Deal’s calculation of the new fees, Bezos will save $2.5 million by missing the new tax; annual taxes on are estimated to be around $416,000 for the three-unit spread, according to Department of Finance records.

“Changes in tax policy change consumer behavior and this is definitely evidence of that,” said Miller.

Despite a slight acceleration in deals, brokers said the wealthiest buyers in the market have been shopping for some time. “It’s absolutely a finite group of people and it always has been,” said Shaun Osher, founder of CORE Real Estate. “I still think there’s a limited supply of quality inventory for those buyers.”

212 Fifth Avenue

Compass’ Leonard Steinberg, whose team is on track to close four deals around $20 million each this month, said each of the buyers was in the market for more than a year. Richard Steinberg of Douglas Elliman recounted a similar story, of a buyer who just closed on a $30 million property after more than a year of looking. “Our super luxury market is soft — it doesn’t mean we can’t get deals done, but it takes twice as long,” he said.

While Serhant predicted the string of ultra-luxury deals would trickle down to the rest of the market — “Same thing happened in 2011,” he said — not everyone agreed. Jed Garfield, of townhouse brokerage Leslie J. Garfield, said emphatically that the string of records in no way correlates to a market trend. “Three guys don’t make a market, they make a headline,” he said.

— Additional reporting by Erin Hudson and Heidi Patalano