Every weekday The Real Deal rounds up New York’s biggest real estate happenings. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com.

This page was updated at 4 p.m.

Video produced by Sabrina He

WeWork wants to get into … electronic gaming? The troubled co-working giant applied for a trademark for “Play By We” earlier this year, according to documents published in the UK last week. The company has hired a handful of staffers for the fledgling business, but their fate is now unclear as thousands of job cuts are planned following Softbank’s takeover. [Bloomberg]

SL Green signed two more leases at One Vanderbilt. Alternative investment firm Oak Hill Advisors is taking 45,954 square feet — the entire 16th floor — while The Carlyle Group is adding 33,034 square feet to fill out the 34th floor, its second expansion in the new tower beside Grand Central Terminal. [Press Release]

Howard Hughes Corporation CEO Paul Layne with former CEO David Weinreb (Credit: Getty Images)

With a new CEO and a new focus, what will Howard Hughes do with the South Street Seaport? The Texas-based developer is planning to sell $2 billion in “non-core assets,” including 85 South Street in New York, and will consider partnering with third parties on the Seaport to reduce its equity commitment. [TRD]

Zillow CEO Rich Barton insists its ibuying is not home-flipping. Instead of making money off of home price appreciation, the company’s Zillow Offers tool generates money for the company in the form of a transaction fee, Barton emphasized at an event Monday. [TRD]

Ribbon CEO Shaival Shah (Credit: iStock, Pixabay)

All-cash homebuying startup Ribbon raised $330 million in new debt and equity. The startup, founded in 2017, empowers buyers who need financing to compete against all-cash bids in a competitive market. [TRD]

Vacation rental startup Vacasa is now valued at $1 billion. The startup raised $319 million in a strategic round led by Silicon Valley private equity firm Silver Lake, bringing its total funding to more than $500 million. Vacasa currently manages 23,000 homes on behalf of properties. [TRD]

Ben Carson’s HUD wants banks to lend on low-income homes again. HUD and the Department of Justice are moving to reduce bank fines for minor infractions associated with FHA mortgages, as nonbank lenders have increasingly filled the void left by banks since the last recession. [TRD]

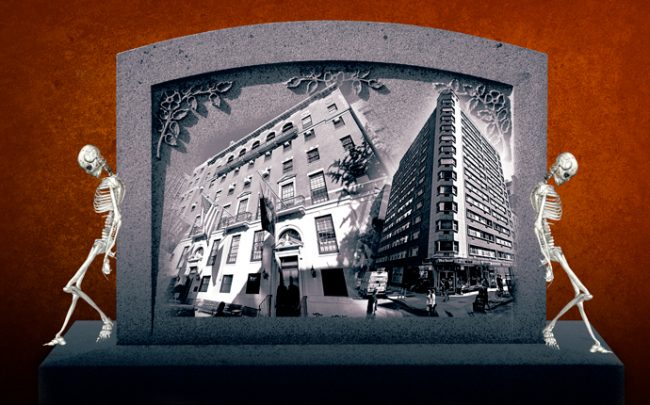

221 East 71st Street and 60 East 12th Street (Credit: Google Maps and iStock)

NYC’s multifamily market had a deathly Q3. Hammered by new rent laws, the multifamily market experienced its slowest first half of the year since 2011, and the year-over-year drops in transaction, building and dollar volume were even starker in the third quarter, according to a report from Ariel Property Advisors. [TRD]

The city has started the clock on Industry City’s rezoning request. The beginning of the official review comes amid fierce opposition from some Sunset Park advocates and mixed signals from the area’s City Council member, Carlos Menchaca. The council will vote on the 16-building waterfront complex’s application in seven months. [Curbed]

A tenant-harassing Brooklyn landlord has filed for bankruptcy. The joint venture between East Coast MIG and HQ Real Estate made the filings for four contiguous Clinton Hill properties. They include $29.3 million in debt to Michael Shah’s Delshah Capital, which acquired the debt on the properties last year. [CO]

Mayor Bill de Blasio (Credit: Getty Images)

De Blasio’s aborted presidential campaign relied on donors with city business ties. Although the mayor has decried the influence of big money on politics, federal filings show his campaign was hardly free of such influence. For example, relatives of Brooklyn developer Rubin Schron, who has an interest in the Industry City rezoning (see above), donated a total of $5,600. [Politico]

NYCHA’s seven-year itch: Post-Sandy rehab is still a mess. Work has been completed at just two of the 35 developments damaged by the October 2012 superstorm, projects were delayed by years and Housing Authority contractors cheated workers on wages and stole heating oil. [The City]

Specials permits for hotels may soon be required in one more part of the city. The area south of Union Square, where the city approved an upzoning for a 21-story tech hub last year, could be the next neighborhood to be subject to restrictions on hotel development. The de Blasio administration is pushing for such a policy citywide. [Curbed]

How to buy an apartment for $55,000. (Hint: political connections.) Bronx City Councilman and AOC rival Fernando Cabrera bought an apartment from a government office controlled by the Bronx Democratic machine last year and has listed it at a 150-percent markup. [Crain’s]

220 Central Park South and Vornado chairman Steven Roth (Credit: Google Maps and Getty Images)

Two more high-priced sales at Vornado’s 220 Central Park South. A trust named “DCJ220CPS” dropped $55 million on the 6,591-square-foot condo on the building’s 45th floor. The Wall Street Journal linked the trust to David and Constance Littman. And real estate investor David Mandelbaum — an early backer of Vornado’s Steve Roth — snagged himself a $23.4 million pad. [TRD]

Opponents of the commercial waste zones bill want more time. Nearly a dozen City Council members are trying to slow or stop the passage of the bill, which is headed for a final vote Wednesday. Real estate interests believe the effort will raise the cost of waste collection and worsen customer service. [Crain’s]