Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 6:30 p.m.

The Manhattan District Attorney’s office has subpoenaed eight years of Donald Trump’s tax returns. Investigators are demanding the information as they look into the role Trump and his family business played in making hush-money payments as the 2016 election drew closer. The subpoena to accounting firm Mazars USA requests federal and state tax returns dating back to 2011 for Trump and his company. [NYT]

A home automation company backed by Blackstone Group is merging with a unit of SoftBank. Vivint Smart Home Inc. will create a company valued at $5.6 billion through the merger. The company makes a variety of smart home security products. [Reuters]

Brokers can now charge a maximum of $20 per application fee. The Department of State announced on Friday that licensed brokers and salespeople cannot collect more than $20 on application fees. Tenants had complained of being charged upwards of hundreds of dollars for applications since New York’s new rent laws passed in June. [Gothamist]

It might take 100 years to finish the Sunnyside Yard project. The city will hold a public meeting about the massive project on Monday and release some early design concepts for it. While the city expects to finish its master plan by the end of the year, but it could be a century before the project itself is done, according to Sunnyside Yard director Adam Grossman Meagher. [Sunnyside Post]

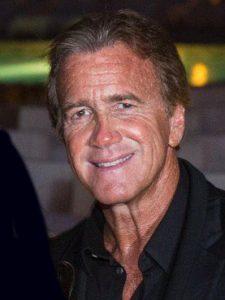

Jeff Sutton

Jeff Sutton is making a Fifth Avenue retail play. The Wharton Properties president signed a contract for about 4,600 square feet of ground-floor retail at 730 Fifth Avenue the building by West 56th Street. The overall retail condo, which Sutton co-owns it with Brookfield Asset Management, spans about 89,000 square feet. He also owns the adjacent building at 720 Fifth Avenue. [PincusCo]

Bernie Sanders (Credit: Getty Images)

Bernie Sanders is making a call for national rent control. The $2.5 trillion affordable housing plan would also focus on ending homelessness. It would expand public housing, increase the amount of affordable housing and limit annual rent increases to no more than 1.5 times the inflation rate or 3 percent. The campaign will release the full plan within the next month. [NYT]

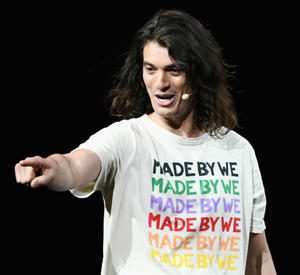

WeWork CEO Adam Neumann (Credit: Getty Images)

WeWork’s IPO valuation just keeps getting lower. Sources have now told Reuters that the co-working giant may seek a valuation between $10 and $12 billion for its initial public offering, a dramatic decrease from the $47 billion valuation it hit in January. Its dropping valuation could impact other real estate startups as well. [Reuters]

And it turns out Adam Neumann is no Mark Zuckerberg. The WeWork co-founder’s reluctant decision to cede some of his powers as the company prepares to go public is an indication that the era of founders taking their companies public while still maintaining strong voting power is over. [Bloomberg]

Markets are starting the week on a high note. TRD’s analysis of 28 real estate stocks found that they did better than the S&P 500, increasing by more than 3 percent. However, 19 of the companies saw their share prices plunge on Friday. CoStar Group’s value fell the most, dropping by 7.7 percent to close on Friday at $570.11, while Newmark Knight Frank did the best, rising by 14.4 percent to close at $10.11. [TRD]

George Kaufman’s third wife and longtime lawyer are in a bitter dispute over his $500 million estate. The developer amended his will two months before dying to remove lawyer Thomas Kearns as a trustee and executor and giving the private wealth management company Bessemer Trust control of his estate. An attorney for Kearns says Kaufman was isolated and abused for months by his wife Mariana Zoullas Kaufman, which her attorney has disputed. [WSJ]

Deputy Mayor Vicki Been’s views on the failed good-cause eviction bill have stirred controversy. Housing advocates are upset that Been said she was “not sure what the problem is that we’re actually trying to solve” and that she wants “to be sure that the solution is a solution that fits the problem and is not just a solution that we borrowed from another city or is a flavor of the day.” [NYDN]

Five real estate investors have been arrested for allegedly defrauding taxpayers and lenders. Iskyo “Isaac” Aronov and his partners would identify homes in gentrifying neighborhoods including Bedford-Stuyvesant that owed more than what they could pay and negotiate with banks to let them go for less than market rates. Aranov’s team would then perform gut renovations and resell the properties — some of which landed on the Bravo TV show Million Dollar Listing New York. [BuzzFeed]

A criminal hack at the Corcoran Group on Friday caused the entire company to get an email with agent splits. The email also included marketing budgets and gross commission income, according to TRD. The email came from Corcoran sales president Bill Cunningham and was retracted quickly. The hack appeared to be contained to one email account, and customer data was not involved. Corcoran plans to investigate the hack as criminal activity. [TRD]

There were 12 luxury contracts signed for about $81 million in Manhattan last week. Both figures were up from the week before, when the borough saw 10 luxury contracts signed for about $69 million. The properties spent an average of 475 days on the market and had an average discount of 3 percent from the original to the final asking price. This year’s third quarter is so far tracking 27 percent below last year’s. [Olshan]

Brooklyn’s luxury market saw 12 contracts signed last week for a total of roughly $32.7 million. Contract volume was the same as last week, while dollar volume was slightly lower at about $32.6 million. The average contract went for about $2.7 million, and the properties spent an average of 182 days on the market. [Compass]

The state wants the city to decide how rent increases will apply to vacancy leases. The division of Homes and Community Renewal said in a memo it will be up to the city’s Rent Guidelines Board to determine whether landlords can raise rents in vacant apartments based on renewal increases the board approved for one- or two-year leases. The guidance has confused some in the real estate industry. [TRD]

Erbo Properties landed $56 million in construction financing from G4 Capital Partners. The money is for its planned conversion of a warehouse property at 541-545 West 21st Street in Chelsea into an office building. The project will include retail space on the ground floor. [CO]

FROM THE CITY’S RECORDS:

Commercial sales:

Prologis acquired two parcels at 512 Johnson Avenue in East Williamsburg, Brooklyn for $21 million. [ACRIS 1,2]