Just before the 2008 crash, developer Young Woo made a big investment in an unlikely venture: South American farmland.

Woo and his partner Margarette Lee bought 2,000-acre plot of farmland less than an hour outside of Mendoza, Argentina, where Woo lived in his teen years. The site is part of a multimillion-dollar investment that’s only just starting to pay off.

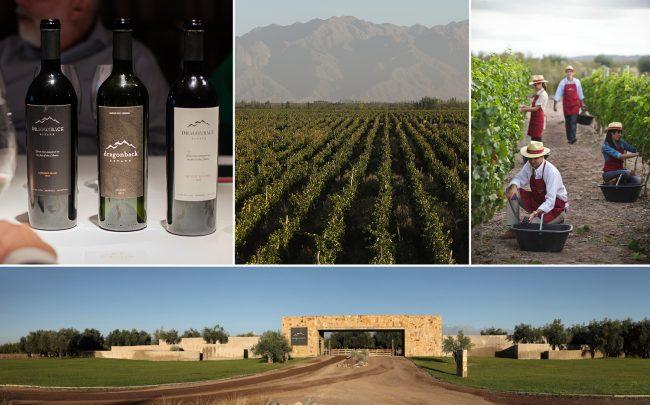

“We said things are too good,” Lee recalled and, anticipating a downturn, they decided to buy up South American farmland. More than a decade later, the principals of Youngwoo & Associates have transformed the land in Argentina into a 300-odd lot winery known as Dragonback Estate, where buyers can purchase their own 2.4-acre vineyard for roughly $250,000. The development also includes a winery, hotel and restaurant, known as the Rosell Boher Lodge.

Read more

The estate is a textbook example of the firm’s out-of-the-box style of development — with past projects including the redevelopment of Pier 57 and a Chelsea condo with “sky garage” instead of the basement. But a shared vineyard and sprawling hospitality project was not part of their original plan. They had initially set out to run a farm but, after five years bought out their local partners after being “unsatisfied” with how operations were being handled, Lee said.

Looking for alternate land uses, they had the soil tested and realized it was “excellent” for producing wine. From there, they developed the concept of “a gentleman’s farm,” where buyers could own an income-producing vineyard and pay a small annual fee of around $6,500 to have local partners handle the winemaking.

“We feel very lucky,” said Lee. “We’re real estate developers so we’re interested not in selling the wine, but selling the land.”

Each plot can produce up to 8,000 bottles of wine at full capacity, the developers said. Buyers have their choice of what kind of vines they will grow, and whether they want to keep their harvest or sell to nearby wineries. According to the developers, Malbec, Cabernet Sauvignon and Cabernet Franc are the most popular wines owners produce.

Buyers can also build homes on their vineyards, which is what Woo and Lee are doing: They’re constructing a house on a few lots that will be “our little place to go when we get old,” Lee joked.

Argentina is in the midst of a recession. This summer, a rescue package from the International Monetary Fund failed to stabilize the economy, which is facing a budget deficit, high inflation and continued political instability.

According to Lee, the development has sold two thirds of its lots with buyers hailing from Canada, Germany, Brazil, Argentina and the U.S.

In the U.S., Youngwoo recently partnered with EquityMultiple to launch a $500 million Opportunity Zone fund. Through the tax program, the developer is looking to invest in New York, Oakland, Seattle, Detroit, Los Angeles and Portland.

Write to Erin Hudson at ekh@therealdeal.com