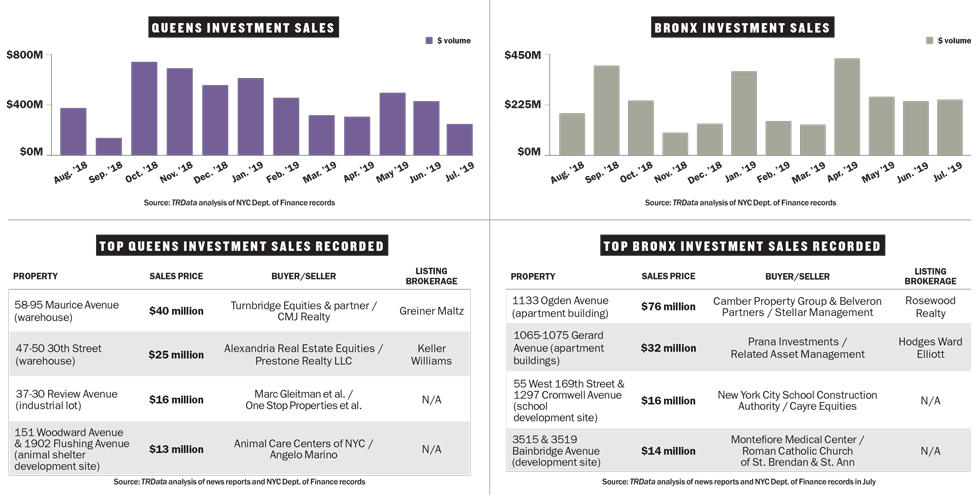

INVESTMENT SALES IN MANHATTAN AND BROOKLYN

Manhattan investment sales slowed in July with $2.06 billion in deals recorded, a 41 percent drop from June and 17 percent below the 12-month average. The largest deal went to California-based DivcoWest Real Estate Investments, which paid Boston Properties $310 million for 540 Madison Avenue, Divco’s second NYC office building. The Brooklyn market, meanwhile, continued to improve with $636 million in deals recorded, up 29 percent from June and 8 percent above the 12-month average. The top deal was the sale by Toby Moskovits’ Heritage Equity Partners of 564 St. John’s Place to Harbor Group International for $117 million — a year after Moskovits and her partner Michael Lichtenstein saved it from foreclosure.

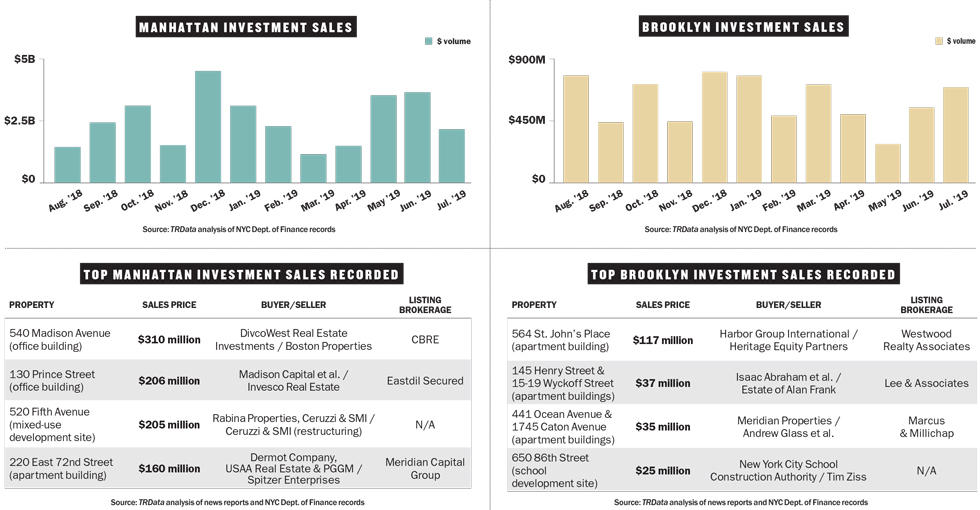

INVESTMENT SALES I N QUEENS AND THE BRONX

Queens’ investment sales market slowed down in July with just $226 million in deals recorded, about half of both the previous month’s volume and the 12-month average. The borough’s top deal went to Turnbridge Equities and an institutional partner, which picked up the FedEx ship center at 58-95 Maurice Avenue from CMJ Realty for $40 million. The investment sales market in the Bronx, meanwhile, held steady in July with $231 million in deals, up 1 percent from the prior month and 2 percent below the 12-month average. The top deal was Stellar Management‘s sale of the Highbridge House rental tower at 1133 Ogden Avenue for $76 million to Camber Property Group and Belveron Partners, which plan to return the building to complete affordability.