After getting pummeled by Compass’ aggressive recruiting, Realogy Holdings says its rival is letting up.

Four months after filing a wide-ranging lawsuit accusing Compass of “predatory” poaching, Realogy CEO Ryan Schneider described a dramatic drop in Compass’ hiring.

During an earnings call, Schneider said the firm’s “recruiting intensity” in October was down almost 50 percent from September and 67 percent from August, according to Realogy’s calculations. “Something changed in the ecosystem and I think it’s the investor focus on profitability,” he said, in a thinly-veiled reference to SoftBank, one of Compass’ key backers.

Since 2012, Compass’ aggressive hiring of top agents from rival firms has stung competitors — particularly Realogy, which has battled to recruit and retain agents and keep commission splits down amid the heavy competition. “This is by far the biggest change in the competitive environment to our benefit that I have seen in the last two years,” Schneider said.

But in the wake of WeWork’s bungled IPO, investors are increasingly asking questions about the valuations of startups backed by the Japanese conglomerate and its $100 billion Vision Fund. This week, the Vision Fund posted a $9 billion operating loss in the first quarter, its first quarterly loss since 2016.

“My own investment judgement was really bad,” CEO Masayoshi Son said at a Tokyo news conference.

Like other SoftBank-backed companies, Compass has sought to distance itself from WeWork. “It is hard to draw any parallels between our businesses,” CFO Kristen Ankerbrandt wrote in a memo to Compass staff days after WeWork’s suspended IPO.

Compass declined to comment on current recruiting efforts, though it’s clear the company hasn’t stopped recruiting altogether. The New York-based firm currently has 14,000 agents in 250 offices around the country.

Over the summer, L.A. agent Chris Cortazzo — who was Coldwell Banker’s No. 1 agent — took his 16-person team to Compass. In New York, Charlie Attias and Rachel Glazer joined Compass from the Corcoran Group and Brown Harris Stevens, respectively. Just this week, Hamptons agents Cee Scott Brown and Jack Pearson joined Compass from the Corcoran Group.

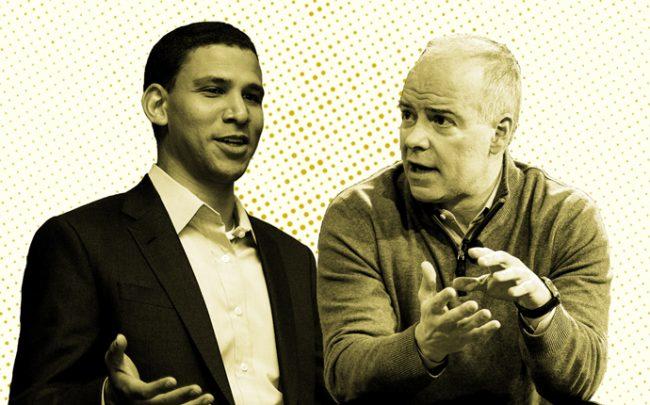

But Compass stopped entering new markets in January to focus on building a deeper presence in existing markets, CEO Robert Reffkin told The Real Deal during an October interview.

“We didn’t try to conquer the world,” he said. “We are focused on depth over breadth.”

For the past few months, Realogy and Compass have been waging war in the courtroom, after Realogy accused its rival of “predatory” poaching and illicit business practices.

“We don’t do a lot of whale hunting… We don’t pay seven-figure bonuses,” Schneider said Thursday. “We’re in the business of recruiting profitable agents. We’re not out making negative offers to agents just to bring in volume.”

During the third quarter, Realogy reported that its agent headcount rose 1 percent during the third quarter and 3 percent year to date. “We’re seizing the moment,” Schneider said.

Read more