Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day. Please send any tips or deals to tips@therealdeal.com

President Trump has released plans to revamp the housing market. A new plan unveiled by the Trump administration on Thursday includes almost 50 proposals to remake the housing market — and could see the end of more than a decade of government control over Fannie Mae and Freddie Mac. [WaPo]

The Fed is gearing up for another rate cut. The Federal Reserve is reportedly planning another rate cut — likely to be a quarter percentage point — as Donald Trump’s trade war continues to escalate. [WSJ]

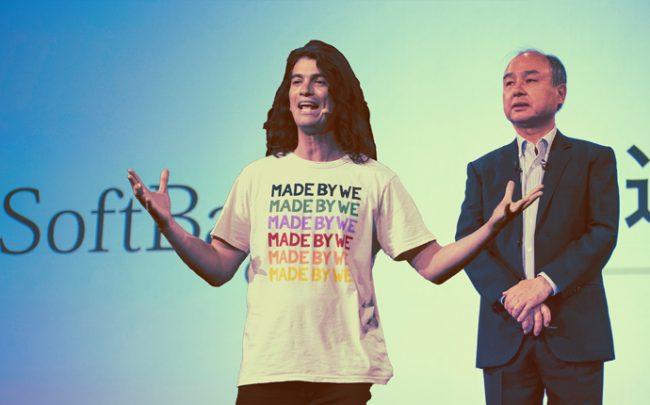

The We Company CEO Adam Neumann and Softbank CEO Masayoshi Son (Credit: Getty Images)

WeWork is considering slashing its valuation to $20B. After weeks of criticism over the company’s business model, its parent the We Company is reportedly considering delaying its planned IPO and slashing its valuation to $20 billion. [TRD]

Online brokerage Dwellowner wants to raise $7M through a token offering. Eric Eckardt, a former Purplebricks executive, is seeking $7 million to $10 million to help grow his new cloud-based brokerage, Dwellowner, via a security token offering. [TRD]

Zillow CEO Richard Barton (Credit: iStock)

Zillow is seeking $1B for “bold expansion.” Zillow is seeking an additional $1.1 billion in investment, which the company said would be used for “working capital, sales and marketing activities, general and administrative matters and capital expenditures” as the company expands. [TRD]

Jeffrey Epstein’s address book lists more than 1,000 names. An anonymous man identified in records associated with Jeffrey Epstein has filed a motion to fight the release of his name, arguing it could cause severe reputational damage. “There are hundreds of other people implicated in dockets,” said Jeffrey S. Pagliuca, an attorney involved in the litigation — suggesting more cases could be on the horizon. [NYT]

Nets’ Spencer Dinwiddie in contract for Brooklyn’s highest apartment. Brooklyn Nets point guard Spencer Dinwiddie has gone into contract for the 68th-floor penthouse apartment at Brooklyn Point, which is currently under construction. The unit was reportedly asking about $3.9 million. [NY Post]

Mayor Bill de Blasio by Gage Skidmore

Bill de Blasio may drop out of the 2020 race next month. Mayor Bill de Blasio, who logged seven hours at City Hall last month, has hinted at a possible end to his embattled presidential campaign, telling a press gaggle Wednesday that it would be “really tough to conceive of continuing” if he doesn’t qualify for the October debates. [NYT]

The world’s most liveable cities aren’t in the U.S. If you haven’t been to Vienna, now’s the time to go. The Austrian capital was named the world’s most liveable city for the second year in a row this week. Others in the top 10 included, Sydney, Melbourne, Osaka, Tokyo and Copenhagen. New York placed 58th, and London 48th. [Bloomberg]

Hedge fund mogul Bill Ackman to make windfall on sale of investment building. A Madison Avenue office building partly owned by hedge fund mogul Bill Ackman is up for sale, and could reach up to $120 million, sources told the New York Post. Friedland Properties, Nightengale Properties and Ackman bought the ground lease in 2015 for $76 million. [NYP]

Sam Zell (Credit: Getty Images)

Real estate billionaire Sam Zell criticizes WeWork. Real estate mogul Sam Zell has criticised WeWork’s business model ahead of the co-working giant’s initial public offering in September, stating in an interview that “every single company in this space has gone broke.” [Business Insider]

Canadian department store chain Hudson’s Bay struggles to find younger audience. A plan to scoop up multiple stores left vacant by Sears Canada seemed like a good one back in 2017, but two years down the line, the CEO of Hudson Bay has expressed regret over the strategy as the Canadian company struggles to attract younger consumers. At least Saks Fifth Avenue is doing alright. [Bloomberg]

Elderly woman owes $7 million in debt on Harlem brownstones. Giselle Allard, 75, says she is facing homelesness after the debt on her four Harlem brownstones ballooned to $7 million. The trouble started back in the 1990s when she purchased her first home from the property owner — under a payment plan — and the owner subsequently died. Confused about where to make payments, she ultimately stopped making them altogether. [NYDN]

Compass CEO Robert Reffkin and Realogy CEO Ryan Schneider

“Dummy job” at Compass created to circumvent Realogy rules. Compass created a “dummy job” for a former Realogy finance executive as a way of getting around his non-compete, a New Jersey judge has ruled. [TRD]

Serial buyers are trading old condos for new on Billionaires’ Row. Wealthy buyers, including rocker Sting and developer Stephen Ross, are trading in their older condos for new ones in the current market. [TRD]

New York’s new global investment fix doesn’t include Chinese capital. Despite concerns about declining Chinese investment in New York real estate, the commercial market may stand to gain from recent global tensions. [TRD]