Every day, The Real Deal rounds up New York’s biggest real estate news. We update this page in real time, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4:20 p.m.

Video produced by Sabrina He

Redfin plans to disclose broker commissions on all Seattle listings — for both the buyer’s and seller’s agents. The discount firm will do so starting Oct. 1, when the Northwest MLS will also allow 30,000 agents and brokers to publish how much sellers pay the buyer’s broker. The change was announced in July. Last week, Redfin said it would disclose how much it pays buyer’s agents in an effort to be more transparent. “My experience is that when one MLS makes a shift like this others will follow suit,” Kelman told Inman. [Inman]

Thomas Heatherwick pushes back against the haters. The designer of Hudson Yards’ Vessel defended Related Companies and himself against critics at an event in Los Angeles last week. His counter to the idea that his sculptural staircase, in some circles called the Shwarma, had no purpose by asking “but what’s the purpose of Central Park? What’s the purpose of the High Line? What’s the purpose?” [Dezeen]

[video_embed][/video_embed]

Queens just saw its largest property deal in nearly a year. Andrew Chung’s Innovo Property Group is buying out Westbrook Partners’ majority stake in a Long Island City warehouse largely leased to the New York City Housing Authority. The deal is valued at $430 million. The largest deal in the borough before that was Blackstone Group’s $475 million buy of the Parker Towers apartment complex. [TRD]

Real estate stocks are trailing behind the S&P 500. Of 28 stocks tracked by TRD, there’s been a marginal increase o. It’s a similar scenario to last week, which was also reacting to the latest in the U.S.-China trade war. [TRD]

Softbank CEO Masayoshi Son (Credit: Getty Images)

Staffers at SoftBank’s Vision Fund are feeling the heat. Following yesterday’s news that WeWork may IPO at halve its valuation the stakes for fund employees have been revealed and many staffers’ compensation will be tied to WeWork’s IPO performance. They only get payouts once profits are booked and could have their money clawed back in the face of losses; senior staff could see clawbacks of 20 percent or more while more junior employees would be on the hook for repaying around 7 percent. [Bloomberg]

Fannie Mae and Freddie Mac aren’t going anywhere yet. The U.S. Treasury Department released its housing reform plan yesterday and, based on the report’s language, it seems that mortgage guarantors Fannie Mae and Freddie Mac are not getting out from under the government’s thumb anytime soon. Though the Trump Administration has recommended recapitalizing the companies and giving them independence, a clear plan for getting them the funds is vague. [WSJ]

Paul Manafort calls foul on the state’s mortgage-fraud case against him. President Donald Trump’s former campaign chairman is seeking to have New York’s case against him dropped on the grounds that he’s already been tried on the charges in federal court. Manafort’s currently serving his seven-plus year sentence in Pennsylvania. [Bloomberg]

Mayor Bill de Blasio signalled a possible end in sight for his presidential campaign. De Blasio didn’t make this month’s debates and said that he’s going to keep going to try to qualify for October. But if that doesn’t work out, he said it’d be “really tough” to keep his campaign alive. He said one of the biggest challenges for his run has been competing against candidates who don’t have a second job. “The irony is our current political system basically encourages folks to run for president who don’t have a substantial executive job at that moment,” he said. [AMNY]

Adam Neumann lashes out at Uber and Lyft. In a private meeting with analysts the We Company CEO criticized the ride-sharing companies’ spending, saying he thinks “there were growth issues. I think when you grow at any price there are consequences.” Shots fired. [Bloomberg]

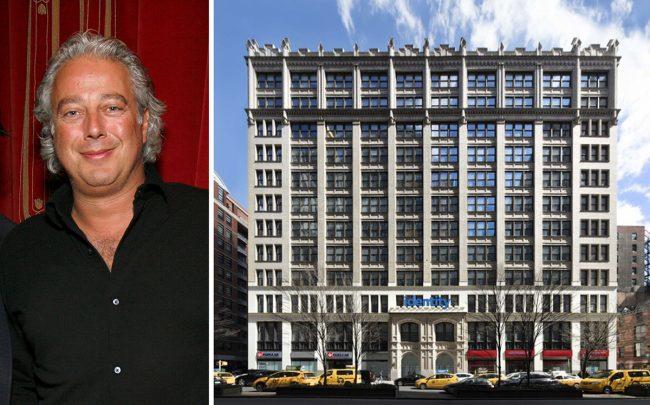

Aby Rosen and 345 Park Avenue South (Credit: Getty Images)

Aby Rosen traded 345 Park Avenue for millions and a stake in a life science fund. Rosen sold the 12-story office building by Madison Square Park to healthcare investment firm Deerfield Management for about $530 million — $385 million of which was paid in cash and another $150 million was his stake in one of Deerfield’s funds. Blackstone provided the buyer with a five-year, floating-rate loan of $540 million. [CO]

These nations have planted flags in the Big Apple. Though foreign investment in commercial property has fallen dramatically since 2016, overseas buyers still poured some $9.5 billion into acquisitions last year. The Real Deal broke down the top 20 deals in Manhattan by country from summer 2017 and 2019 to offer a look at new foreign investment landscape in the city. [TRD]

5 Prince Street is on the market; price TBD. The Lower East Side building is officially up for grabs. Bari Restaurant Equipment bought the property and the adjacent 234 Bowery three years ago for a $12.3 million. Most recently, the Prince Street building was offered for rent at $20,000 per month. Cushman Wakefield has the listing. [Bowery Boogie]

Compiled by Erin Hudson

FROM THE CITY’S RECORDS:

Financings:

Calmwater Capital provided RedSky Capital with a $60 million refinancing for 143-157 Roebling Street in Williamsburg. [ACRIS]

Stellar Management refinanced 44 West 28th Street in NoMad with a $78 million loan from New York Community Bank. [ACRIS]

Compiled by Mary Diduch