Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page at 9 a.m., 12:30 p.m., and 4 p.m. ET. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4:00 p.m.

Jonathan Schwartz and Aaron Appel

Aaron Appel, the head of JLL’s debt team, is leaving to start AKS Partners. He’s taking Keith Kurland, Jonathan Schwartz and Adam Schwartz with him, citing a different approach after JLL acquired HFF for $2 billion. [CO]

Michael Collopy, an agent at City Connections Realty, died after a hit-and-run incident with a cyclist. The company described him as “very generous, very smart and a very kind,” and will honor the Yankees ticket-holder at an upcoming game. The city’s medical examiner has yet to determine the official cause of death. [TRD]

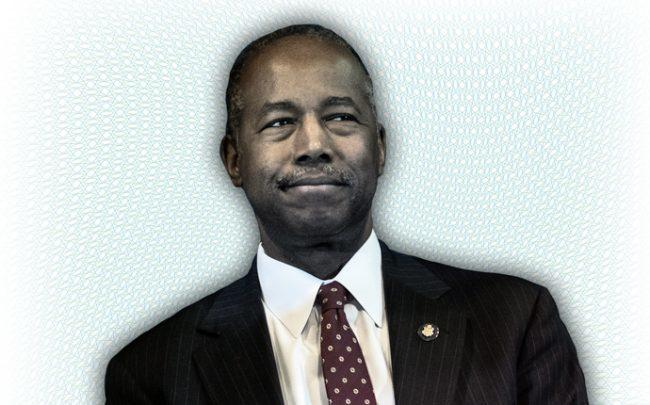

Secretary of the Department of Housing and Urban Development Ben Carson (Credit: Getty Images and iStock)

Rich people are going to get richer no matter what, according to HUD Secretary Ben Carson. The frank words drew chuckles from investors at the Opportunity Zones Expo this morning. [TRD]

FiDi is getting a new gastropub. MezCali inked a 20-year lease from nonprofit AHRC New York City at 83 Maiden Lane. The restaurant will open in 2020. [CO]

July was a slow month for resi sales, but there were still some big-ticket deals. TRD rounded up the top three sales of the month. [TRD]

21 East 63rd Street (Credit: Compass)

Swiss jeweler townhouse HQ has been listed for $40 million. That’s more than four times what Chopard paid for it in 2002. The Beaux Arts townhouse, known as the Chopard Mansion, is currently zoned as commercial, but Sotheby’s agent Robin Rothman is also hoping to attract homebuyers. [TRD]

It’s a bad week for billionaire real estate developer Stephen Ross. The Long Island Rail Road has still not given the go-ahead on design plans that were submitted by Related and partner Oxford partners in the summer of 2018. [NYP]

To fix the subway, tax the rich. At least that’s what Moody’s suggests. The rating agency, echoing Bill de Blasio’s 2017 calls for a millionaire’s tax, recommends New York City tax the wealthy to pay for the subway. According to the press release, low wage growth will hinder the Metropolitan Transportation Authority’s ability to boost revenue by raising fares. [Crain’s]

Some unions say the re-entry population is being exploited by nonunion construction firms. Nonprofits have driven people coming out of prison to nonunion companies, which have lower pay and in some cases, little to no benefits, compared to unions. Now, the practice is at the center of an ongoing fight between New York’s developers, nonunions and unions, which have seen their membership dwindle significantly. [NYT]

Zillow CEO Rich Barton (Credit: JD Lasica via Flickr)

Zillow shares fell after its second-quarter earnings report. The listing giant’s shares fell 16 percent after changes to the way it serves ads alarmed investors. Zillow has shifted from conventional real estate ads to ads that target home-flipping. The company’s New York City listings platform, StreetEasy, caused caused two years ago when it released its Premier Agent ad program. [Bloomberg]

The mayor’s retail vacancy report didn’t come to a conclusion. A de Blasio administration report finds that vacant storefronts don’t plague all parts of the city equally, citing bubbles in Manhattan and Brooklyn while other areas are underperforming. It’s also unclear what policy recommendations could come out of the report. [Crain’s]

Jho Low (Credit: Getty Images)

There are now 17 people charged in connection with the 1MDB scandal. The fallout from the notorious money-laundering scheme has extended to a Goldman Sachs executive and a former executive, among others. Jho Low, the mastermind behind the scheme, was accused of diverting money from the $6.5 billion Malaysian fund to buy properties in New York and California. His properties are now being listed for sale as part of a forfeiture suit, while he remains at large. [NYT]

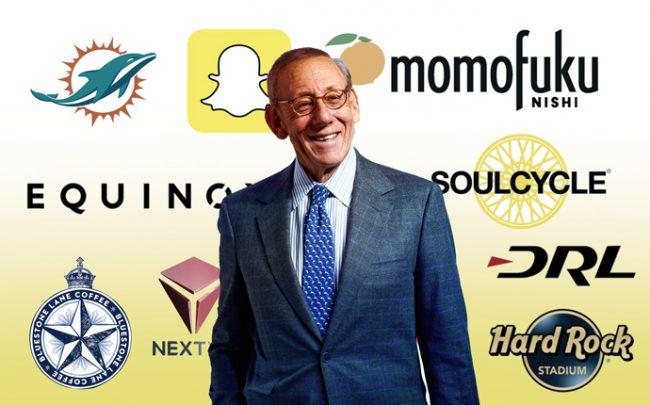

Related CEO Stephen Ross (Credit: Getty Images, Wikipedia, Facebook, and Twitter)

Stephen Ross’ empire is far bigger than Equinox and SoulCycle. Personally and through companies included Related Companies, RSE and Vayner Media, the billionaire has invested in more than 30 businesses. Ross is already facing business backlash after it was learned that he will host a fundraiser for Donald Trump at his Hampton’s home. [TRD]

St. Luke Baptist Church at 1916 Park Avenue (Credit: Google Maps and iStock)

A Harlem church is suing a developer over a delayed project. St. Luke Baptist Church in Harlem is suing Guido Subotovsky, founder of Azimuth development for what is says is fraud in connection with developing a residential building on its land. According to court documents, the church’s then-attorney Shasanmi gambled away money he owed the church. [TRD]

Compiled by Georgia Kromrei

FROM THE CITY’S RECORDS:

New permit filings:

Structured Development filed plans for a four-story storage facility at 435 Tompkins Avenue in Staten Island. [DOB]

New building filing: BRP Companies pre-filed an application for a 24-story tower at 163-05 Archer Avenue in Jamaica, Queens. [DOB]

Commercial sales:

The New York Times acquired a three-story commercial building at 28-11 Linden Place in Queens for $6.9 million. [ACRIS]

Compiled by Mary Diduch