Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4:00 p.m.

WeWork has made some unique design choices on its IPO prospectus. Normally, companies rank banks linearly on the cover of their offering documents, putting the lead bank with the most input in the top left. But WeWork decided to have the names of banks like JPMorgan and Goldman Sachs encircle its logo instead. “Sadly,” wrote Wall Street Journal reporter Lauren Silva Laughlin, “the protective ring of Wall Street institutions around We Co. failed to save it from a stalled offering.” [WSJ]

A Harry Potter exhibit is coming to the Flatiron District. Warner Bros. has leased about 35,000 square feet of space across at least three levels of 935 Broadway for the exhibit, which will feature recreations of settings from the movies such as the Forbidden Forest and the Great Hall. [Crain’s]

Sheldon Solow’s son just bought a winery on Long Island. Stefan Soloviev expanded his vineyard holdings in Long Island with the purchase of a 53-acre site in Cutchogue. It will likely be another two or three years before wines are for sale [NYP]

Adam Neumann has started discussions about his future role at WeWork. He could possibly transition into the role of chairman or stay on as CEO with an independent chairman joining the board. Neumann has faced growing criticism about his role at the company as WeWork attempts to hold an initial public offering before the end of the year, but the discussions have put a board challenge from investors on hold for now. [Reuters]

Toby Moskovits is planning her first Bronx project. Moskovits and Michael Lichtenstein have purchased 286 Rider Avenue in Mott Haven for $10 million from Robert Newblatt of 286 Rider Avenue LLC. They plan to demolish the warehouse at the site and replace it with a 140-unit rental building spanning 120,000 square feet. At least 25 percent of the units will be affordable. [CO]

Industry City

The Industry City zoning is being delayed again. Brooklyn Councilman Carlos Menchaca said on Thursday that he would oppose the plan for the rezoning after Industry City president Andrew Kimball indicated he would look to formally launch its land use review process on Monday, according to Crain’s. Kimball had acquiesced to Menchaca’s demand to alter the rezoning plan and include community benefits with it, but the council member is now saying a community group needs to be formed to bless the rezoning before it can move forward. [Crain’s]

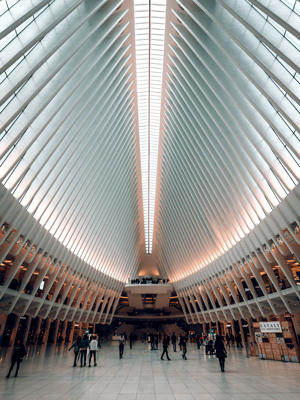

The Oculus at World Trade Center

It might cost another $200,000 to fix the Oculus’ leaky skylight. The Port Authority of New York and New Jersey has already spent at least $50,000 to seal the skylight with water-resistant tape after it started leaking last year and expects to spend $200,000 more to seal it with a waterproof membrane, according to the Wall Street Journal. The skylight is supposed to open every Sept. 11, and officials believe it broke during its opening on Sept. 11 last year. [WSJ]

WeWork CEO Adam Neumann (Credit: Getty Images and iStock)

SoftBank is pushing for Adam Neumann to be ousted as WeWork’s CEO. The bank is WeWork’s largest investor but has become frustrated with Neumann’s behavior, the company’s troubled plans for an initial public offering and its hemorrhaging losses, according to The Real Deal. Neumann and other executives did not expect such a negative reaction to the company’s IPO prospectus last month and have since said they will delay WeWork’s IPO. They have made other changes as well, but some critics maintain they are not enough. [TRD]

Fannie Mae and Freddie Mac could start keeping their profits again this week. The expected agreement between the pair of mortgage finance companies and the Trump administration would be a major step toward letting the firms build up capital and operate as private companies again, according to the Wall Street Journal. They would be allowed to keep about one year’s worth of profit ($20 billion) under the deal, years after the government essentially nationalized them following the 2008 financial crisis. [WSJ]

Your broker might owe you a refund of application fees. After the state clarified earlier this month that brokers acting on landlords’ behalf cannot charge tenants more than $20 in application fees, some tenants who were charged more are requesting and getting refunds, according to the New York Times. However, the state’s memo does not specify whether tenants are entitled to refunds, and some who have sought them have not heard back. [NYT]

Co-ops are adding amenities to compete with condos. The Dakota just installed a fitness center last year, for instance, and the Carlton Regency has added a roof deck, a children’s playroom and a gym, according to The Real Deal. The additions can be costly, but they can attract buyers in a slow market filled with amenity-laden condos. [TRD]

Normandy and Invesco have inked a $200 million refinancing for 888 Broadway. The five-year floating-rate loan for the office building came from TPG Real Estate Finance Trust, according to the Commercial Observer. The office property comprises a pair of interconnected buildings at 888 Broadway and 38 East 19th Street, and firms including Netflix, ABC Carpet & Home and Australian software company Atlassian have recently inked leases there. [CO]

A Manhattan antiques store is shrinking drastically. Showplace, located on West 25th Street between Broadway and Avenue of the Americas, lost almost its entire ground floor in a recent lease renegotiation, according to the New York Times. The deal is a sign that Manhattan’s once thriving antiques culture is waning. [NYT]

There were 11 luxury contracts signed for about $94 million in Manhattan last week. That was one fewer than the week before, but dollar volume was up from about $81 million. The properties spent an average of 560 days on the market and had an average discount of 19 percent from the original asking price. It was the 12th week in a row with fewer than 20 contracts signed. [Olshan]

Brooklyn’s luxury market saw 13 contracts signed last week for a total of roughly $40.4 million. Both numbers were up from the previous week’s 12 contracts signed for about $32.7 million. The average contract went for about $3.1 million and the properties spent an average of 153 days on the market. [Compass]