At 220 Central Park South, a recent string of eye-popping sales seemed to brighten an otherwise gloomy year in the luxury market.

In the span of four weeks, condos at the Vornado Realty Trust tower sold for $55 million, $64 million and $60 million. But were the lofty prices a sign of a market on the mend? Not quite.

“It’s only a benchmark of a period of time,” said Donna Olshan of Olshan Realty. “You need context, and the context is: When did that property go into contract?”

For developments under construction, years often pass between a sale going into contract — fixing the price — and the closing that makes headlines. At CIM Group and Harry Macklowe’s supertall 432 Park Avenue, for example, unit 59A closed for $14.9 million in June, property records show. It had gone into contract in November 2012, nearly seven years before.

The discrepancy means some condos are closing at prices much greater than they would fetch today.

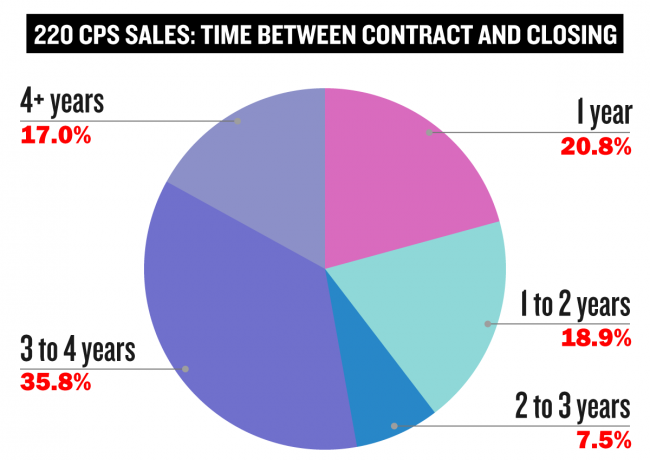

A TRD analysis of 53 deeds at 220 Central Park South shows the median time between contract and closing was nearly three years. The longest was the buyer of unit 49A, who waited almost five years to seal the deal on a $64 million pad.

Read more

Jonathan Miller, CEO of appraisal firm Miller Samuel, said the high-end market is at “peak uncertainty” — shaken by this year’s mansion tax, the 2018 SALT deduction cap and the retreat of foreign buyers, which had all contributed to an oversupply of expensive condos and a slump in prices.

“The vast majority of buyers of ultra-luxe product throughout the city in 2014 to 2017 are losing millions at resale,” said Jason Thomas, a broker at Sotheby’s International Realty.

But Nikki Field, also of Sotheby’s, said many owners of properties with eight-figure values were avoiding losing money at resale. “Even if they are buying up, they are either warehousing their apartments or waiting to put them on the market,” she said.

“People that own $20 million-and-above properties … they don’t sell dumb,” she added. “It’s a small part of their financial portfolio, so they don’t need the money for something else.”

The market conditions have changed the way units in new developments are sold, Field said.

An analysis of 53 unit sales at Vornado’s tower showed most took more than three years to close after contracts were signed. The market fell in the interim. (Click to enlarge)

In 2015, some buyers were happy to go into contract for apartments in properties yet to be built. But the oversupply of luxury properties today has changed that.

Many developers are adapting by not launching sales until projects are well along in construction. Madison House on East 30th Street, for example, topped out in the summer and began sales in September. At the Centrale, a development at 138 East 50th Street, sales launched this year after construction was almost complete.

The shift toward quicker turnarounds could help to foster greater price transparency in the industry. Developments that sell units from plans alone are not required to disclose the true price agreed to in the contract. It might be years — when the sale closes and property records appear online — before sales prices are revealed.

For now, brokers and developers in the luxury market are left to sell remaining inventory in buildings where some units sold at the peak of the market, sometimes making for awkward price comparisons. At 45 East 22nd Street in Flatiron, for example, unit 18A sold for $5.8 million in 2017, just above the asking price. This year, the nearly identical unit 17A closed for about $4 million — or 31% less.

The critical difference? When they sold.

Write to Sylvia Varnham O’Regan at so@therealdeal.com