The M1 Hotel Text Amendment adopted by City Council last December, which requires a special permit for the construction of hotels in most light manufacturing zones, was widely expected to have a chilling effect on hotel development in New York City. Six months down the line, those predictions appear to have been validated – at least for certain segments of the market.

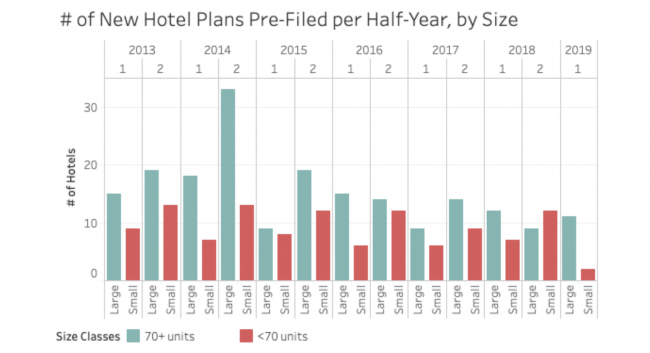

An analysis by the The Real Deal of Department of Buildings filings for new hotels has found that while developers are continuing to plan larger hotel projects at a rate comparable to historical levels, new plans for smaller hotels have suddenly become rare.

“Typology-wise, there’s a consequential difference” between hotels built in M1 zones and hotels that can be built in commercial districts, said architect Gene Kaufman, one of the city’s most prolific budget hotel designers. “A lot of the hotels that have been built — and are still being built now in Brooklyn and Queens in particular — are tiny, they’re 40, 50 rooms. I think those are the ones that will no longer be built.”

TRD’s analysis found that since 2013, the median new outer-borough hotel has had 70 rooms — less than half the size of the median new Manhattan hotel, which has 166. As outer-borough hotel development has consistently outpaced Manhattan in recent years — largely due to lower costs — around 40 percent of new hotel plans submitted during that time have had fewer than 70 rooms. But so far this year, only 2 out of 13 new hotel plans submitted fell into that category.

In fact, for the first five months of 2019, not one new hotel plan was submitted with fewer than 70 rooms. That streak was finally broken on June 13, when plans were submitted for a 61-key, six-story hotel at 3294 Atlantic Avenue in East New York, Brooklyn. A week later, plans were filed for a tiny 11-room, 14-story hotel, on a narrow lot at 21 Park Place near City Hall.

Meanwhile, filings for larger projects have continued to roll in at a steady clip, the largest of which was a 18-story, 300-key project at 145 Bowery, where the Lightstone Group is planning a Lower East Side Moxy Hotel.

The decline in small hotel projects appears to be a question of economics — as land in commercial districts is generally more expensive than in manufacturing zones, hotels built on commercial land tend to be more upscale as well. “What’s typically happened in the hotel industry is that if you’re a Marriott or a Hilton or any one of the major brands, they don’t take 30- or 60-key properties,” Kaufman said.

The decline of small hotels is likely to be welcomed by the New York Hotel and Motel Trades Council, a major backer of the rezoning. As TRD documented in January, the city’s leading hotel union has historically struggled to organize hotels in the outer boroughs, in large part due to their smaller size.

Regime change

M1 hotel projects that had their foundations completed prior to the rezoning are permitted to proceed without special permits, which led to a burst of activity late last year as developers sought to meet the deadline. Kaufman noted that he is now working on five projects in Long Island City’s M1 areas, a neighborhood where he was not previously active, as result of this rush.

Three of those projects are being developed by budget hotel magnate Sam Chang, who said he’s been winding down his business over the past year. The M1 rezoning “put me in my retirement,” Chang told the Wall Street Journal in May.

Late 2018 also saw a spurt of new hotel plans being filed, with sub-70-room hotel plans outnumbering larger hotel plans for the first time since 2010. At the same time, several projects that missed the deadline have already found themselves held up by the new zoning rules — although some have slipped through the cracks temporarily.

In fact, the first new hotel project to receive permits in 2019 was in a manufacturing zone in Long Island City, despite the fact that this was no longer allowed. The project at 38-53 10th Street was issued permits on Jan. 4, but an audit took place the following month, and the job was hit with a “notice to revoke.”

A DOB spokesperson confirmed that the new zoning rules were what prompted the decision, and that the owner has been ordered “to obtain CPC [City Planning Commission] special permits and resolve all other DOB objections if they want to move forward.”

“Following the passage of the zoning text amendment for hotels in M1 districts, DOB provided training for our plan examination staff on this new CPC special permit requirement,” the spokesman said. “In addition, the Department is auditing all hotel project applications in M-1 districts to ensure that hotel projects have CPC special permits, as required.”

The site owner and architect on the project did not respond to requests for comment. Despite conveying to the DOB that they plan to comply with the new requirements, they have yet to apply for a special permit.

And just last week, another developer decided to drop its hotel plans altogether as a result of the new rules.

Greenpoint-based Broadway Stages, which has been trying to build a “transient hotel and community facility” for the North Brooklyn Boat Club on Newtown Creek for years, finally got permits to begin work at 51 Ash Street this April. But a recent audit found the project to be in violation of the new rules, and a notice to revoke was issued.

“In order to comply with the (new) M1 zoning amendment, Broadway Stages is amending the plan, and will be turning the hotel into office spaces, while proceeding with the plans to build a boathouse on the ground level,” a representative for the developer said.

To date, no one has ever applied for a special permit to construct a new hotel where one is required, either under the latest change or under previous geographically-limited rezonings. But as the current boom of hotel construction wraps up in a few years, it is possible that a developer will have to test the waters — despite the current consensus that the special permit process will be too costly and time-consuming for builders.

“I think that eventually someone will try to get a special permit,” Kaufman said. “And when that happens — and as far as I know, it has never happened, despite previous rezonings — I think we’ll find out what exactly those criteria are and whether or not they’re viable and profitable. So far the prediction has been that it’s not very viable.”